National Takaful Company Watania Pjsc On Twitter intended for size 1200 X 1200

National Takaful Company Watania Pjsc On Twitter intended for size 1200 X 1200Do Auto Insurance Give Extensions – The easiest way to obtain cost-effective vehicle insurance would be to first look for prices after which take time to compare these people. Study about the firms that are providing the quotes and select which is providing everything required in a price you really can afford to pay for. Since you can find a lot of companies available all claiming to provide low priced automobile insurance quotes, you will need to study a bit about each one prior to making your choice.

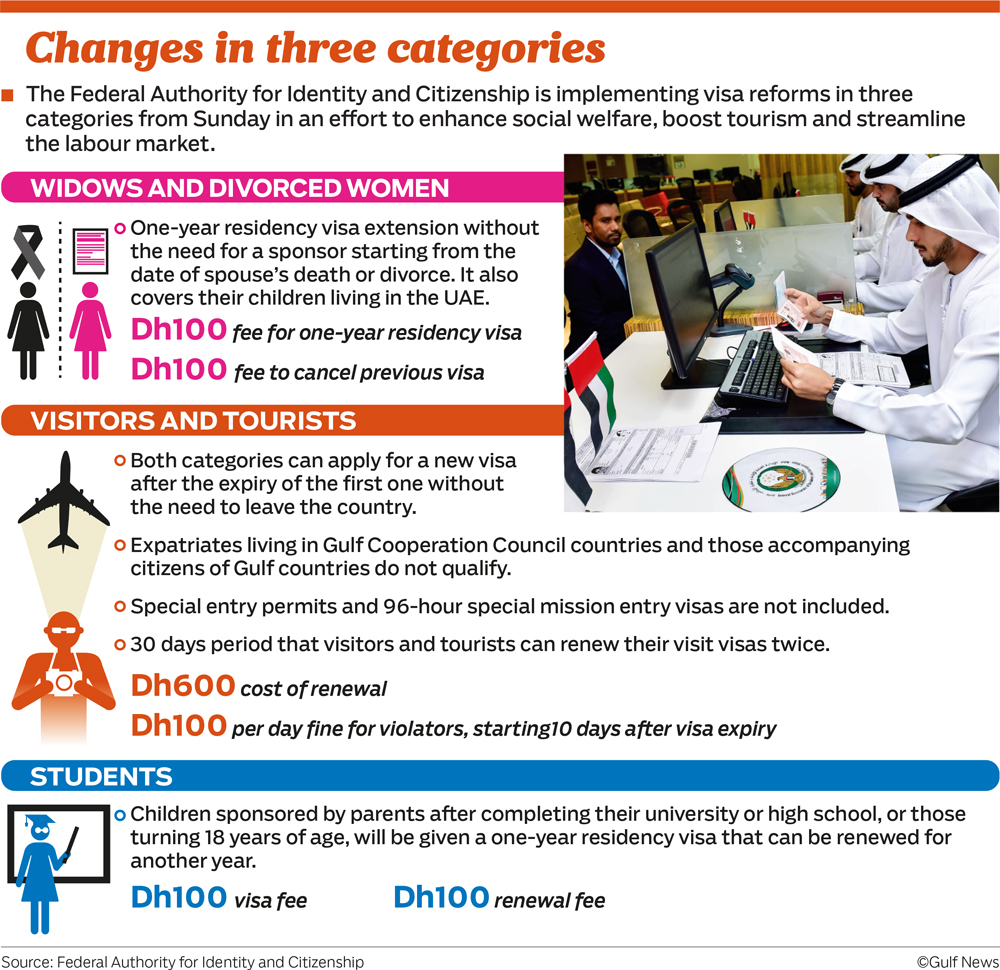

New Visa Rules For Uae Visitors From October 21 Government regarding sizing 1000 X 970

New Visa Rules For Uae Visitors From October 21 Government regarding sizing 1000 X 970Don’t simply glance at the big named insurers, possibly. There are smaller, local automobile insurance businesses that offer affordable prices. And, since they will be smaller, they’re able to deliver more personal plan to their clients. Liability-only auto insurance is obviously going being the cheapest choice, because it is a nominal amount coverage expected in each state. Nevertheless, it only covers items like property damage and therapeutic bills to the others linked to an accident in which you’re located responsible. What about your individual therapeutic bills? How do you receive improvements for your individual vehicle? This is certainly comprehensive / collision insurance policy options that you will definitely be considering.

Contractors All Risks Car Insurance Definition throughout measurements 2121 X 1414

Contractors All Risks Car Insurance Definition throughout measurements 2121 X 1414Finding low priced automobile insurance estimates is not only about choosing the best value payment amount, and really should basically be thought to be when you have a classic junk car that isn’t really worth the money you make payment for to insure it. You’ll nonetheless wish to maintain your medical costs in your mind, though. One more factor to take into consideration is what might eventually your family’s finances should you be badly injured in the crash and can not work for the long stretch of time? Some insurance rates includes solutions with this too.

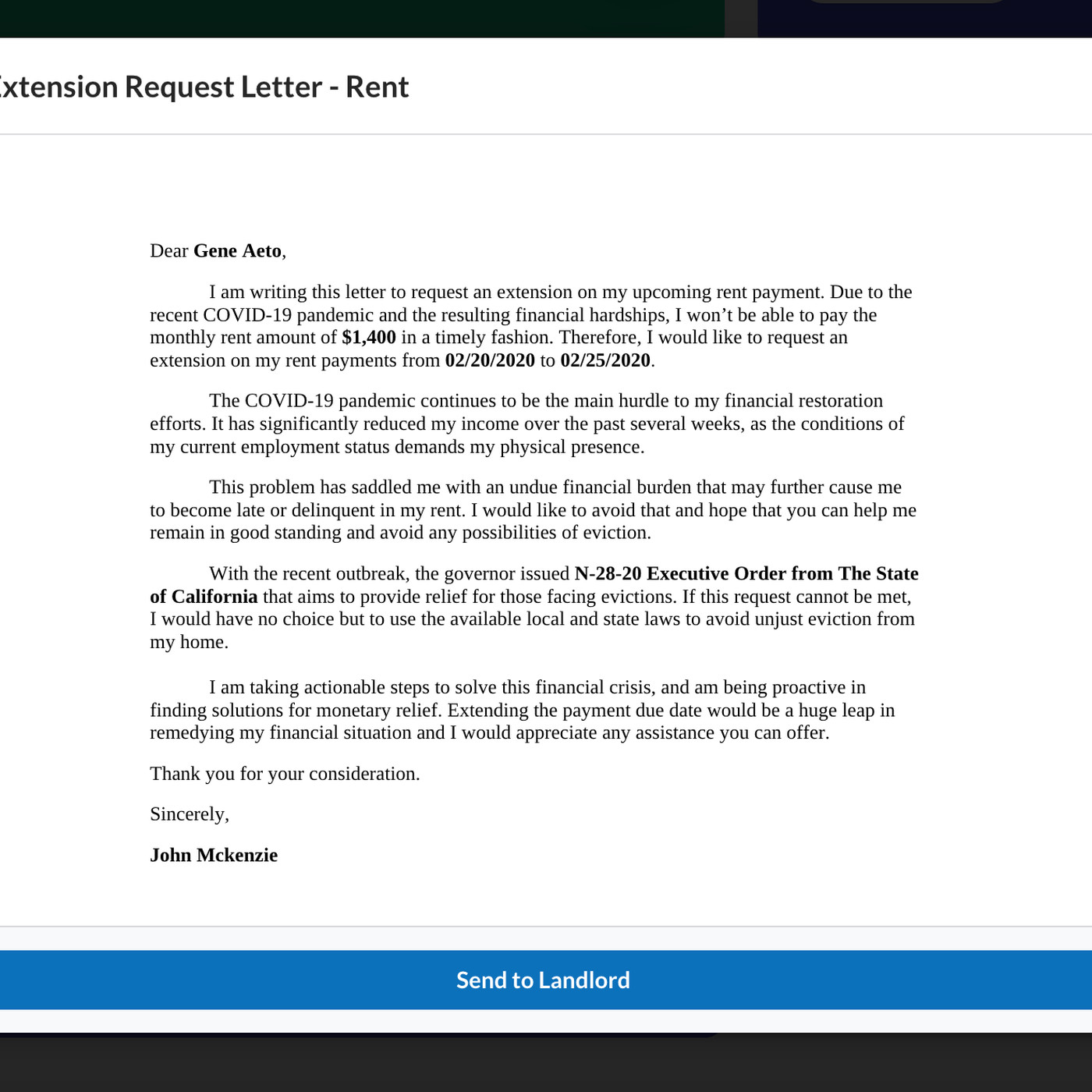

Donotpays New Service Will Try To Help You Get Bill inside measurements 1400 X 1400

Donotpays New Service Will Try To Help You Get Bill inside measurements 1400 X 1400As with any sort of insurance, you have the deductible VS payments debate. The deductible could be the insurance provider ‘s strategy for producing the policyholder share a number of the responsibility of the accident. The low the deductible, the greater the superior, and the other way around. Decide what might be described as a better solution to meet your needs. If you’re not sure, inquire the insurance professional or fiscal expert for advice.

Insurance Regulator May Give Grace Period For Renewal Of with regard to sizing 1200 X 900

Insurance Regulator May Give Grace Period For Renewal Of with regard to sizing 1200 X 900You also can perform a little bit of mathematics on your individual. If you were to opt for the higher deductible, just how much are you capable to save money on a lesser premium? Would definitely how much cash you’d probably save be equivalent to that particular from the deductible inside event you happen to be within an episode and must pay a number of the repair costs from your win? Whatever you determine, you continue to could be capable to possibly conserve lots of money with discounts. Just about every company supplies a number of discounts, and you will find there’s chance you will be capable to be eligible for a minimum of one. One place you can visit find great deals and low priced automobile insurance quotations is esurance. You can begin by simply working using a “Coverage Counselor” to get the best coverage. Also, look at Esurance discounts – you can find a large number of and you also could possibly be eligible for a one.