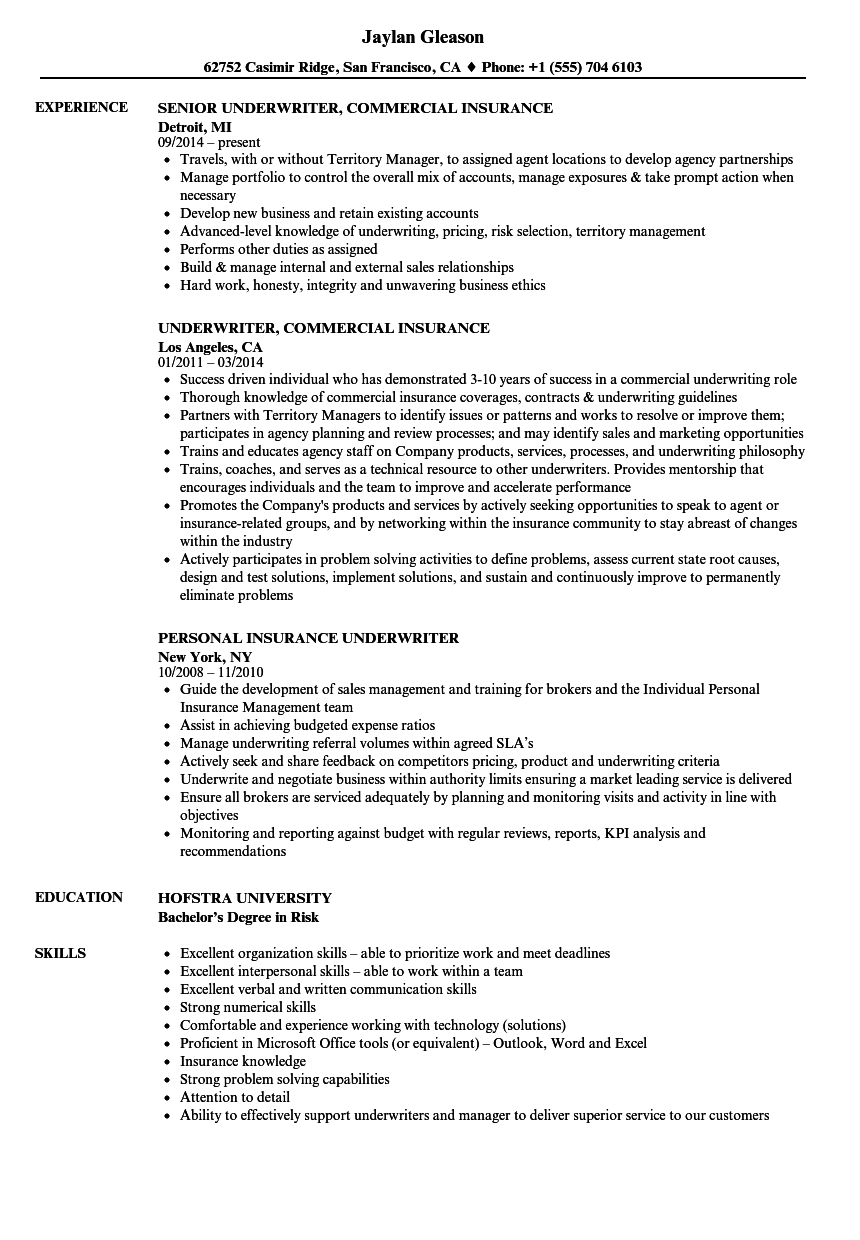

Insurance Underwriter Resume Samples Velvet Jobs with size 860 X 1240

Insurance Underwriter Resume Samples Velvet Jobs with size 860 X 1240Auto Insurance Underwriter Job Description – Be intelligent along with your motor insurance coverage. You will discover many organisations available that share a wide various discounts. You may be qualified to apply for some you do not be aware of exist. Keep this kind of at heart when you might be doing looks for quotes and looking at each company. Usually, the businesses list the kinds of savings they have on his or her websites. There is also a better potential for getting seriously low-priced car insurance in case you have a clean record, are near least two-and-a-half decades of aging, have a very good credit standing, and own a car having a lot of security features.

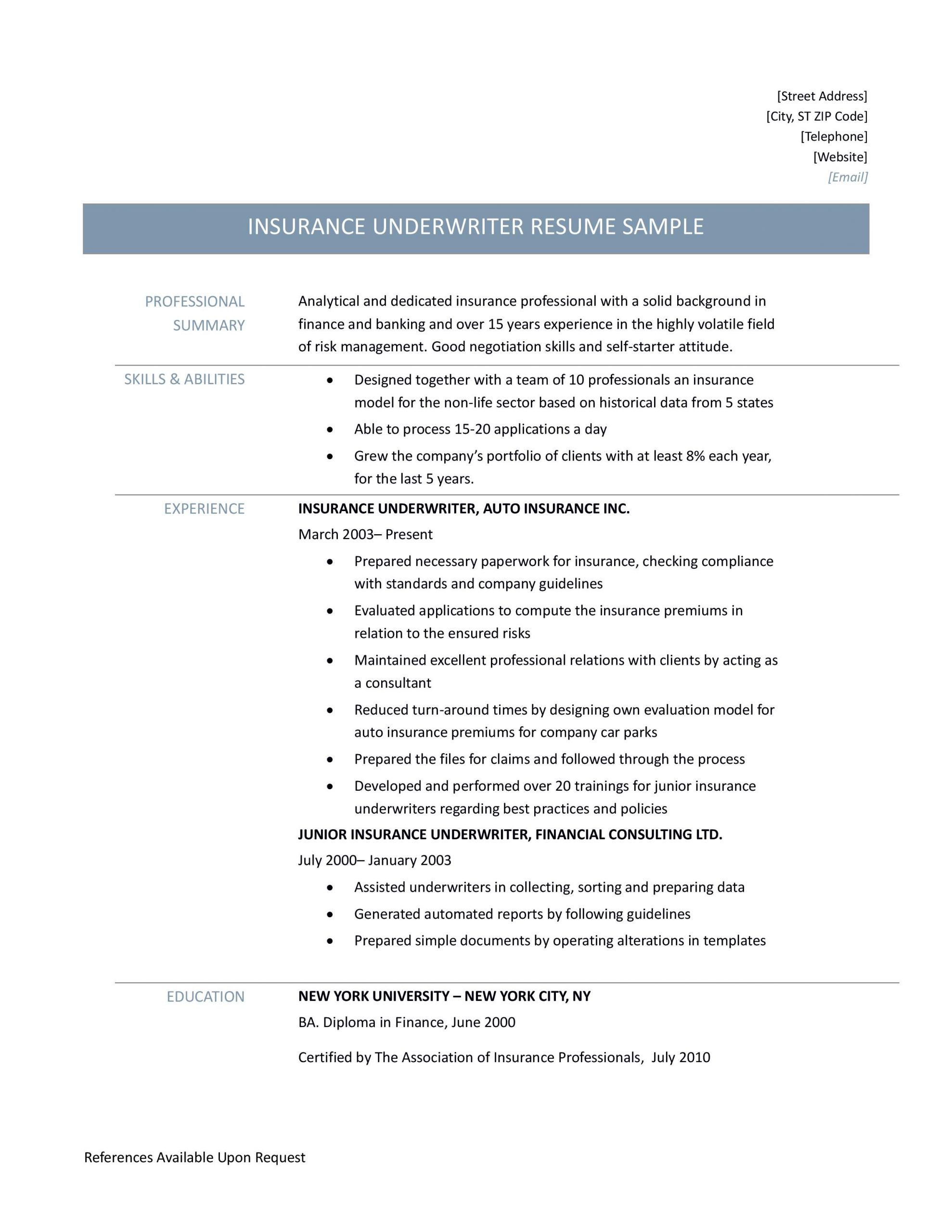

Insurance Underwriter Resume Samples Tips And Templates within dimensions 2550 X 3300

Insurance Underwriter Resume Samples Tips And Templates within dimensions 2550 X 3300It’s and a good plan to get smart along with your insurance. For instance, in case you DO have got a mature automobile that is certainly presently worth lower than say, $4, 000, you may not desire to work with having comprehensive and accident in your insurance plan. It might stop worth continually making repayments on the car that basically isn’t really worth a whole lot of. However , that would be wise to be kept within the back of the mind if a thing DOES eventually your vehicle, you will be usually the one to blame for repairs, and investing in a brand new one.

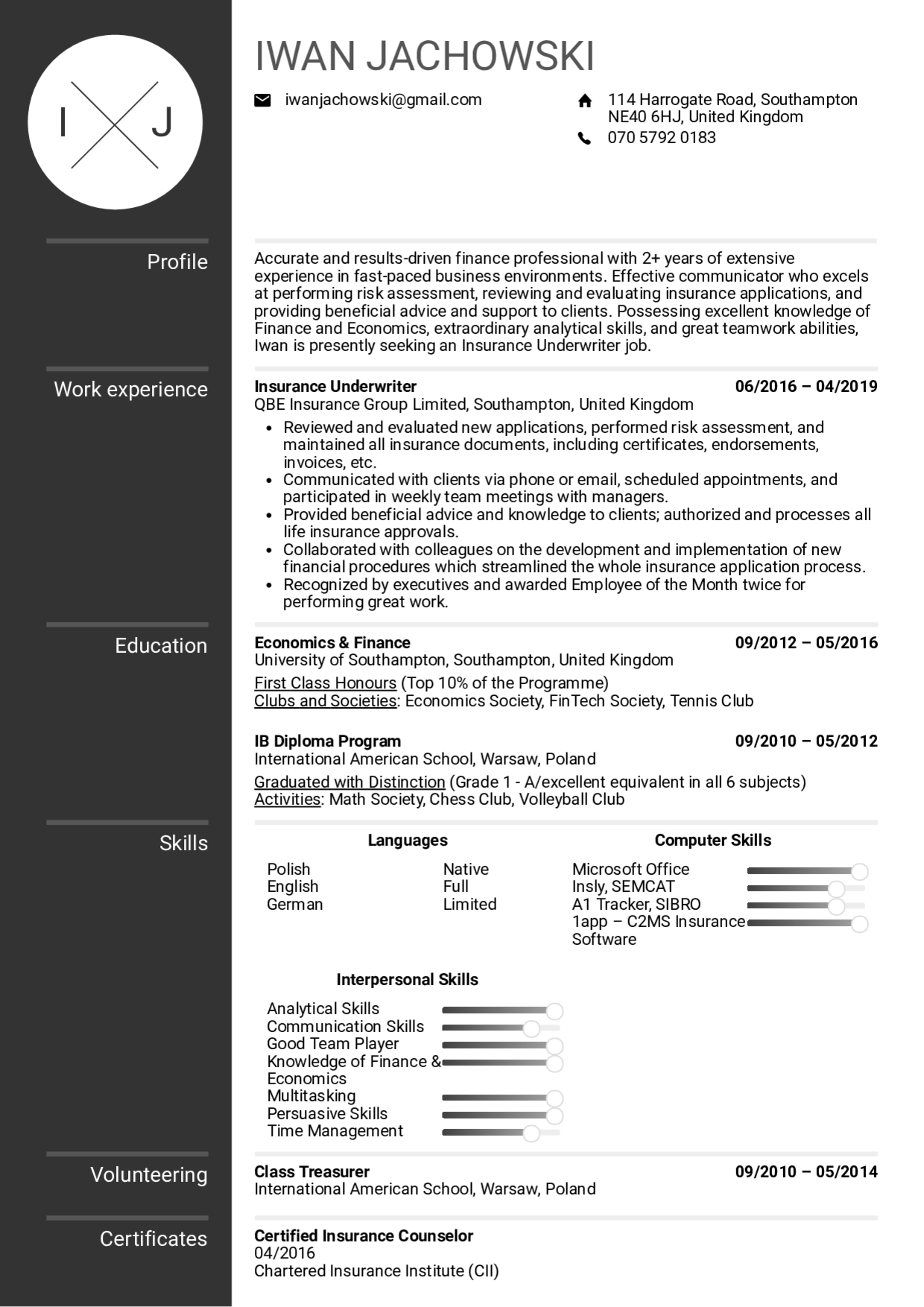

Resume Examples Real People Insurance Underwriter Resume regarding proportions 1240 X 1754

Resume Examples Real People Insurance Underwriter Resume regarding proportions 1240 X 1754Another way you may choose to receive really low-priced automobile insurance is in case you bundle it along with some other sort of insurance – specifically home insurance or multi- motor insurance – all with similar company. Many companies give greater discount to prospects who’re prepared to purchase multiple policies from their website. Some even offer deals upon motor insurance / life insurance coverage packages.

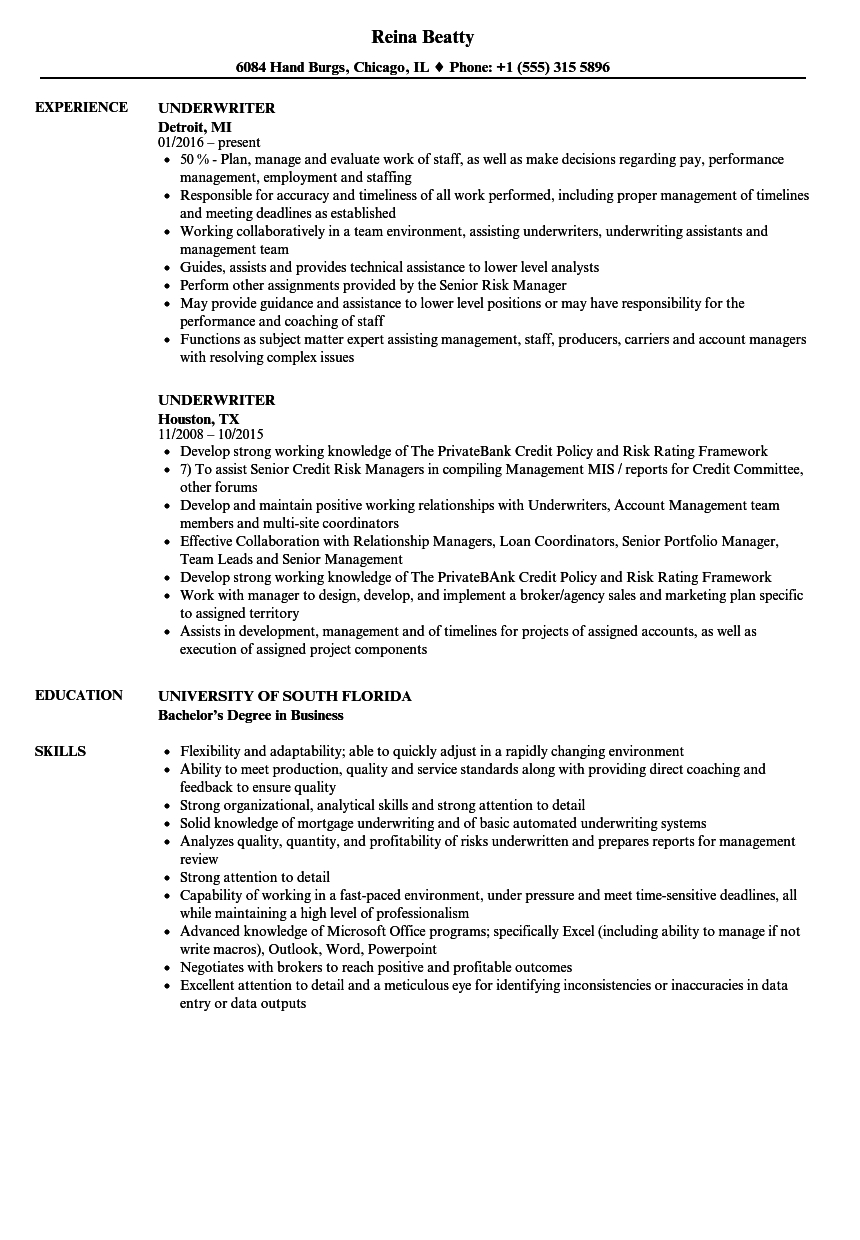

Underwriter Resume Samples Velvet Jobs in sizing 860 X 1240

Underwriter Resume Samples Velvet Jobs in sizing 860 X 1240To possibly save possibly more income, consider enrollment inside a defensive driving course. Should you successfully complete this, a great insurer will more than likely compensation you having a discount in your premium. If you might be having difficulty obtaining low prices as you do not have great credit rating, you could adequately reap the benefits of doing work having a credit score improvement or debt enterprise. By the very least, discover credit score improvement and the way you’ll be able to do it yourself. Consider just about every measure necessary to exhibit car insurance firms that you might be attempting to tidy up your credit history.

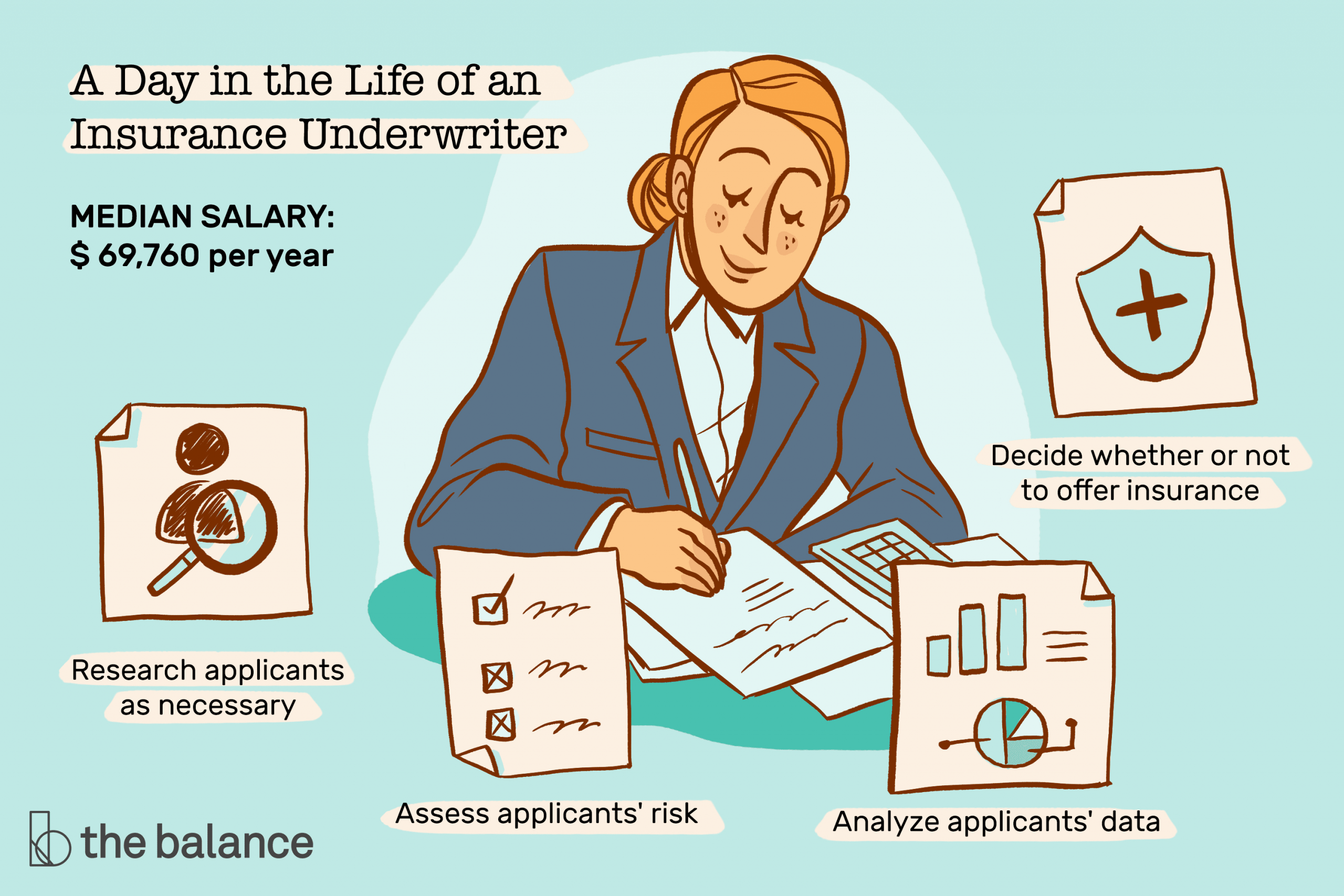

Insurance Underwriter Job Description Salary Skills More with regard to measurements 3000 X 2000

Insurance Underwriter Job Description Salary Skills More with regard to measurements 3000 X 2000If you might be a student, professional or even an affiliate a specific club, appearance and discover what types of discounts may be available for your requirements. When once again, you don’t know what types of savings you may be qualified to apply for. Were you aware which you could potentially lower your expenses when you are a responsible student with a’s and b’s? Or for as being a head with your field? Or perhaps whenever you might be an engineer as well as teacher / lawyer as well as doctor or customer of the auto club?