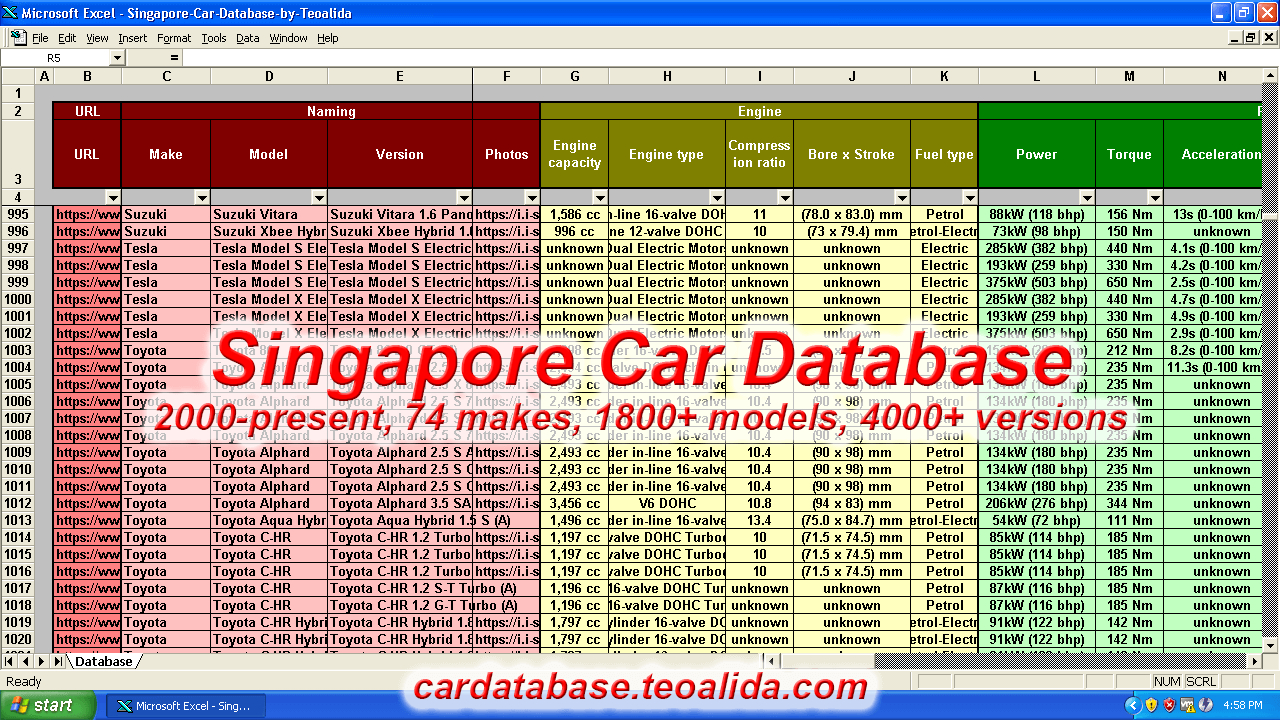

Car Database Year Make Model Trim Engines Specs Xls inside proportions 1920 X 1080

Car Database Year Make Model Trim Engines Specs Xls inside proportions 1920 X 1080Car Insurance Database Usa – A single with the first steps when you get low-cost online automobile insurance is as simple as discussion quotes and researching the firms that offer the regulations. Avoid result in the mistake of missing lesser-known, smaller insurers as they possibly can often provide better, extra personalized customer care as opposed to corporations. Just because 2/3s with the US information mill protected by 7 motor insurance companies does not mean you’ve to become among those. It could possibly be worth it to become part with the one-half who have gets your insurance coming from a smaller company.

Car Models List 200 Makes 5000 Automobile Models inside proportions 3200 X 1800

Car Models List 200 Makes 5000 Automobile Models inside proportions 3200 X 1800Prices are planning to vary substantially, regardless, and a lot of with the elements that affect the speed are items which you may not have much treatments for, including the position, express, age, past driving record, and the like. Even your credit rating probably have an effect about the quotes you obtain. If you don’t possess the very best driving history or even the best credit, make an effort to acquire back on track with those you’d like it is possible to to be able to be entitled to lower quotes.

Car Database Year Make Model Trim Engines Specs Xls with size 1920 X 1080

Car Database Year Make Model Trim Engines Specs Xls with size 1920 X 1080A further aspect to consider will be the amount of insurance coverage you actually need. The cheapest plan isn’t necessarily the very best, and might wind up costing you more inside the long term. For instance, low-cost online car insurance probably won’t present collision insurance coverage, that’s something you will need should you don’t desire to have to cover high deductibles inside the function that your automobile is involved with a great car accident. You probably won’t require crash if your automobile looks her age instead of worth a lot. Make a decision when it could be worth every penny to cover higher premiums over a get car finance comparisons.

Car Database Year Make Model Trim Engines Specs Xls in size 1920 X 1080

Car Database Year Make Model Trim Engines Specs Xls in size 1920 X 1080Whenever you’ve a newer automobile, the model making are going to become huge factors inside the costs you will get. It’s easier to discover low-cost online car insurance for those who have a car or truck that’s safe and inexpensive, including a Honda Odyssey minivan, Subaru Umland, or perhaps Jeep Wrangler. The reason is family-oriented vehicles are usually to become driven by mature, secure drivers (parents) that are more unlikely to become reckless. High-end deluxe and sports vehicles must be probably the most expensive to assure.

Car Database Year Make Model Trim Engines Specs Xls with dimensions 1280 X 720

Car Database Year Make Model Trim Engines Specs Xls with dimensions 1280 X 720There will almost always be discounts to look into, even should you do not think you’ll be entitled to any. Most insurance firms provide a selection of discounts, by “Switch and Save” to “Security Features”.