Dash Cam Sales Have Increased A Lot Over The Last Few Years pertaining to proportions 735 X 1102

Dash Cam Sales Have Increased A Lot Over The Last Few Years pertaining to proportions 735 X 1102Auto Insurance Industry News – That is incredibly easy today to acquire motor insurance quotes on line. The part that is certainly not easy is really comparing the quotes and determining which supplies the type(s) of coverage you virtually all need in a sensible price. To be able to begin, you will want to fill in a number of details thus hitting the “submission” button. The forms of details you will be expected to deliver differ from one site for the next. Experts recommend to check at the very least three offers prior to your choice. Also, review of your current policy. It may adequately nonetheless be the ideal option for you personally.

Insuretech News Roundup The Impact Of Ai Technologies On regarding sizing 2560 X 1707

Insuretech News Roundup The Impact Of Ai Technologies On regarding sizing 2560 X 1707Should you desire to add someone else in your policy, like a teenager or perhaps partner, then make sure through adding their details at the same time the moment requesting quotes. What type of coverage do you require? Most claims require drivers possess some form of vehicle insurance. Find out what your california’s minimum requirements are. Actually in the event you think you know, make sure to ensure nothing has evolved since last time you bought a great vehicle insurance coverage.

Article Top 5 Trends In The Insurance Industry with regard to size 800 X 1032

Article Top 5 Trends In The Insurance Industry with regard to size 800 X 1032Most claims require, at least, that individuals have the liability insurance. Once purchasing this type of insurance, a policy limits tend to become indicated simply by three amounts. The first number makes reference for the maximum bodily harm (in thousands ) for starters individual injured in the incident. The second number refers for the maximum liability for every single harm brought on inside accident, and third number indicates the absolute maximum home damage liability. Maintain this in your mind when you happen to be trying to acquire motor insurance insurance quotes on line.

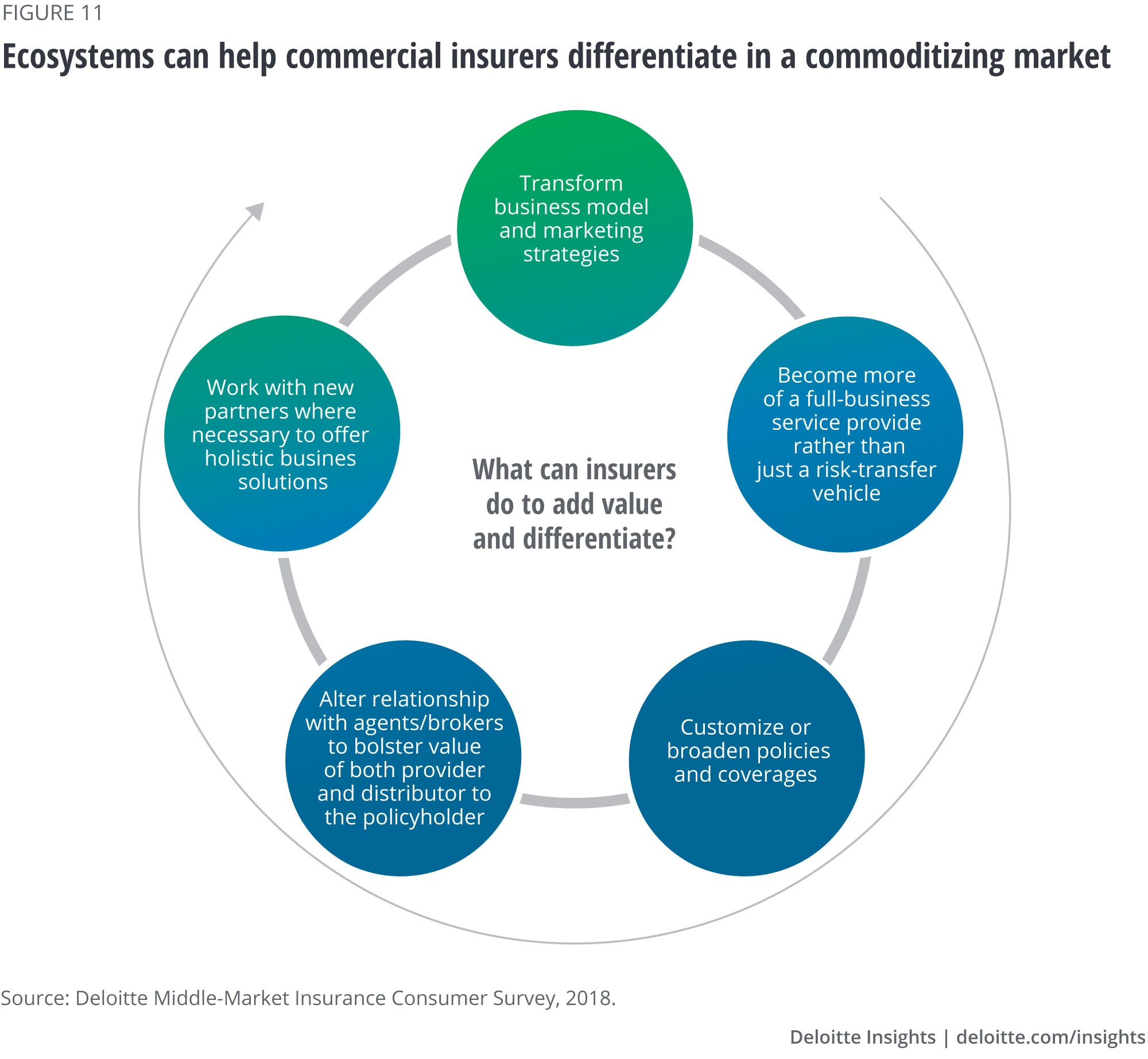

2020 Insurance Industry Outlook Deloitte Insights in sizing 2000 X 1845

2020 Insurance Industry Outlook Deloitte Insights in sizing 2000 X 1845Another aspect to consider is accidental injury protection (PIP). This is important in the event you play a crucial role with your family’s finances. If you turn out badly injured and inside hospital and not able to job, after which have to cover skilled bills added to that, after that your complete family have been around in trouble. PIP is certainly essential coverage to get. Do you need comprehensive coverage? In cases where you might have a low priced, older motor vehicle then you certainly may not. This kind of coverage reimburses you inside event that your motor vehicle is desperately damaged in the incident or taken. If that isn’t worthy of much anyhow, then it could certainly be a waste of cash to cover on a plan with detailed coverage. You may be happier using the risk after which merely paying of the deductible when it is damaged.

Car Insurance In Uae The Complete Guide Money Clinic for sizing 2500 X 1667

Car Insurance In Uae The Complete Guide Money Clinic for sizing 2500 X 1667