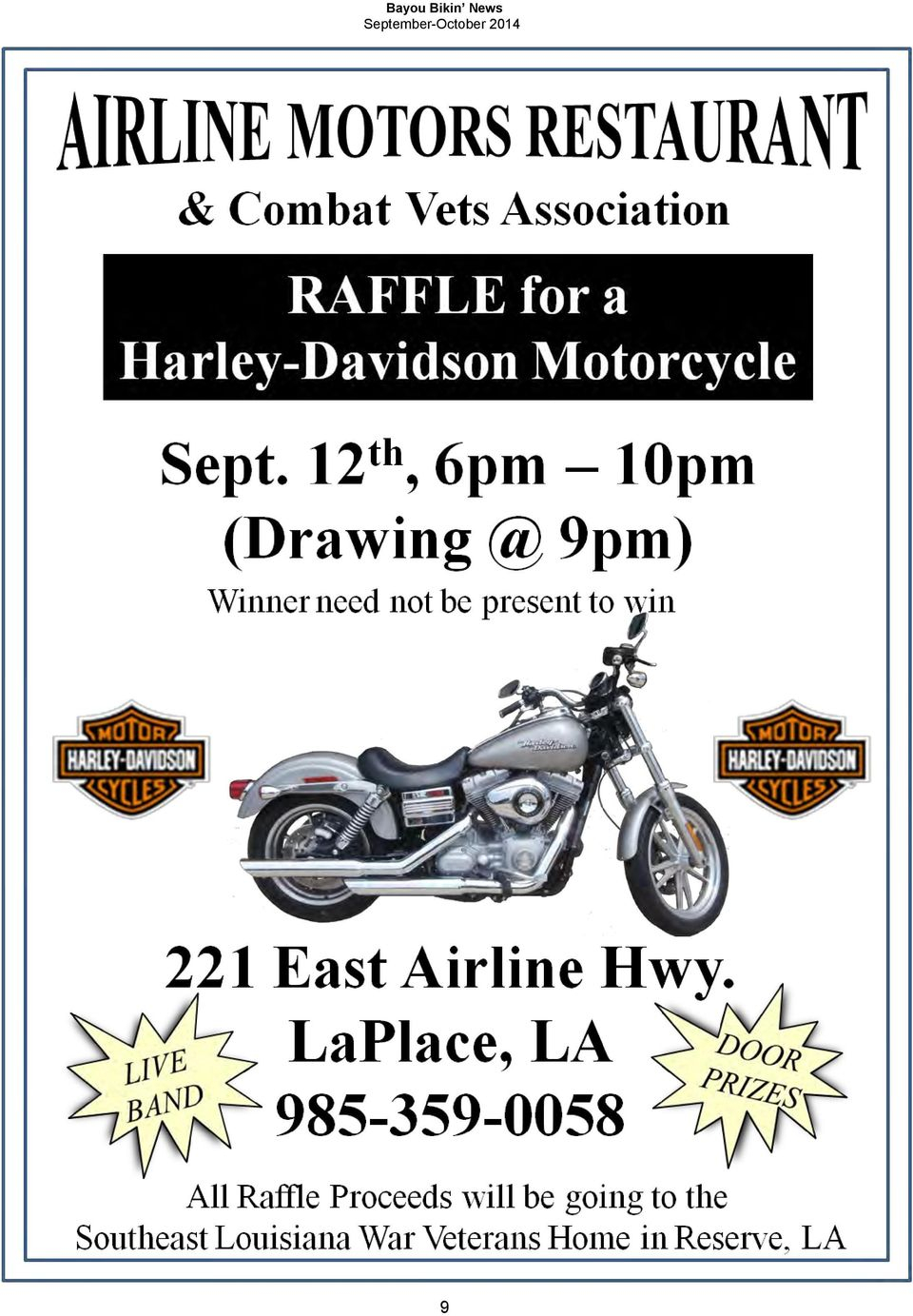

Freedom Of The Road Is Not Free Pdf Free Download with regard to size 960 X 1330

Freedom Of The Road Is Not Free Pdf Free Download with regard to size 960 X 1330Motorcycle Insurance In Shreveport Louisiana – Every driver and passengers within the US must incorporate some form of liability coverage as a way to legally get. It’s not really something you desire to at any time risk carrying out without. You’ll must get one method or another to cover it, if you prefer this you aren’t. Automotive insurance plans don’t must price a lot of cash, nevertheless. You do incorporate some choices in terms of cheap responsibility motor insurance. However , you must never select an insurance policy based about the price tag alone, as you’ll find various additional circumstances which might be crucial that you take into consideration at the same time.

Freedom Of The Road Is Not Free Pdf Free Download in proportions 960 X 1383

Freedom Of The Road Is Not Free Pdf Free Download in proportions 960 X 1383Always check using the unbiased rating agencies like Common & Poor and ARE Best to study the economic steadiness of each and every insurer you happen to be taking into consideration. Take some time to read testimonials off their buyers on each provider. When you don’t know in the event that these are all legitimate testimonials, it is smart to avoid any organization which has been obtaining a lot of claims – just to become about the safe side.

Motorbike Insurance Chep Insurance pertaining to size 3986 X 2112

Motorbike Insurance Chep Insurance pertaining to size 3986 X 2112Find out exactly what the minimum requirements are to get motor insurance within your state. Actually in the event you only require affordable responsibility motor insurance, you should think of additional varieties of coverage at the same time, which include accidental injury protection. PIP insurance covers both your individual as well as your passengers’ medical bills if you happen to be ever linked to a great crash. PIP insurance coverage is sometimes called “no-fault” insurance. However , as it covers medical expenses and perhaps, it will also spend on wage damage. However , no-fault / PIP insurance pays to the genuine damage with the automobile. Because of this, you will need to get your individual crash coverage or by the insurance coverage with the other party whenever they were those who caused the accident.

Muslow Insurance Agency Competitors Revenue And Employees within sizing 1024 X 1222

Muslow Insurance Agency Competitors Revenue And Employees within sizing 1024 X 1222Consider the need for your automobile when looking for cheap responsibility motor insurance to find out when it could be worth the cost to get collision insurance. If it’s an old model, the expense of paying to get this protected might set you back more cash compared to what the particular price could be to do the repair within the celebration that it can be broken. Think about the deductible at the same time.

Clearwater Insurance Llc Motorcycle Insurance pertaining to sizing 1337 X 891

Clearwater Insurance Llc Motorcycle Insurance pertaining to sizing 1337 X 891Various people desire to know the way to decrease the premium. The concept, obviously, would be to purchase ample coverage ideal to meet your needs with no overspending. Hardly ever believe that you’ve got to sacrifice coverage as a way to spend less. Rather, look around several. Consider bundling your motor insurance to varieties of insurance you’ve got, for example home insurance. Some businesses give reductions in price for multiple plans.