Compare 2020 Car Insurance Rates Side Side The Zebra within dimensions 1920 X 987

Compare 2020 Car Insurance Rates Side Side The Zebra within dimensions 1920 X 987Good To Go Auto Insurance Nj – Thanks a lot on the internet, auto insurance is simpler to get than in the past. It’s so easy to acquire multiple auto insurance quotes on the net simultaneously from several businesses, all at one web page. The downside is that you will need to take time to compare them to be able to choose which choice could be the best in your case. To help result in the process proceed quicker, you have to have your facts prepared capable to go.

1 Dollar A Day Car Insurance In New Jersey Goodtogo intended for sizing 1252 X 3613

1 Dollar A Day Car Insurance In New Jersey Goodtogo intended for sizing 1252 X 3613When you receive an vehicle insurance price online, whether with an agent or directly, you will need to offer some documentation like the license, make / type of vehicle, address, VIN, age group, ssn, etc . Like this you aren’t, you’ll find certain age brackets which are considered “higher risk” than the others. Your location may play a role within the kinds of quotes you receive too – particularly when you live within a location at risk of extreme weather and road conditions, or in which there’s a high rate of crime.

I Treid All The Insurance Comparison Websites And None with dimensions 1365 X 768

I Treid All The Insurance Comparison Websites And None with dimensions 1365 X 768If your car or truck provides certain security features, like anti-lock brakes, front and part airbags, GPS, as well as a security alarm, you will probably qualify for the discount when researching auto insurance quotes on the net. Many vehicle insurance firms hand out discounts to safety-conscious motorists. Also, it is possible to potentially save a lot more in the event you take a defensive driver’s training.

Pin Insurance Painterlegend On Insurance Health pertaining to sizing 1400 X 610

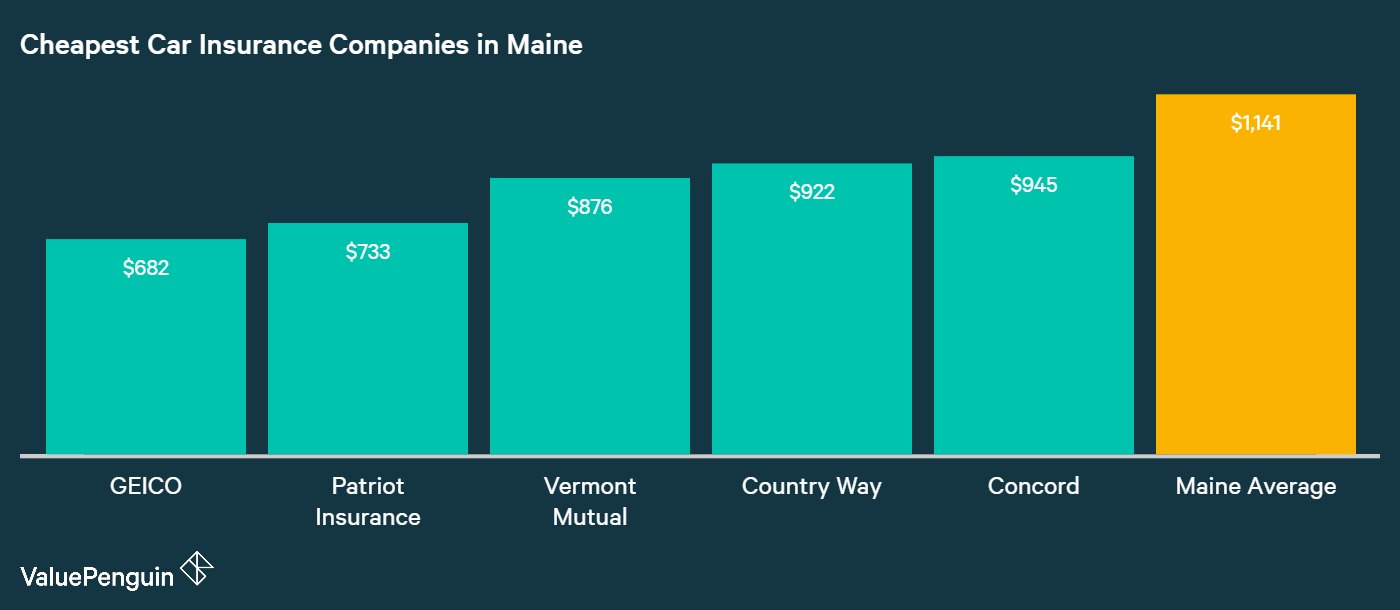

Pin Insurance Painterlegend On Insurance Health pertaining to sizing 1400 X 610A further possible factor hitting the quotes you are certain to get is your credit history. Those with a low credit score could have an even more awkward time finding a very good rate on his or her auto insurance. If perhaps you might have a low credit score, the top factor it is possible to do is make an effort to look for as numerous discounts as is possible. Some insurance firms give an extensive number of discounts so you will likely be qualified to apply for no less than 1 of which.

Seniors Car Insurance Best Rates And Discounts Of May 2020 pertaining to measurements 2121 X 1414

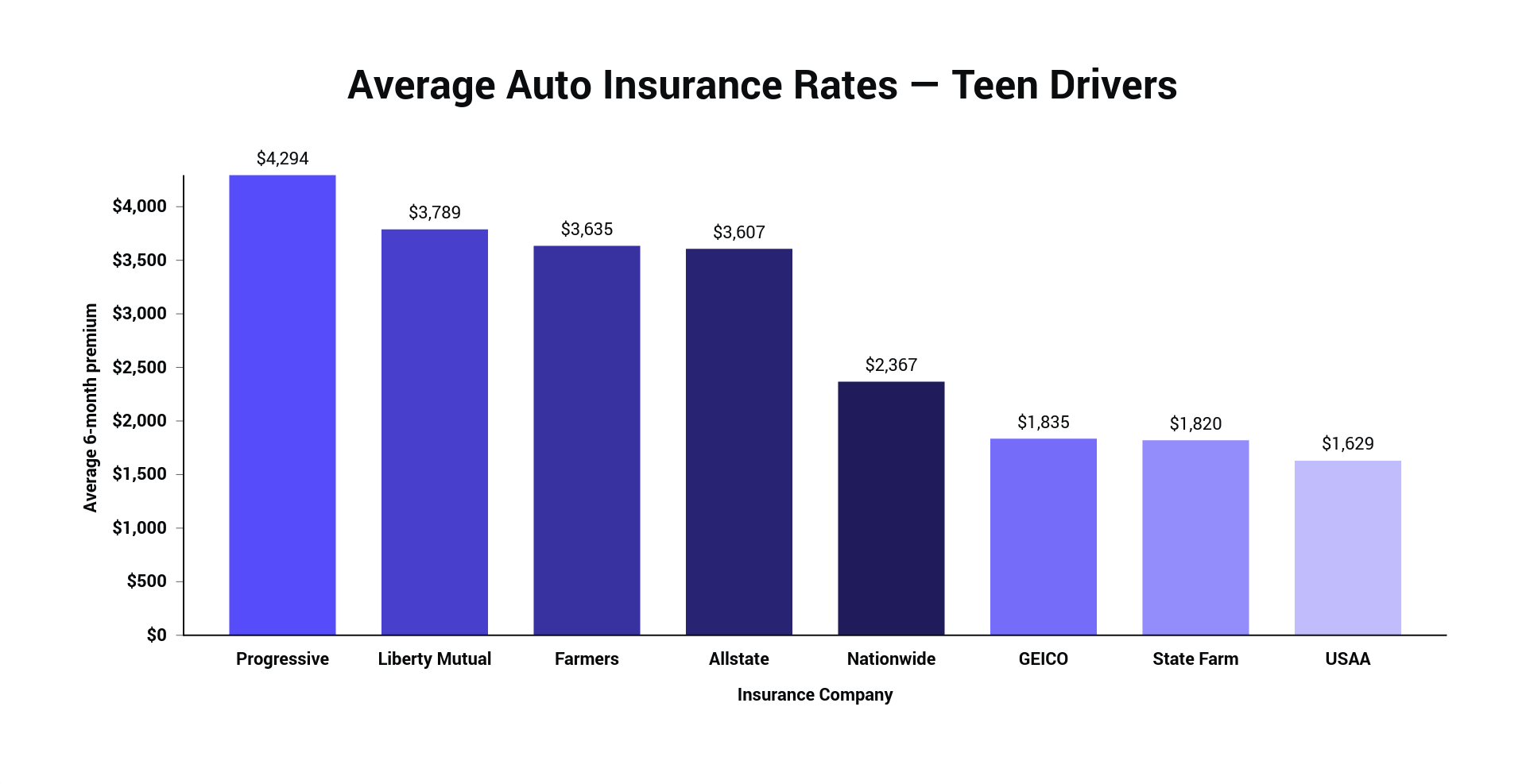

Seniors Car Insurance Best Rates And Discounts Of May 2020 pertaining to measurements 2121 X 1414As for age and gender, the male is usually needed to pay higher rates than girls since women are believed to get more cautious once driving. Also, drivers the younger than 25 are statistically more likely to get careless, in order that they are often charged higher premiums. If perhaps you might be a pupil who also makes a’s and b’s, even so, you will likely be eligible for the discount. At this time there can be a new thing some insurance firms are providing called “usage-based insurance”. What this means is they are giving motorists an opportunity to possess their driving watched using a mobile app in substitution for possible discounts reducing monthly premiums.