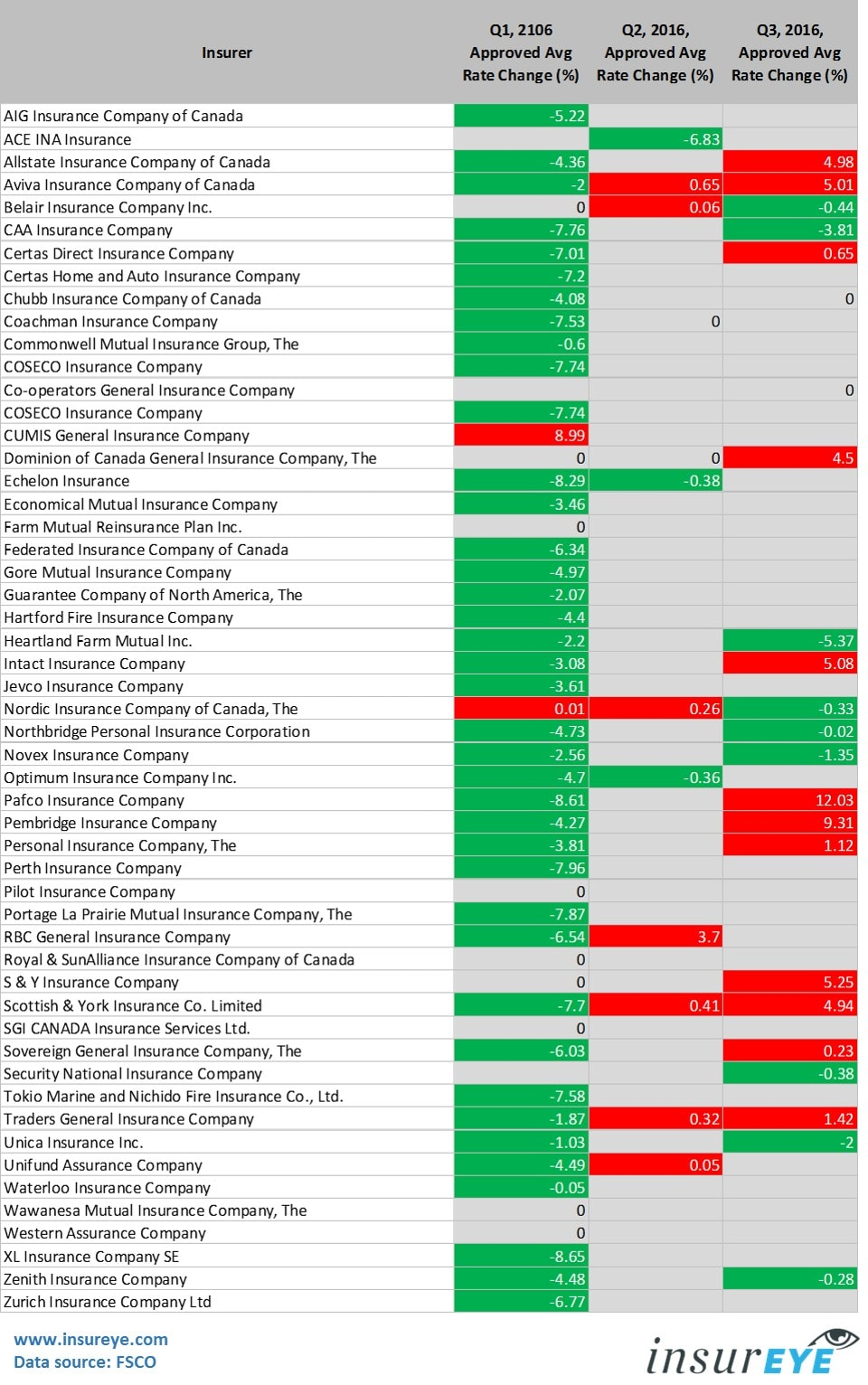

Ontario Car Insurance Will The Premiums Climb Up In 2017 throughout dimensions 960 X 1532

Ontario Car Insurance Will The Premiums Climb Up In 2017 throughout dimensions 960 X 1532Best Rates For Motorcycle Insurance In Ontario – Be clever along with your motor insurance coverage. You will find a lot of companies available that hand out a wide selection of discounts. You may be qualified to apply for some that you do not have any idea exist. Keep this kind of at heart when you might be doing looks for quotes and assessing each company. Usually, the businesses list the forms of savings they have on their own websites. There is also a better potential for getting seriously low-cost automobile insurance for those who have a clean driving history, are in least two-and-a-half decades old, have a great credit history, and own a car or truck having a lot of safety measures.

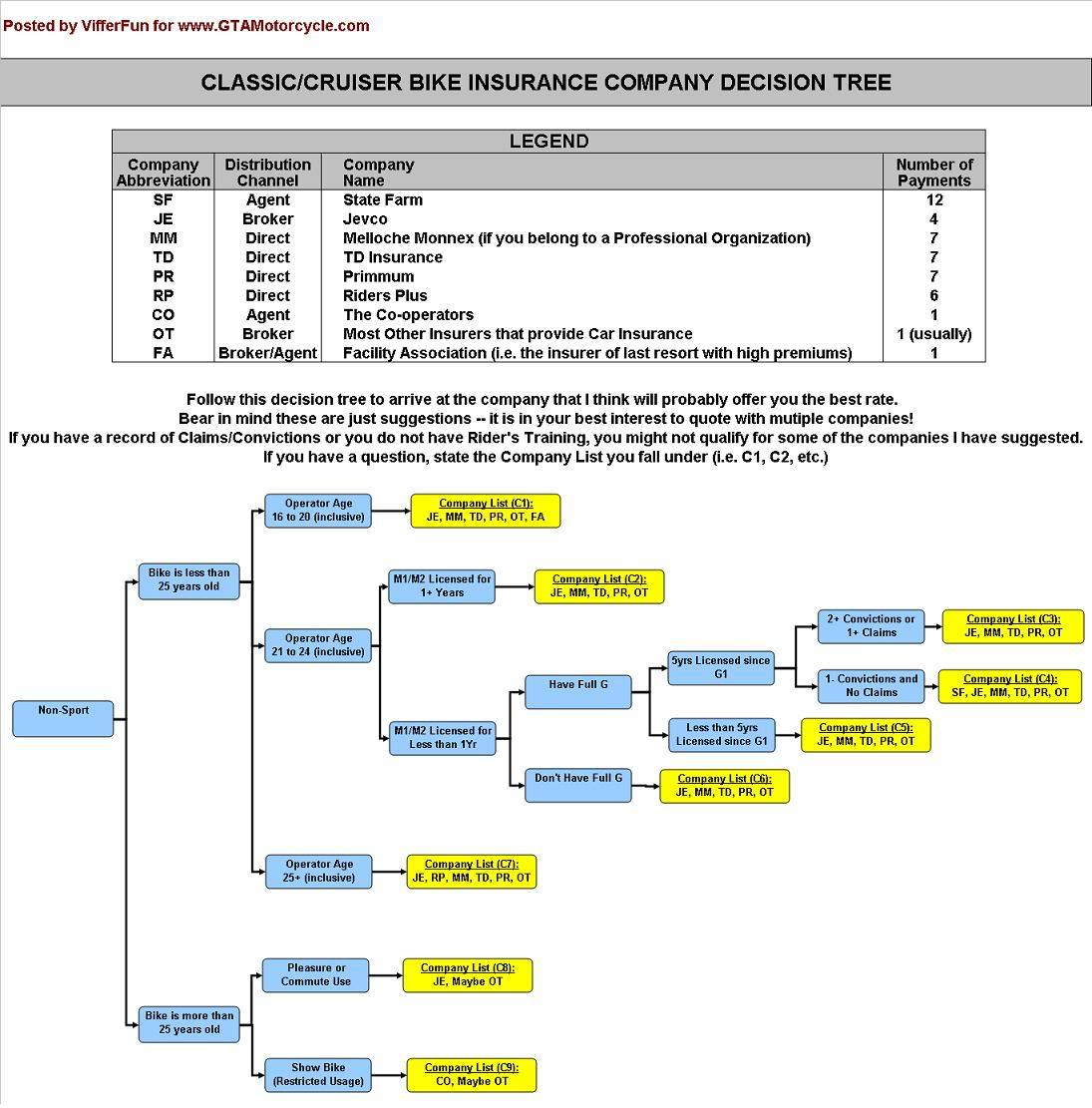

Get Motorcycle Insurance Youmotorcycle within measurements 1095 X 1111

Get Motorcycle Insurance Youmotorcycle within measurements 1095 X 1111It’s additionally a wise decision to get smart along with your policy. For instance, in case you DO include a mature car that’s at the moment worth lower than say, $4, 000, you do not wish to use having comprehensive and accident on the coverage. It might stop worth continually making obligations on the car that actually actually worth much. However , that would be wise to be kept inside the back of the mind if a thing DOES get lucky and your vehicle, you will end up normally the one in charge of repairs, and for getting another one.

Motorcycle Insurance In Ontario Insurance Faith pertaining to dimensions 1100 X 733

Motorcycle Insurance In Ontario Insurance Faith pertaining to dimensions 1100 X 733Another way you may choose to obtain really low-cost car insurance is in case you bundle it along with some other sort of insurance – specifically home insurance or multi- motor insurance – all sticking with the same company. Many companies give greater discount to people who will be prepared to purchase multiple policies from their store. Some even offer deals upon motor insurance / life insurance coverage packages.

Motorcycle Insurance In Ontario 4 Things You Must Know pertaining to dimensions 1280 X 720

Motorcycle Insurance In Ontario 4 Things You Must Know pertaining to dimensions 1280 X 720To possibly save actually more income, consider enrollment in the defensive driving course. In case you successfully complete this, a great insurer will likely praise you having a discount on the premium. If you might be having difficulty obtaining low prices when you don’t possess great credit rating, you may well take advantage of operating having a credit restoration or debt business. In the very least, understand credit restoration and just how you are able to do it yourself. Consider every single measure necessary showing vehicle insurance carriers that you might be fitting in with clear your credit history.

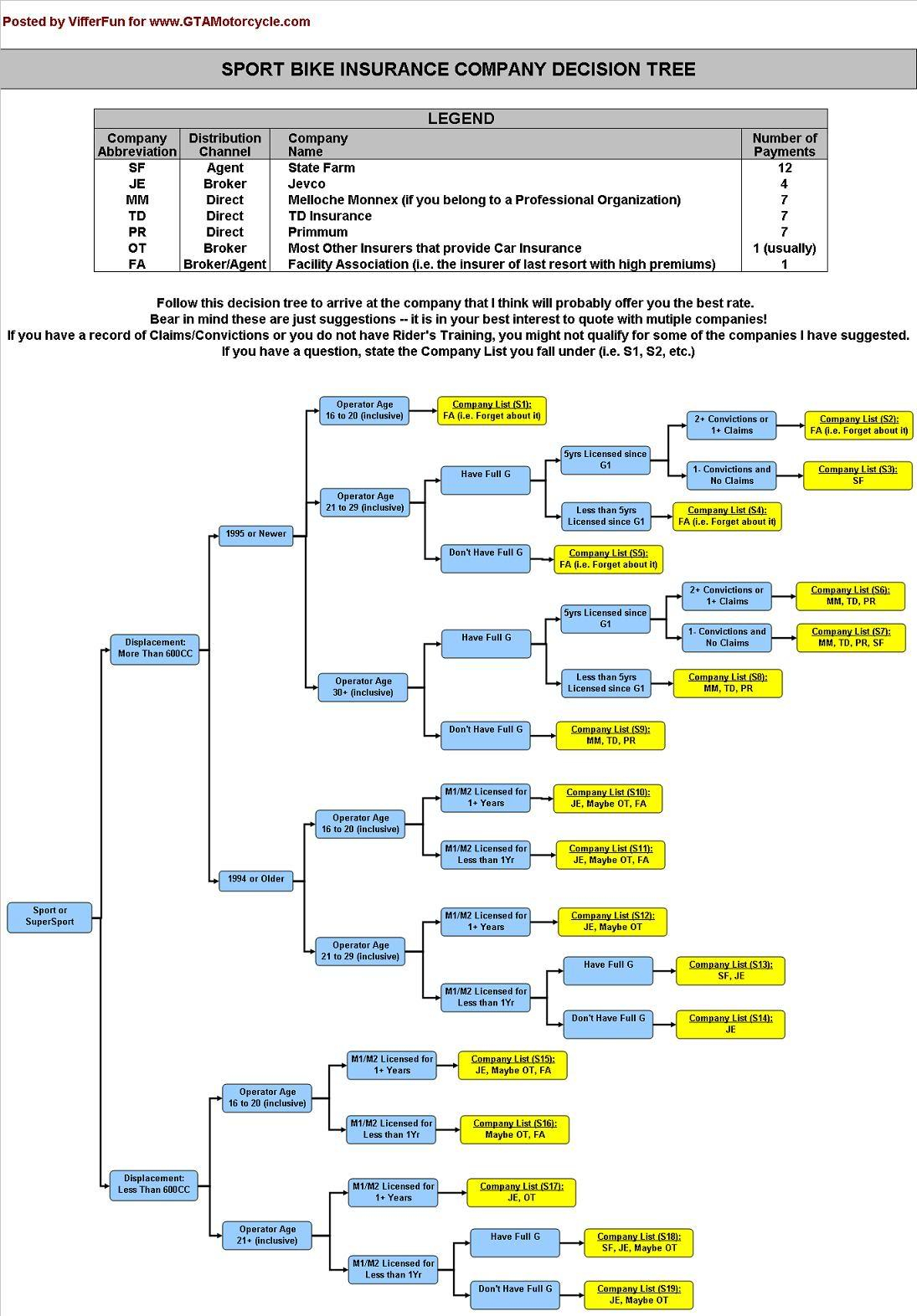

Get Motorcycle Insurance Youmotorcycle with measurements 1095 X 1572

Get Motorcycle Insurance Youmotorcycle with measurements 1095 X 1572If you might be a student, professional or perhaps a person in a particular club, search to see what types of discounts may be available for you. When once again, you can’t predict what types of savings you may be qualified to apply for. Were you aware that you just could potentially spend less when you are a responsible student with high gpa’s? Or for as a head within your field? Or perhaps whenever you might be an engineer as well as teacher / lawyer as well as doctor or membership associated with an auto club?