Royal Automobile Club Of Victoria Wikipedia for measurements 1200 X 693

Royal Automobile Club Of Victoria Wikipedia for measurements 1200 X 693Racv Motorcycle Insurance – Every rider within the US must involve some form of liability coverage so that you can legally get. It’s not really something you desire to at any time risk performing without. You’ll must discover one method or another to spend it, if you want that you aren’t. Automotive plans really do not must expense big money, although. You do involve some choices with regards to cheap burden auto insurance. However , you shouldn’t select a plan based about the value alone, as you can find various additional factors which are vital that you think of also.

Motor Insurance Premium Excess Discounts Guide Pdf Free for dimensions 960 X 1412

Motor Insurance Premium Excess Discounts Guide Pdf Free for dimensions 960 X 1412Always check while using self-employed rating agencies like Common & Poor and WAS Best to educate yourself on the economic balance of each and every insurance provider you happen to be taking into consideration. Take some time to read evaluations business consumers on each business. Whilst you can’t say for sure in the event that they’re all legitimate evaluations, it is still smart to avoid service repair shop that’s been finding a large sum of problems – just being about the safe side.

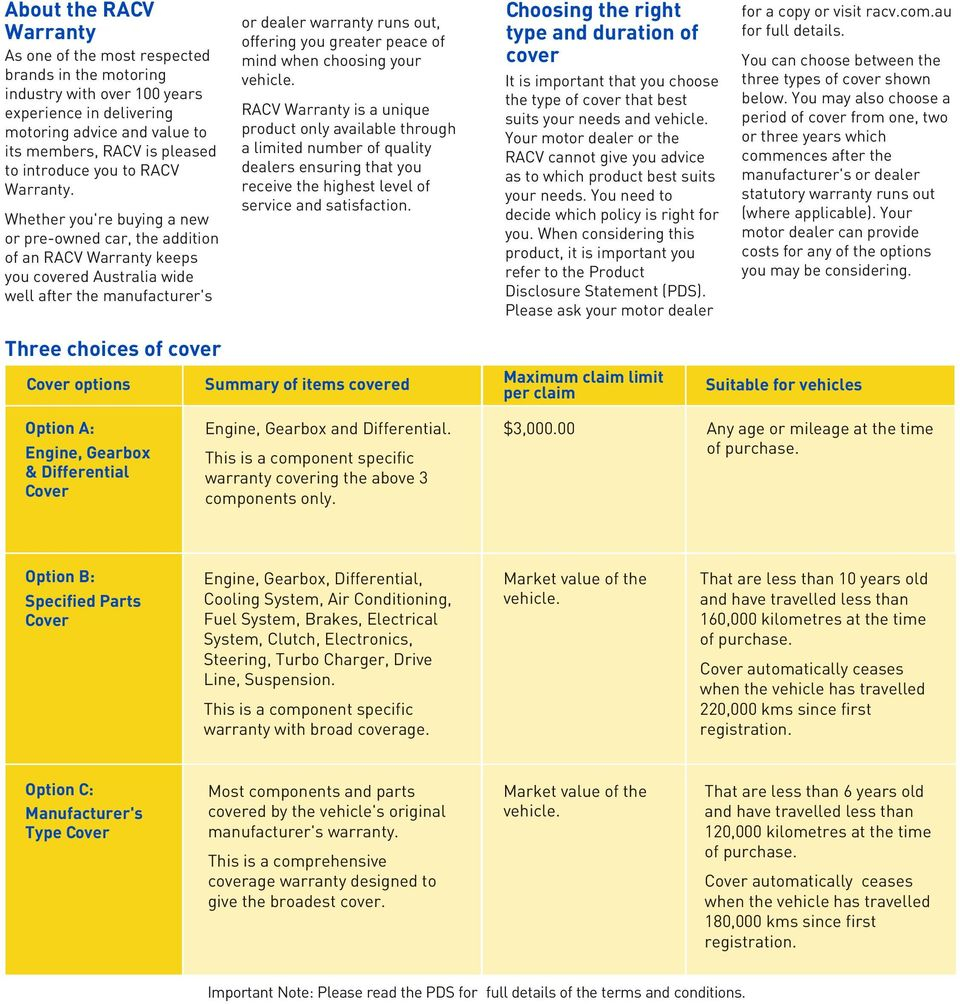

Racv Warranty Three Choices Of Cover Motor Vehicle for proportions 960 X 1004

Racv Warranty Three Choices Of Cover Motor Vehicle for proportions 960 X 1004Find out just what the minimum requirements are pertaining to auto insurance inside your state. Also should you only need inexpensive burden auto insurance, you should think about different kinds of coverage also, which includes injury protection. PIP insurance covers both your own personal along with your passengers’ medical bills if you happen to be ever associated with a great car accident. PIP insurance coverage is sometimes called “no-fault” insurance. However , whilst it covers medical expenses and in many cases, it could also spend on wage damage. However , no-fault / PIP insurance pays for that real damage in the auto. In this, you will need to possess your own personal wreck coverage or by the insurance coverage in the other party when they were those who caused the accident.

Insurance Racv Car Insurance within proportions 1440 X 960

Insurance Racv Car Insurance within proportions 1440 X 960Consider the need for your car or truck when trying to find cheap burden auto insurance to discover when it will be worthwhile to possess collision insurance. If it’s an adult model, the price tag on paying to possess that protected might run you more income than the particular expense will be to correct it within the function that it can be broken. Think about the deductible also.

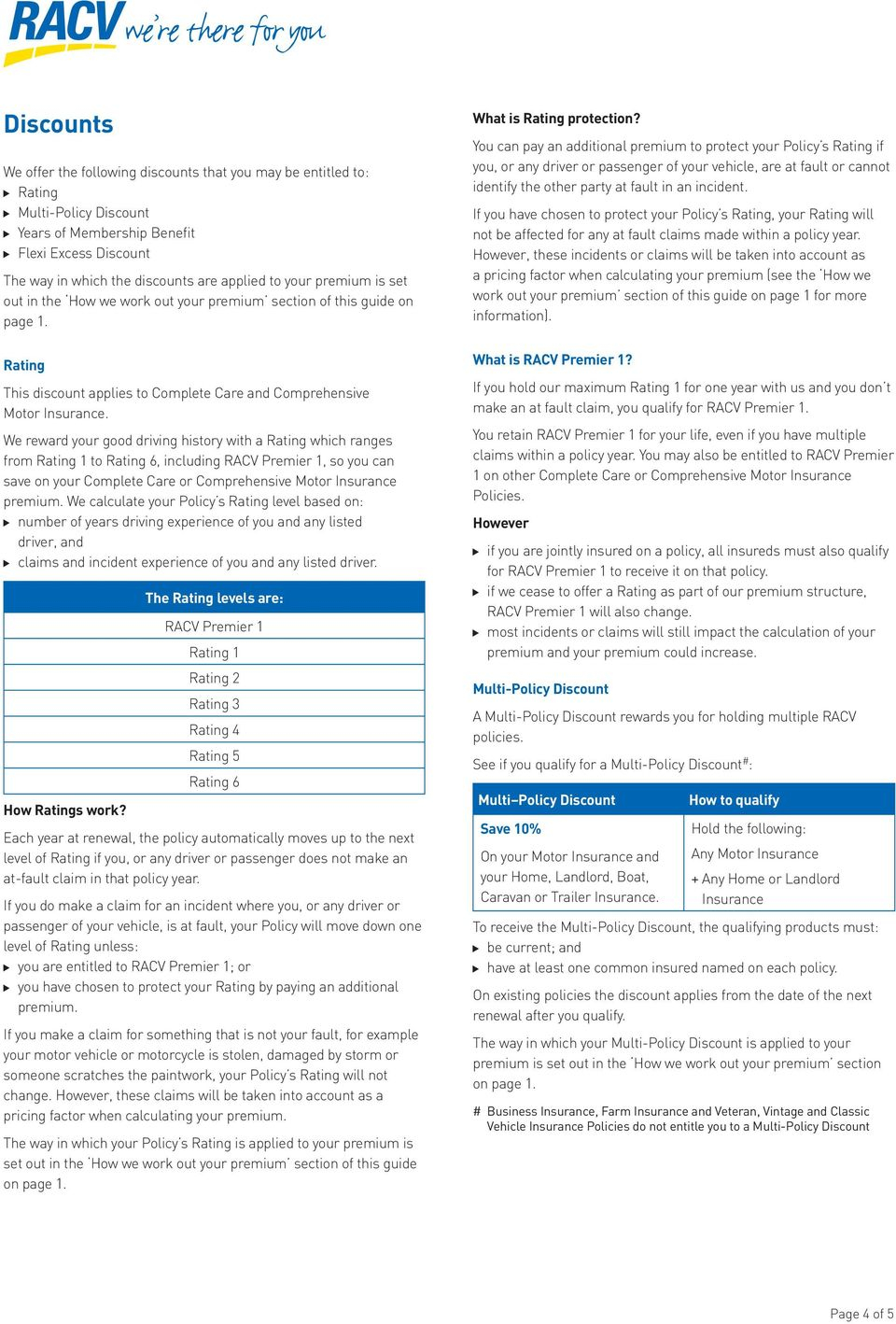

Motor Insurance Premium Excess Discounts Guide Pdf Free for size 960 X 1418

Motor Insurance Premium Excess Discounts Guide Pdf Free for size 960 X 1418A large number of people desire to know the best way to decrease the premium. The theory, obviously, would be to purchase sufficient coverage ideal to meet your needs while not overspending. Do not believe that you’ve got to sacrifice coverage so that you can lower your expenses. Rather, check around a lot of. Consider bundling your auto insurance along with other kinds of insurance you’ve got, like property insurance. Some corporations give reductions for multiple guidelines.