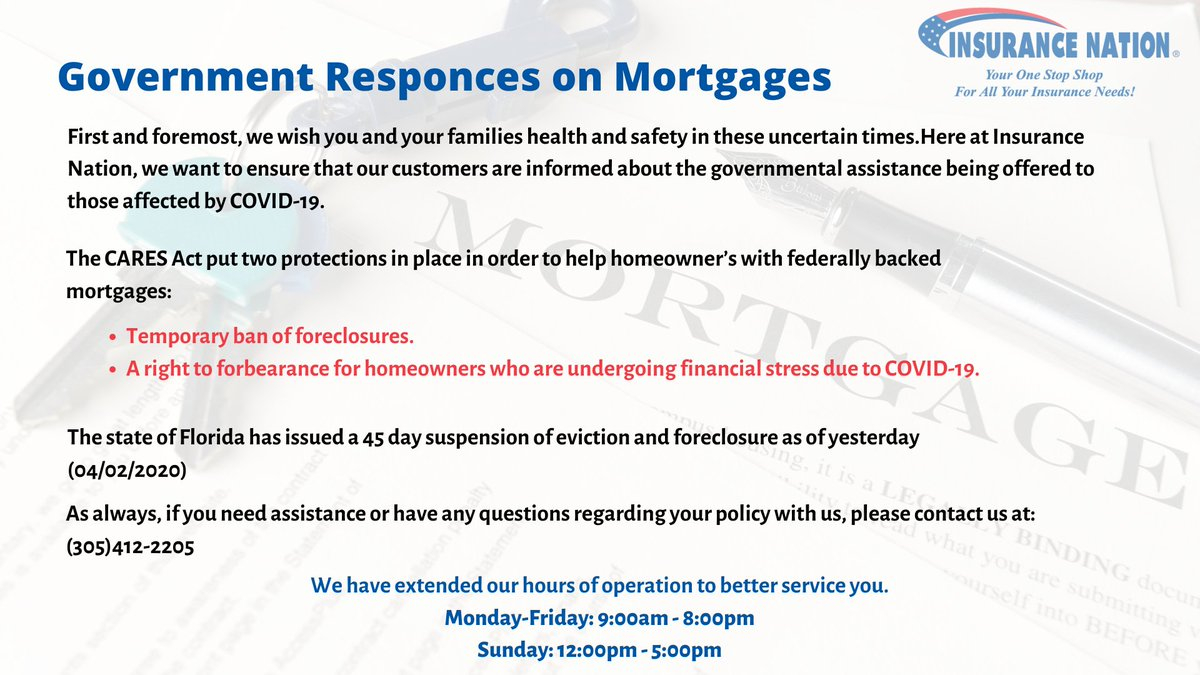

Insurance Nation Insnationtweets Twitter pertaining to sizing 1200 X 675

Insurance Nation Insnationtweets Twitter pertaining to sizing 1200 X 675Infinity Auto Insurance Riverside Ca – Thanks a lot for the internet, auto insurance is a lot easier to get thany other time. It’s so easy to acquire multiple automobile insurance quotes internet at the same time from diverse corporations, all at one internet site. The downside is that you must invest time to compare them so that you can determine which choice could be the best for you personally. To help increase the risk for process get quicker, you need to have your data prepared and able to go.

Infinity Insurance Extra Insurance Services within size 1170 X 780

Infinity Insurance Extra Insurance Services within size 1170 X 780Anytime you receive an car insurance insurance quote online, whether using an agent or directly, you will want to offer some documentation for example the license, make / type of vehicle, address, VIN, years, ssn, etc . Like this or otherwise not, you will find certain age ranges which can be considered “higher risk” than the others. Your location may are likely involved within the varieties of quotes you receive also – particularly if you live in a region at risk of extreme weather and road conditions, or in which you will find there’s high rate of crime.

Infinity Pharmacy Competitors Revenue And Employees Owler within size 1024 X 2163

Infinity Pharmacy Competitors Revenue And Employees Owler within size 1024 X 2163If your automobile features certain safety measures, like anti-lock brakes, front and part airbags, GPS, with a home security system, you’ll likely qualify to get a discount when searching for automobile insurance quotes internet. Many vehicle insurance firms hand out discounts to safety-conscious motorists. Also, it is possible to potentially save a lot more in case you take a defensive driver’s study course.

Infinity Insurance Coverage Discounts 2020 pertaining to size 1000 X 1000

Infinity Insurance Coverage Discounts 2020 pertaining to size 1000 X 1000One more possible factor having an effect on the quotes you is certain to get is your credit history. Those with a bad credit score could have an even more awkward time finding a great rate on the automobile insurance. In the event that you’ve got a bad credit score, the most effective matter it is possible to do is attempt to look for as much discounts as is possible. Some insurance firms give an extensive number of discounts so you will likely be qualified to receive at the very least a person of which.

This Insurance Stock Has About 25 Upside Thestreet with regard to dimensions 1200 X 800

This Insurance Stock Has About 25 Upside Thestreet with regard to dimensions 1200 X 800As for age and gender, men’re usually forced to pay higher rates than women of all ages since women are viewed to become more cautious when ever driving. Also, drivers more youthful than 25 are statistically more likely to become careless, so they really usually are charged higher premiums. In the event that you might be a college student who also makes high gpa’s, on the other hand, you will likely be eligible to get a discount. At this time there is really a more recent thing some insurance providers are selling called “usage-based insurance”. This simply means actually giving motorists the choice to get their driving watched with a mobile app to acquire possible discounts and minimize prices.