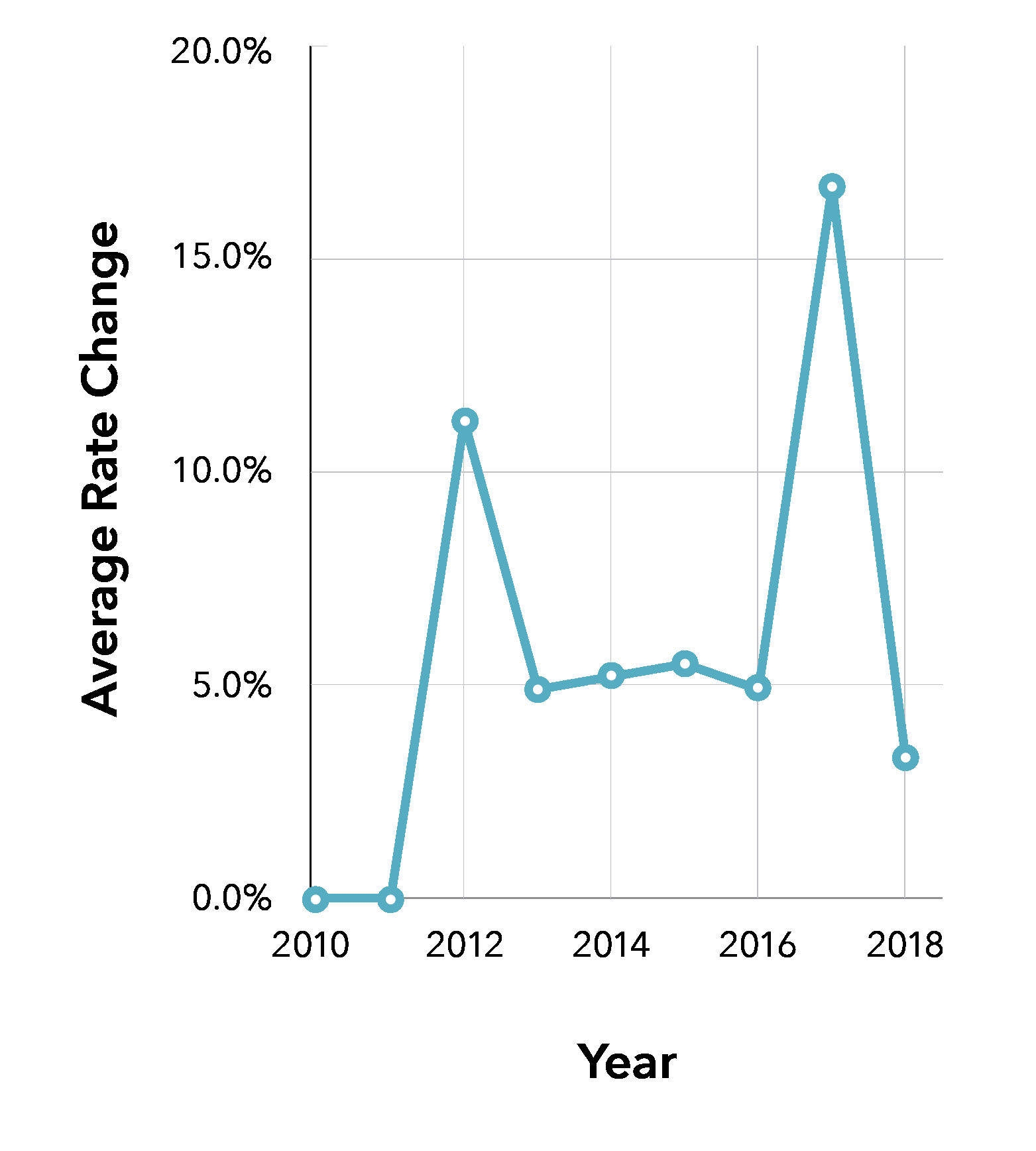

Alberta Car Insurance Costs Canadians On Average 122month intended for sizing 1280 X 720

Alberta Car Insurance Costs Canadians On Average 122month intended for sizing 1280 X 720Car Insurance Rates Bc Vs Alberta – Every rider inside US must involve some type of liability coverage so that you can legally travel. It’s certainly not something you need to at any time risk performing without. You’ll ought to discover one method or another to cover it, if you want this you aren’t. Automobile insurance plans really do not ought to expense lots of money, despite the fact that. You do involve some alternatives with regards to cheap responsibility auto insurance. However , you shouldn’t select a plan based about the selling price alone, as you will find a large number of additional factors which can be imperative that you take into consideration also.

Compare Bc Car Insurance Quotes Bc Auto Insurance Ratehubca with sizing 1563 X 1736

Compare Bc Car Insurance Quotes Bc Auto Insurance Ratehubca with sizing 1563 X 1736Always check with all the impartial rating agencies like Normal & Poor and ARE Best to discover the fiscal steadiness of every insurer you happen to be looking at. Take time to read assessments using their company clients on each enterprise. Whilst you don’t know in the event they’re all legitimate assessments, it is smart to avoid service repair shop that is finding a large number of issues – just to become about the safe side.

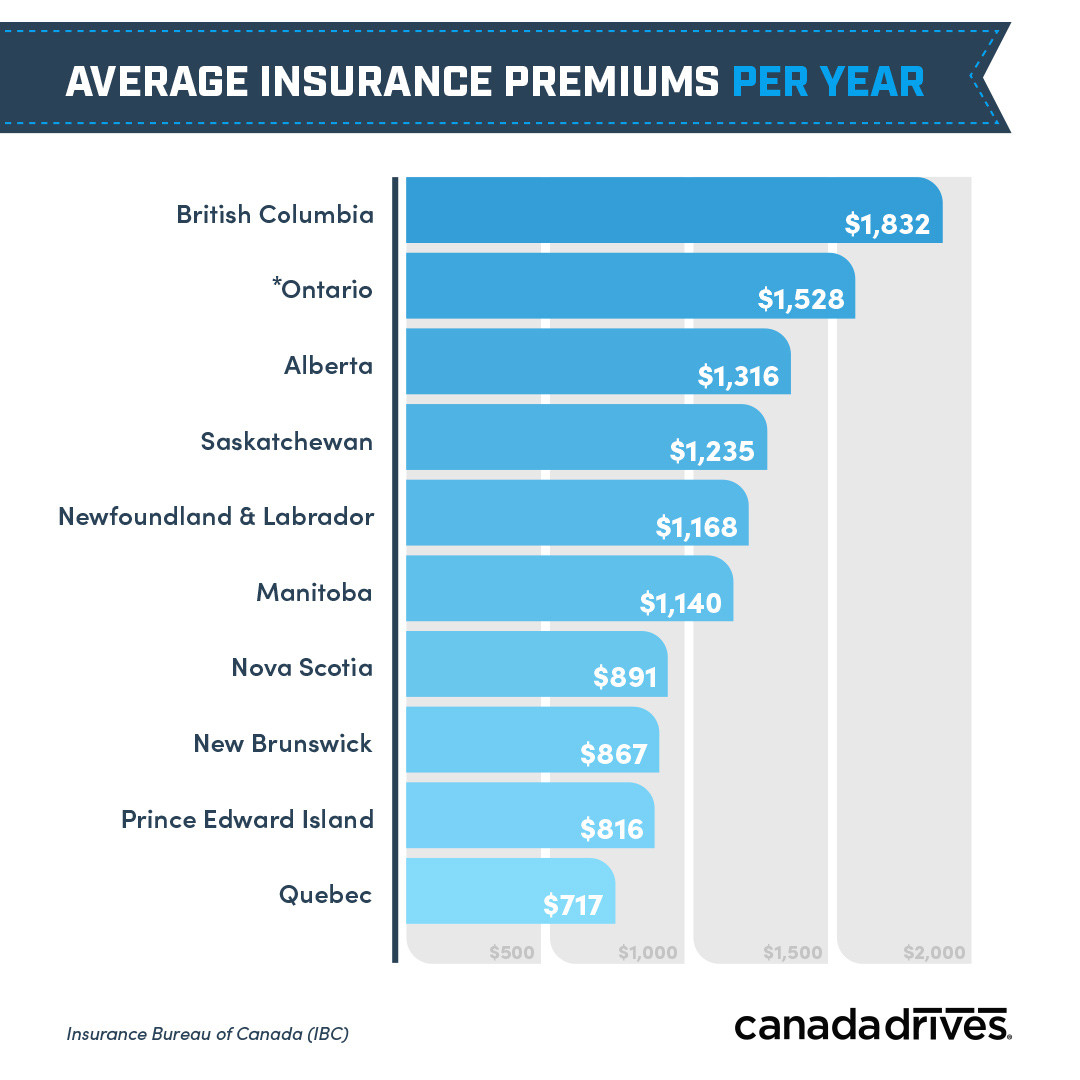

Car Insurance Rates Across Canada Whos Paying The Most And regarding sizing 1080 X 1080

Car Insurance Rates Across Canada Whos Paying The Most And regarding sizing 1080 X 1080Find out just what the minimum requirements are designed for auto insurance within your state. Also in the event you only require low-cost responsibility auto insurance, you should think of different kinds of coverage also, which include injury protection. PIP protection covers both your own personal as well as your passengers’ medical bills if you happen to be ever associated with a great automobile accident. PIP insurance policies are also known as “no-fault” insurance. However , as it covers medical expenses and in many cases, it may also purchase wage reduction. However , no-fault / PIP insurance pays to the genuine damage from the automobile. Because of this, you will need to possess your own personal crash coverage or by the insurance plan from the other party whenever they were individuals who caused the accident.

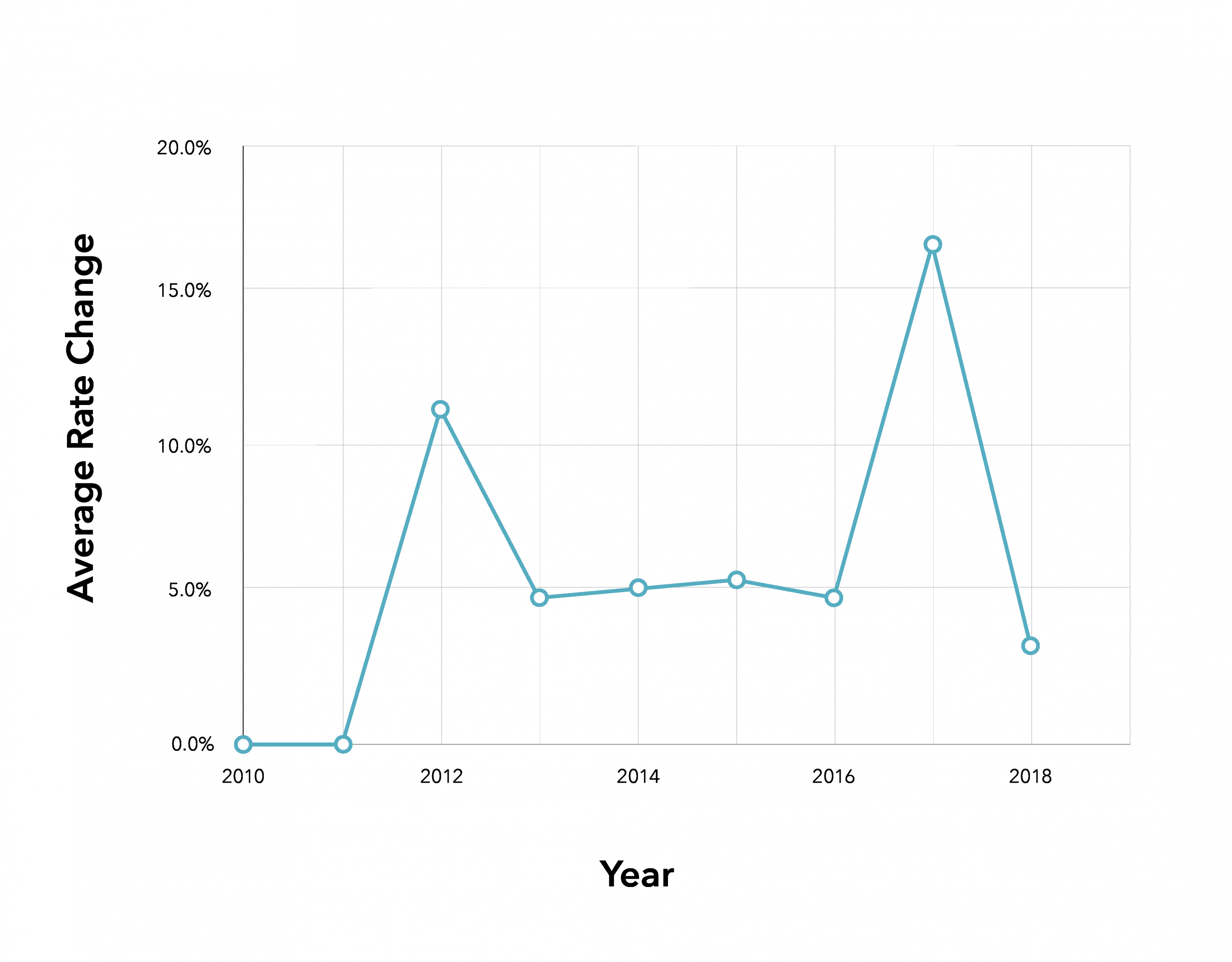

Compare Bc Car Insurance Quotes Bc Auto Insurance Ratehubca throughout sizing 4268 X 3335

Compare Bc Car Insurance Quotes Bc Auto Insurance Ratehubca throughout sizing 4268 X 3335Consider the need for your automobile when seeking cheap responsibility auto insurance to find out whether it could be worth the cost to possess collision protection. If it’s a mature model, the price of paying to possess this protected might run you more cash compared to what the particular expense could be to correct it inside celebration that it really is broken. Think about the deductible also.

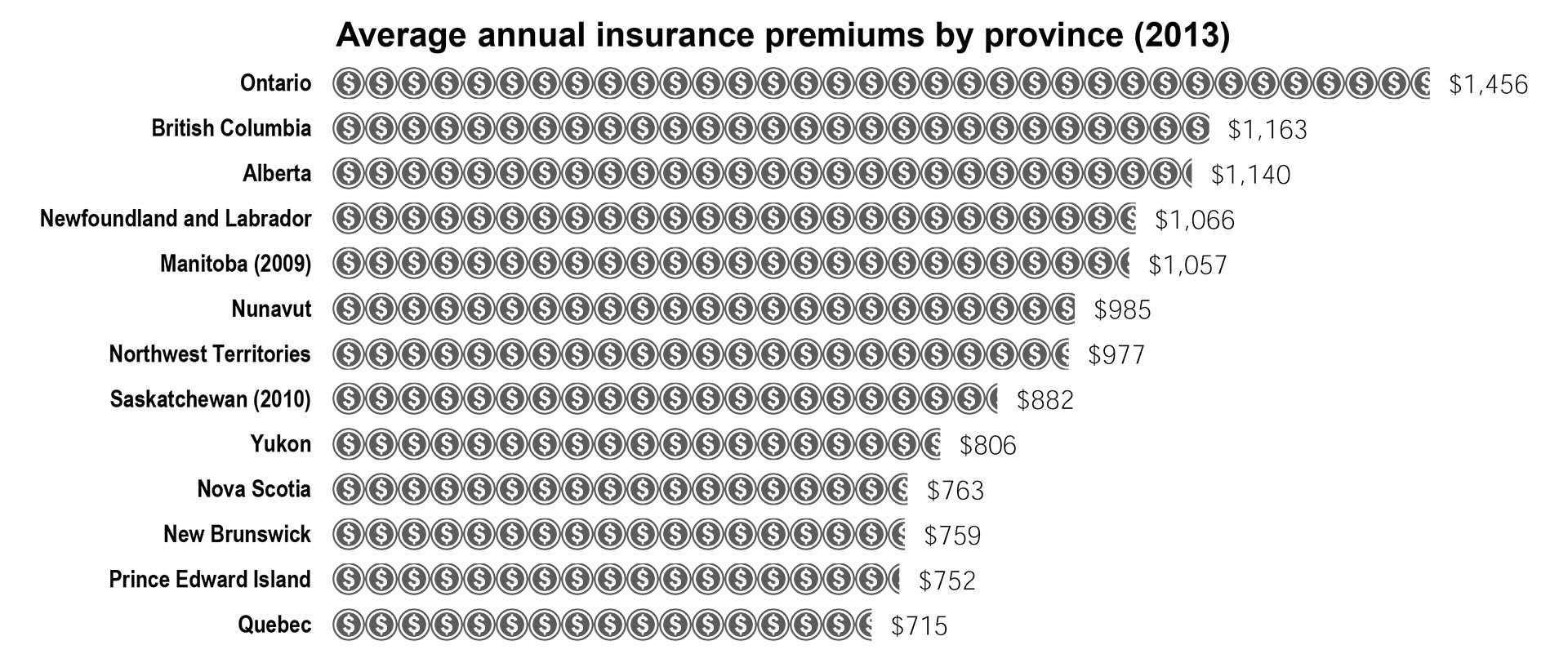

Car Insurance Differences From Province To Province pertaining to measurements 1920 X 812

Car Insurance Differences From Province To Province pertaining to measurements 1920 X 812Various people need to know how you can reduce the premium. The concept, obviously, is usually to purchase sufficient coverage ideal to your requirements while not overspending. By no means feel that you’ve to sacrifice coverage so that you can lower your expenses. Rather, look around a lot of. Consider bundling your auto insurance along with other kinds of insurance you’ve, including property insurance. Some firms give reductions for multiple insurance policies.