Calamo Car Insurance Information And Facts You Have To Know within sizing 1190 X 1682

Calamo Car Insurance Information And Facts You Have To Know within sizing 1190 X 1682Auto Insurance Providers In Michigan – Auto insurance coverage is something nobody wants to spend but it’s necessary and need to be practiced. It might look like a fantastic unnecessary expense initially — until your car or truck is damaged in some manner and after that it’s important that you will get which claim paid for you. In this time, it does not take deductible you don’t need to spend. Regardless of what sort of automobile you’ve got, you are going to – at least – get low cost automobile insurance that covers the basic principles and fits certain requirements on your state.

Calamo Car Insurance Information You Must Know with sizing 1190 X 1682

Calamo Car Insurance Information You Must Know with sizing 1190 X 1682Consider benefit from online tools that permit you to compare many quote at any given time to help you begin to see the similarities mud differences between multiple insurance providers. If you’ve got house insurance as well as your provider also provides car insurance, see should you can get yourself a discount should you bundle that all together.

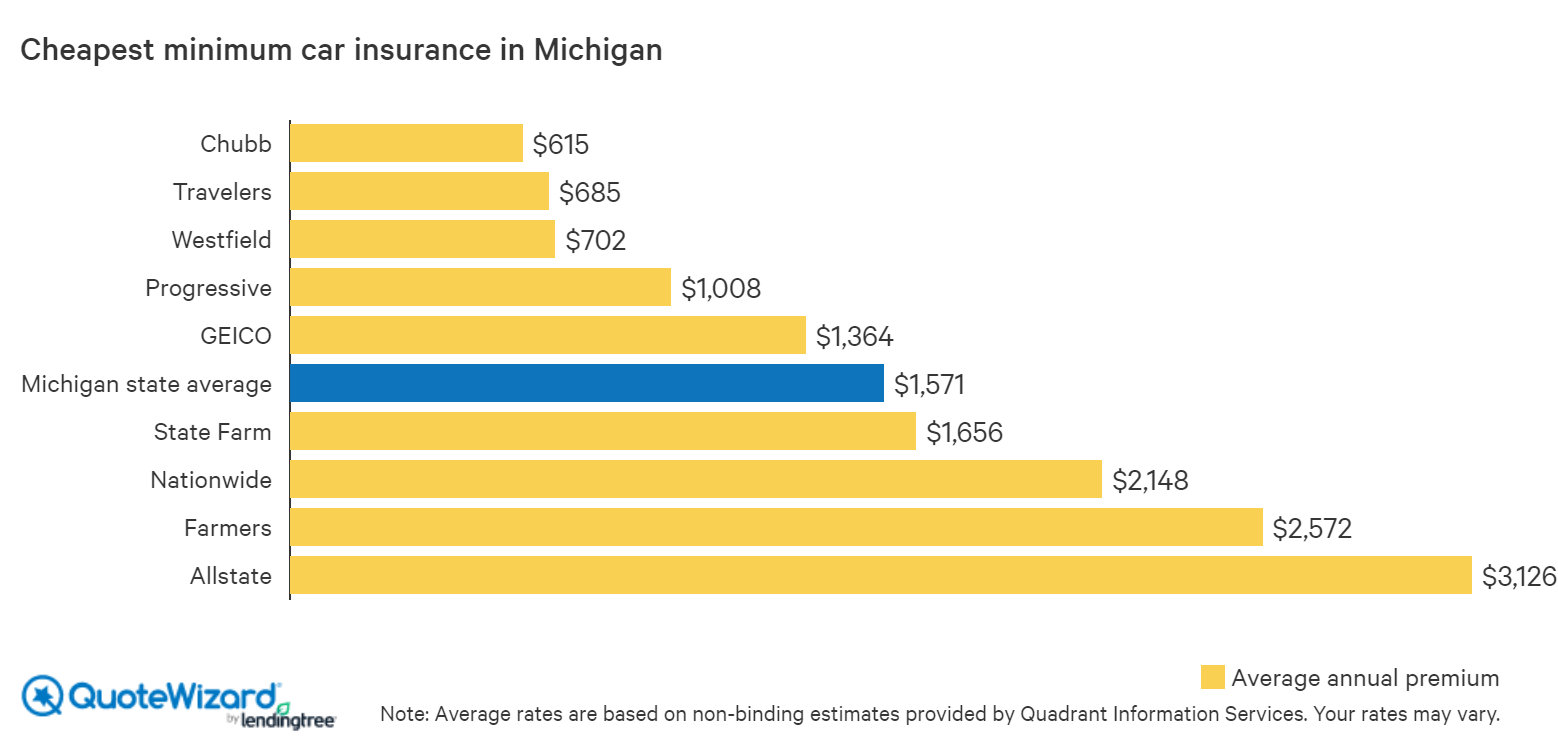

Cheapest Car Insurance In Michigan Quotewizard with dimensions 1558 X 750

Cheapest Car Insurance In Michigan Quotewizard with dimensions 1558 X 750In addition towards the style to make with the vehicle, the driving record, age, and credit standing, below are a few additional factors that affect the rates you will get when you wish to acquire cheap automobile insurance: Zipper code – some areas are simply just likely to have higher-than-normal injuries and car reduction because of heavier road circumstances and traffic and/or excessive criminal offense rates. Number of kilometers – The amount of mileage you apply to your motor vehicle monthly make a difference the rates. Age and spouse status. Young, unmarried guys most often have to spend essentially the most. Recent claims record – People that have past filing claims inside past could be more likely to spend more after they switch businesses or perhaps renew a present insurance policy.

Sorry Guess I Was Not Clear My Son Is Over 30 Years Old with proportions 1365 X 768

Sorry Guess I Was Not Clear My Son Is Over 30 Years Old with proportions 1365 X 768Each company possesses its own guideline in regards to what constitutes as “high risk”. If you have been involved with a great accident or have various other negative items on your own driving history, the variance in prime differs from one company to another. So long as you’re diligent to check out savings and solutions to save, you have to be in a position to find a plan and rate you’ll be able to experience.

Best Auto Insurance Providers pertaining to proportions 1396 X 940

Best Auto Insurance Providers pertaining to proportions 1396 X 940You could want to think about skipping on thorough insurance policy coverage in case you have an adult automobile because the money you have to pay for your insurance might set you back far more compared to what the existing “clunker” will be worth at any rate. However , it’s in all probability best if you involve some sort of insurance policy coverage to spend for your cost of the medical bills should you develop into injured.