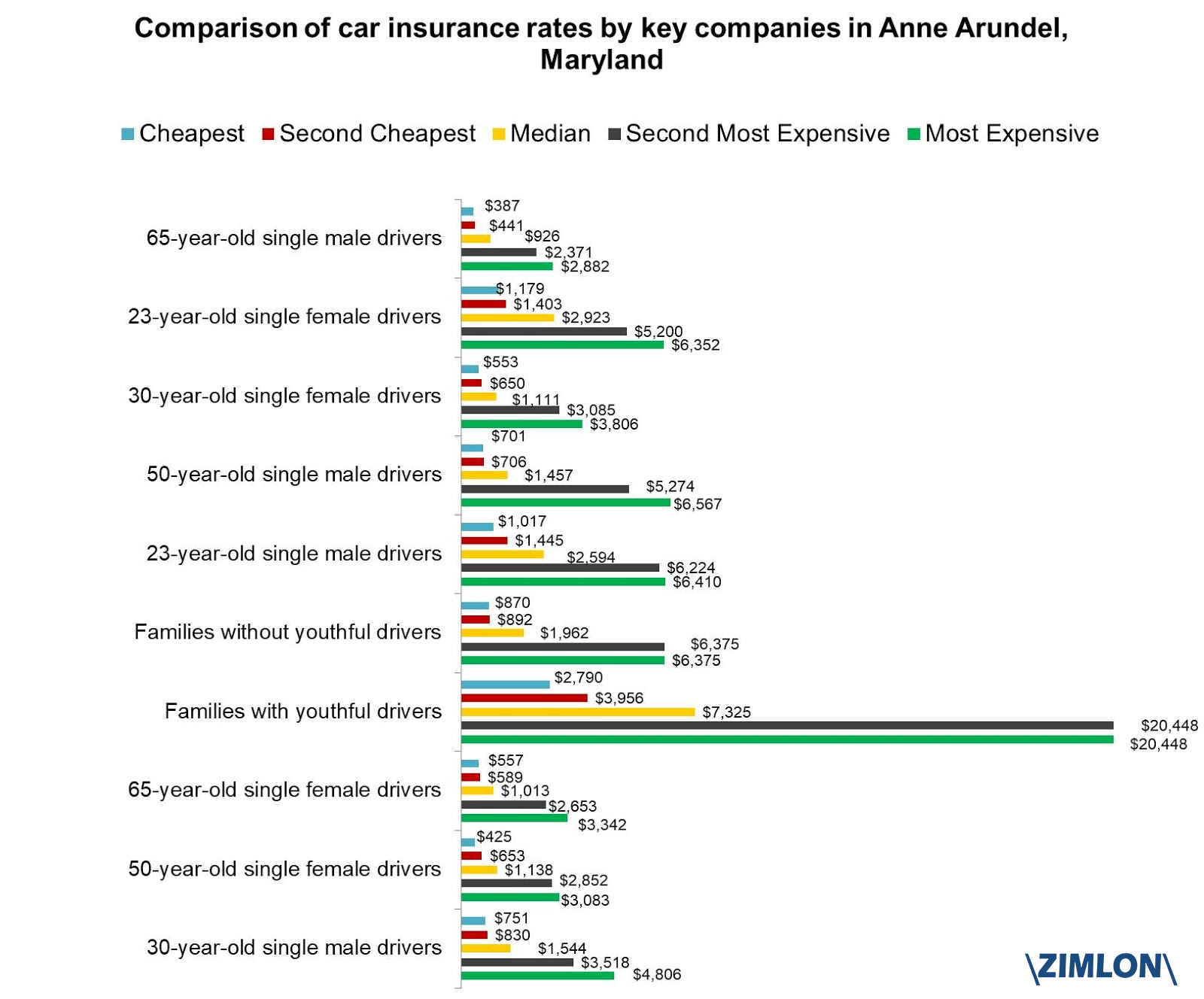

Latest Data Driven Insurance Research inside size 1600 X 1328

Latest Data Driven Insurance Research inside size 1600 X 1328Auto Insurance 18 Year Old Female – Auto insurance coverage is something nobody wants to cover yet it’s necessary and need to be achieved. It might appear to be an excellent unnecessary expense initially — until your car or truck is damaged in some manner after which it’s important you will get which claim paid for you. For this time, it is the deductible you don’t wish to cover. Regardless of what type of motor vehicle you’ve, you will – at the minimum – get low cost automobile insurance that covers the fundamentals and matches the needs for the state.

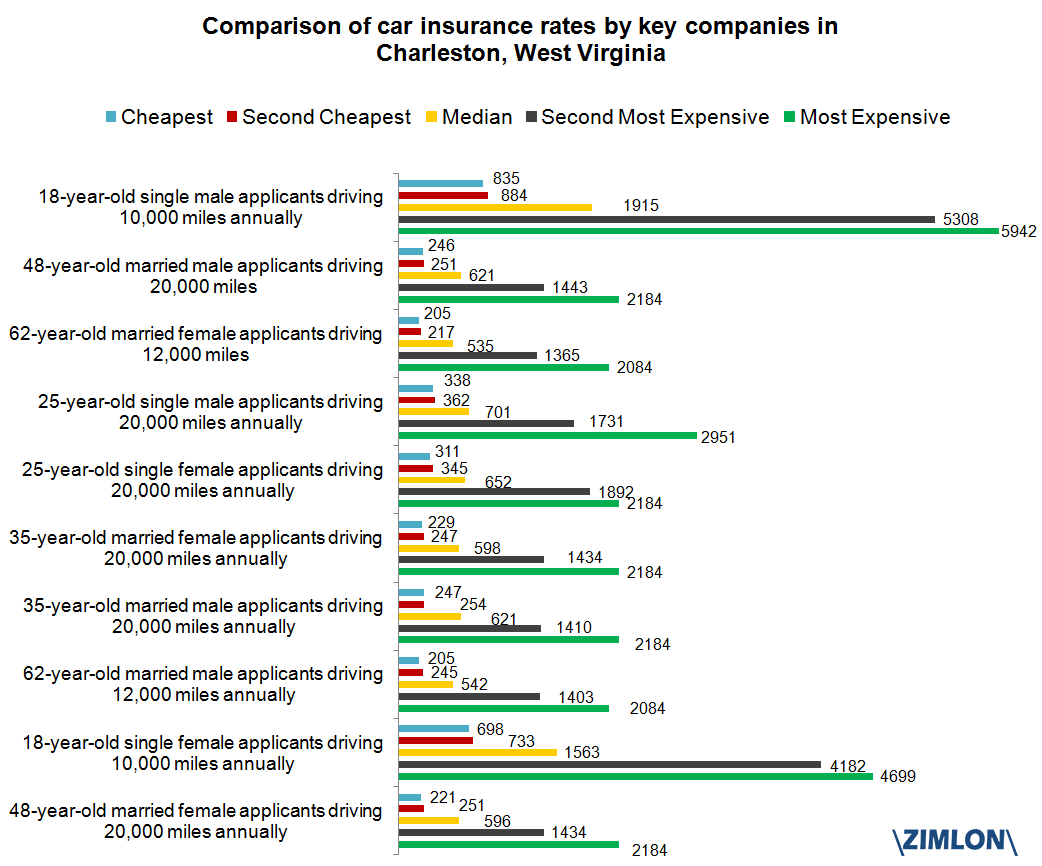

Latest Data Driven Insurance Research throughout size 1042 X 866

Latest Data Driven Insurance Research throughout size 1042 X 866Have good thing about online tools that enable you to compare several quote at the same time to enable you to begin to see the similarities mud differences between multiple insurance providers. If you’ve house insurance as well as your provider also provides car insurance, see in case you can get yourself a discount in case you bundle that all together.

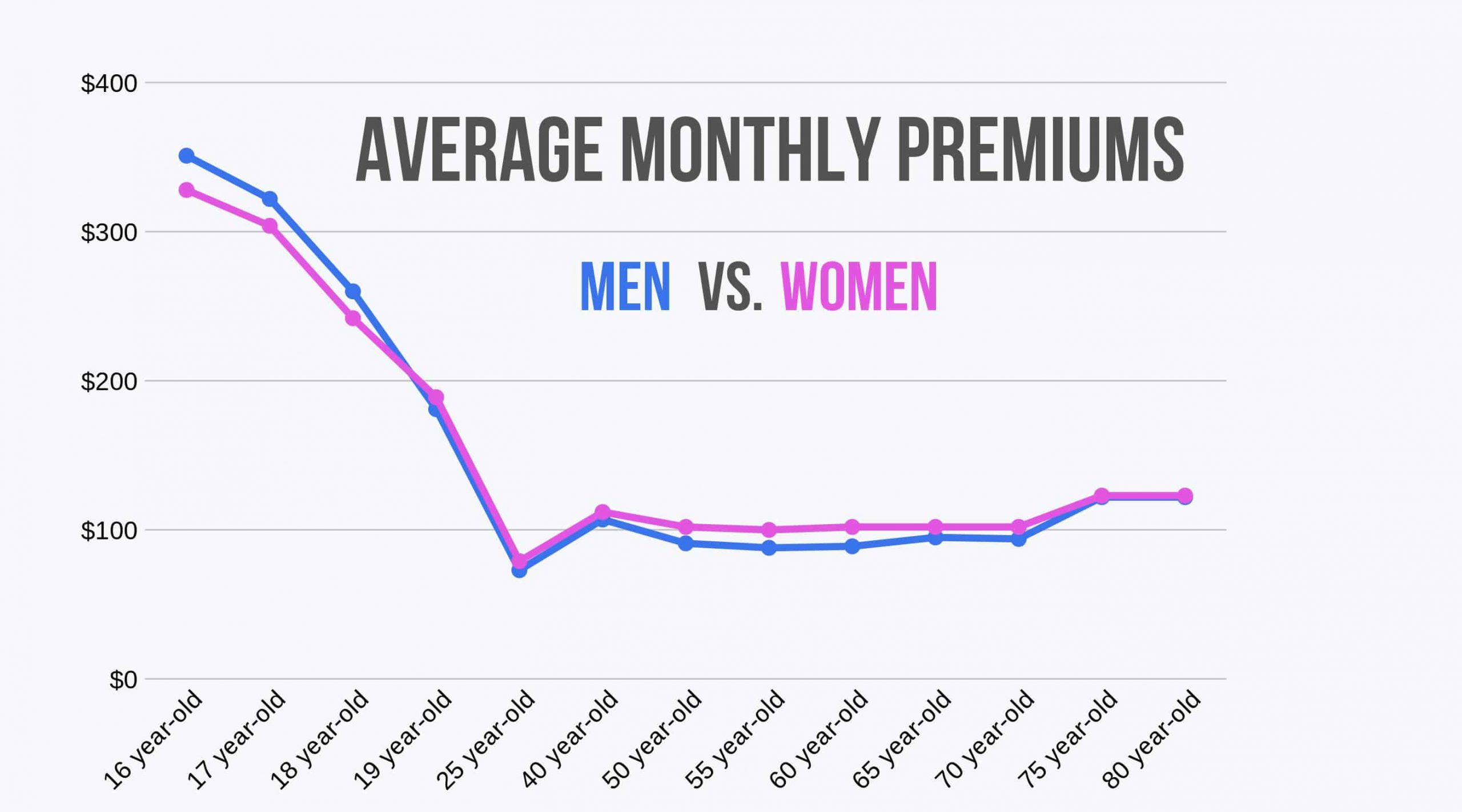

Car Insurance Rates Age Gender Complete Guide regarding sizing 2813 X 1563

Car Insurance Rates Age Gender Complete Guide regarding sizing 2813 X 1563In addition on the version and earn from the vehicle, the driving record, age, and credit rating, below are a few variables that affect the rates you’re going to get if you want to have cheap automobile insurance: Go code – some areas are merely gonna have higher-than-normal mishaps and car reduction because of heavier road circumstances and traffic and/or huge transgression rates. Number of mls – The amount of mileage you put onto your automobile monthly could affect the insurance costs. Age and spouse status. Young, unmarried men normally have to cover one of the most. Recent claims record – Individuals with previous filing claims inside past could be more likely to cover more whenever they switch firms or perhaps renew an existing coverage.

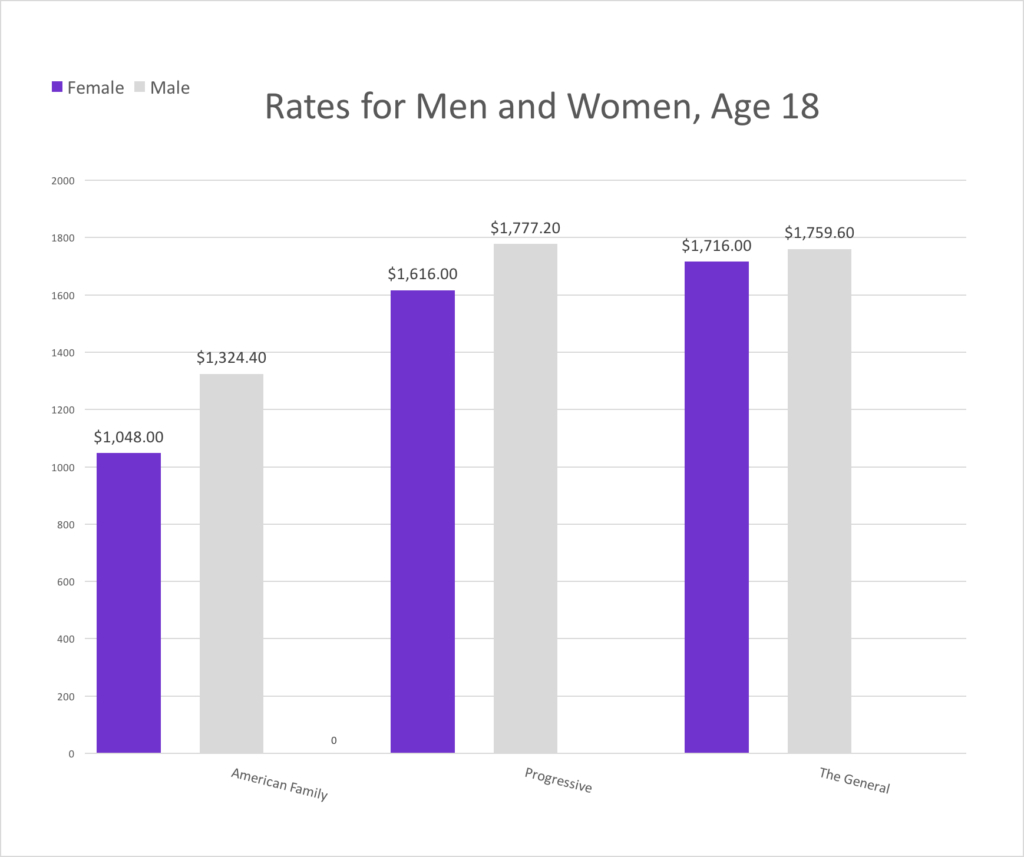

Car Insurance For 18 Years Old Female Now Available inside size 1280 X 720

Car Insurance For 18 Years Old Female Now Available inside size 1280 X 720Each company possesses its own guideline in regards to what constitutes as “high risk”. If you have been associated with a great accident or have additional negative items on the driving history, the variance in superior differs from business to business. Given that you happen to be diligent to see discount rates and methods to save, you ought to be capable of find an insurance policy and rate you’ll be able to experience.

Quotes On Wisconsin Car Insurance Obrella with regard to size 1024 X 857

Quotes On Wisconsin Car Insurance Obrella with regard to size 1024 X 857You could be considering skipping from extensive insurance coverage in case you have a mature motor vehicle since money you have to pay to the insurance might set you back much more compared to what that old “clunker” will be worth anyways. However , it’s likely best if you involve some sort of insurance coverage to cover to the cost of the medical bills in case you change into injured.