Full Coverage Car Insurance Progressive within measurements 2400 X 1256

Full Coverage Car Insurance Progressive within measurements 2400 X 1256Does Progressive Rv Insurance Cover Roadside Assistance – The best method to acquire cost-effective vehicle insurance is always to first look for insurance quotes and after that spend some time to compare all of them. Study about the firms that are providing the quotes and judge what one is providing solutions in a price within your budget to spend. Since you can find a lot of companies around all claiming to make available affordable motor insurance quotes, you will need to study a bit about all of them before you make your selection.

Best Rv Insurance 2020s Rv Insurance Comparison pertaining to measurements 735 X 1102

Best Rv Insurance 2020s Rv Insurance Comparison pertaining to measurements 735 X 1102Don’t only glance at the big insurers, possibly. There are smaller, local motor insurance businesses that offer affordable insurance quotes. And, since they will be smaller, they’re able to deliver more unique plan to the clientele. Liability-only automobile insurance is obviously going to become the cheapest alternative, since it is a nominal amount coverage expected in each state. On the other hand, it only covers items like property damage and skilled bills for that people involved with an accident that you’re observed responsible. What about your individual skilled bills? How do you obtain fixes for your individual vehicle? This really is comprehensive / collision coverage options that you’re going to definitely be considering.

Progressive Rv Insurance Review 2020 Are They Worth It throughout sizing 735 X 1102

Progressive Rv Insurance Review 2020 Are They Worth It throughout sizing 735 X 1102Finding affordable motor insurance prices it not just about seeking the best value payment, and will simply be deemed when you have a classic junk car that isn’t definitely worth the money you spend to insure it. You’ll even now need to maintain your medical costs at heart, though. One more point to give thought to is what can occur to your family’s finances should you be badly injured in the car accident and can not work for the long time frame? Some quotes will incorporate solutions with this too.

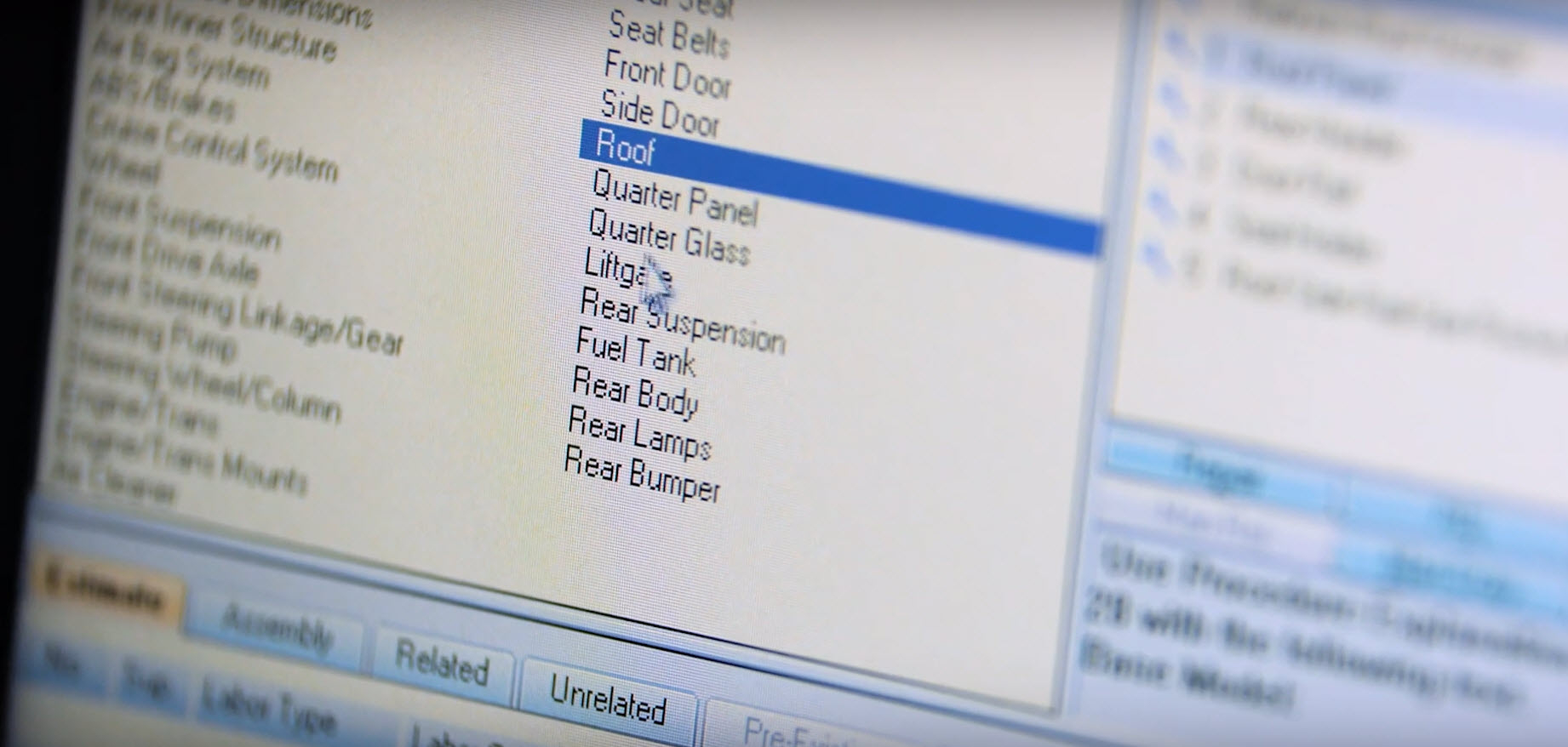

Progressive Insurance Settlements And Claims Pain in proportions 1200 X 675

Progressive Insurance Settlements And Claims Pain in proportions 1200 X 675As with any form of insurance, you will find the deductible VS monthly payments debate. The deductible may be the insurance carrier ‘s means of producing the policyholder share a few of the responsibility associated with an accident. The low the deductible, the larger the high quality, and the other way round. Decide what can certainly be a better solution to your requirements. If you’re not sure, inquire the insurance professional or economical expert for advice.

Progressive Rv Insurance Review Are They Worth It Updated throughout proportions 1842 X 878

Progressive Rv Insurance Review Are They Worth It Updated throughout proportions 1842 X 878You also can execute a little bit of mathematics on your individual. If you were to opt for the higher deductible, just how much will you be capable of reduce a reduced premium? Could how much money you’d save be equivalent to that particular with the deductible inside the event you might be in an occurrence and must pay a few of the repair costs from the win? Whatever you make a decision, you’ll still may be capable of probably conserve big money with discounts. Just about every company supplies a various discounts, and there’s a chance you will be capable of be entitled to no less than one. One place you can visit find great deals and affordable motor insurance quotations is esurance. You can begin simply by working which has a “Coverage Counselor” for top level coverage. Also, look at Esurance discounts – you can find a large number of and also you could be entitled to one.