Admiral Insurance Images Stock Photos Vectors Shutterstock with proportions 1500 X 1101

Admiral Insurance Images Stock Photos Vectors Shutterstock with proportions 1500 X 1101Car Insurance Login Admiral – This is extremely easy currently to obtain auto insurance quotes on-line. The part that’s not easy is really comparing the quotes and determining which provides the type(s) of coverage you virtually all need in an affordable price. To be able to begin, you will need to complete a couple of details thus hitting the “submission” button. The forms of details you will end up expected to deliver consist of one site for the next. Experts recommend to check a minimum of three offers prior to your own preference. Also, review of your current policy. It may well even now be the better option in your case.

Admiral Group Plc Half Year Results 2019 inside dimensions 1280 X 720

Admiral Group Plc Half Year Results 2019 inside dimensions 1280 X 720Should you wish to add someone else for a policy, like a teenager or perhaps other half, then make sure through adding their details too when ever requesting quotes. What type of coverage do you want? Most expresses require drivers possess some kind of vehicle insurance. Find out what your california’s minimum requirements are. Also in case you think you know, make sure in order that nothing is different considering that the last time you bought a great vehicle insurance plan.

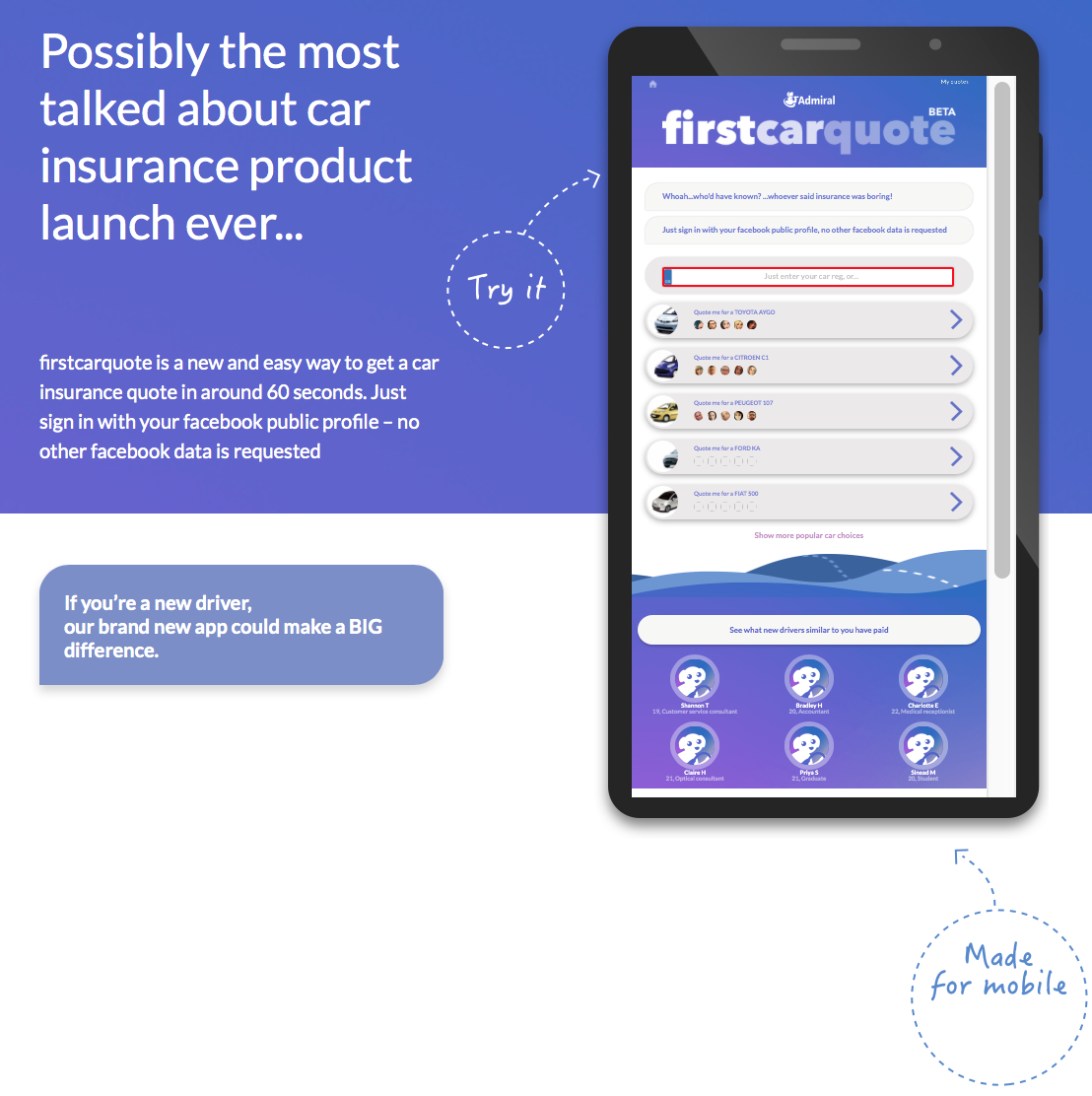

From Facebook Likes And Internet Of Things To Insurance throughout sizing 1108 X 1112

From Facebook Likes And Internet Of Things To Insurance throughout sizing 1108 X 1112Most expresses require, at least, that individuals have burden insurance. The moment purchasing this type of insurance, the protection limits tend being indicated by simply three amounts. The first number alludes for the maximum bodily damage (in 1000s of dollars ) for starters individual injured in an incident. The second number refers for the maximum liability for each damage induced inside accident, and third number indicates the most residence damage liability. Retain this planned when you’re trying to obtain auto insurance estimates on-line.

Admiral Startupbootcamp intended for dimensions 1360 X 1200

Admiral Startupbootcamp intended for dimensions 1360 X 1200Another factor is injury protection (PIP). This is vital in case you play a huge role with your family’s finances. If you find yourself badly injured and inside hospital and can not do the job, then have to pay for therapeutic bills in addition to that, your whole family have been around in trouble. PIP is obviously crucial coverage to get. Do you need comprehensive coverage? In the event that you’ve got an inexpensive, older motor vehicle then you certainly probably won’t. This kind of coverage reimburses you inside event that your automobile is horribly damaged in an incident or lost. If that isn’t price much anyways, then it may certainly be a waste of greenbacks to pay for on a plan with complete coverage. You could be happier utilizing the risk then simply make payment on deductible whether or not this is actually damaged.

Elephant Insurance Is Live In Ohio A Decade Later in proportions 3778 X 1768

Elephant Insurance Is Live In Ohio A Decade Later in proportions 3778 X 1768