Usaa Review A Good Bank If You Can Get It regarding dimensions 2234 X 1180

Usaa Review A Good Bank If You Can Get It regarding dimensions 2234 X 1180Military Car Insurance Usaa – This is quite easy currently to have motor insurance quotes on the net. The part which is not easy is really comparing the quotes and determining which provides type(s) of coverage you virtually all need at the acceptable price. To be able to begin, you may need to fill in a couple of details striking the “submission” button. The forms of details you will be expected to supply differ from one site on the next. Experts recommend that compares no less than three offers prior to making your selection. Also, research your current policy. It may well nonetheless be the better option for you personally.

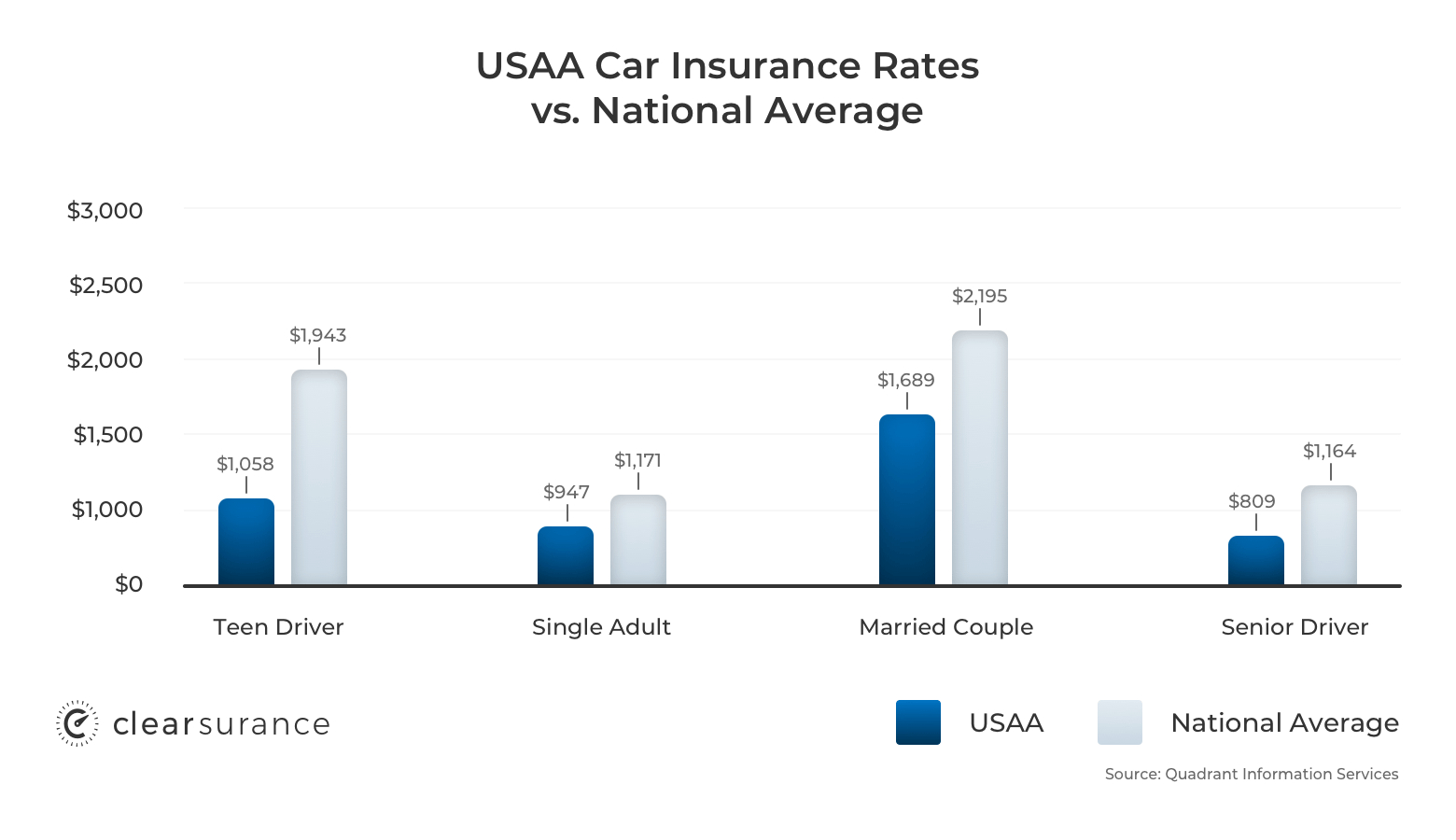

Usaa Insurance Rates Consumer Ratings Discounts pertaining to proportions 1560 X 900

Usaa Insurance Rates Consumer Ratings Discounts pertaining to proportions 1560 X 900When you wish to add someone else for your policy, for example a teenager or perhaps loved one, then make certain through adding their details also once requesting quotes. What form of coverage do you require? Most says require drivers incorporate some kind of vehicle insurance. Find out what your california’s minimum requirements are. Also should you think you know, check to ensure nothing has evolved considering that the last time you bought a great vehicle insurance plan.

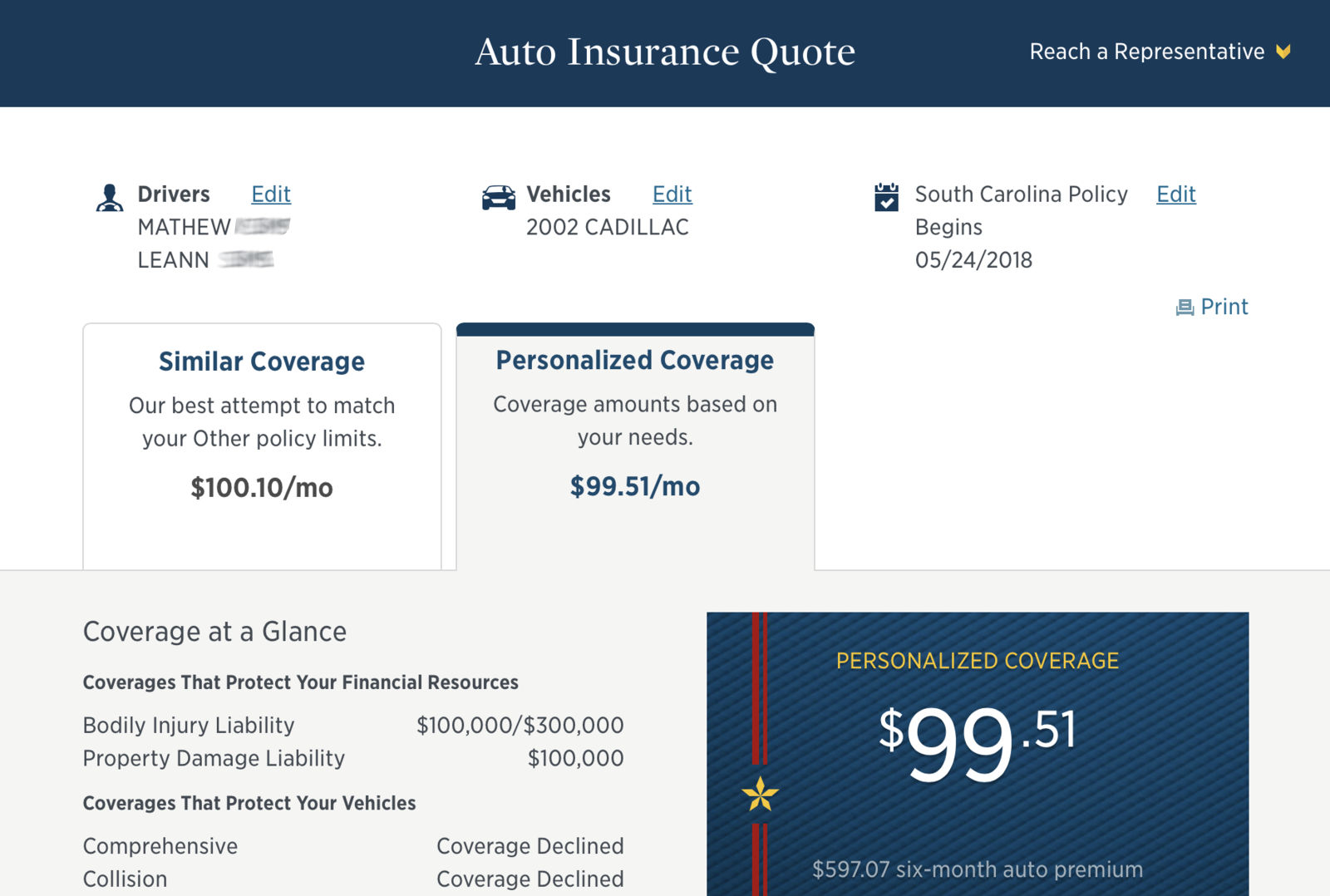

Usaa Car Insurance Review Best For Military Families with regard to size 1700 X 1133

Usaa Car Insurance Review Best For Military Families with regard to size 1700 X 1133Most says require, anyway, that individuals have obligation insurance. Once purchasing this form of insurance, a policy limits tend to become indicated simply by three volumes. The first number pertains on the maximum bodily personal injury (in 1000s of dollars ) for starters individual injured in the mishap. The second number refers on the maximum liability for every single personal injury induced within the accident, and third number indicates the absolute maximum property or home damage liability. Retain this at heart when you happen to be trying to have motor insurance estimates on the net.

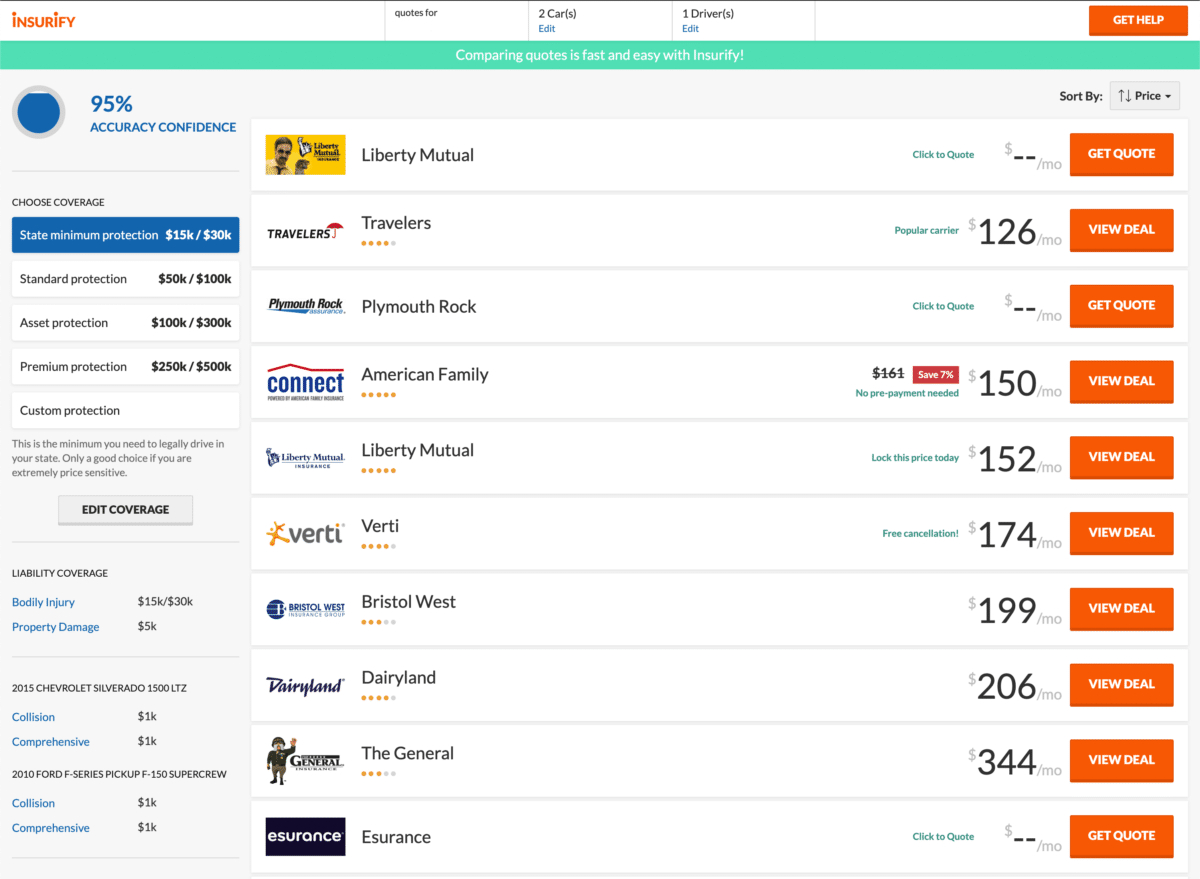

Usaa Car Insurance Guide Best And Cheapest Rates More pertaining to dimensions 1600 X 1078

Usaa Car Insurance Guide Best And Cheapest Rates More pertaining to dimensions 1600 X 1078Another aspect to consider is compensation for injuries protection (PIP). This is important should you play a crucial role inside your family’s finances. If you find yourself badly injured and within the hospital and not able to job, and after that have to spend skilled bills in addition to that, after that your whole family have been around in trouble. PIP is certainly significant coverage to possess. Do you need comprehensive coverage? In the event you might have a low priced, older car you then probably won’t. This form of coverage reimburses you within the event that your automobile is desperately damaged in the mishap or compromised. If that isn’t well worth much regardless, then it could be considered a waste of greenbacks to spend on a plan with thorough coverage. You could be best using risk and after that only paying of the deductible whether it is damaged.

Military Car Insurance 2020 for proportions 1200 X 879

Military Car Insurance 2020 for proportions 1200 X 879