Recommendations On No Credit Score Test Auto Insurance for sizing 1600 X 1063

Recommendations On No Credit Score Test Auto Insurance for sizing 1600 X 1063Auto Insurance Score Check – Be intelligent together with your auto insurance coverage. You will discover most companies around that hand out a wide number of discounts. You may be qualified to apply for some you don’t know exist. Keep this kind of in your mind when you’re executing pursuit of quotes and evaluating each company. Usually, the businesses list the forms of savings they have on their own websites. You have a better probability of getting seriously low-priced vehicle insurance in case you have a clean record, are near least 25 years or so old, have a great credit rating, and own a car or truck using a lot of security features.

5 Ways To Lower Your Auto Insurance Costs Office Of Public pertaining to sizing 800 X 2000

5 Ways To Lower Your Auto Insurance Costs Office Of Public pertaining to sizing 800 X 2000It’s and a good plan to get smart together with your protection. For instance, in case you DO contain a mature automobile that is certainly at the moment worth lower than say, $4, 000, you will possibly not need to make use of having comprehensive and smashup on your own insurance plan. It might not worth continually making repayments over a car that basically basically worth very much. However , this must always be kept within the back of your head when anything DOES eventually the car, you will end up usually the one accountable for repairs, and investing in an alternative one.

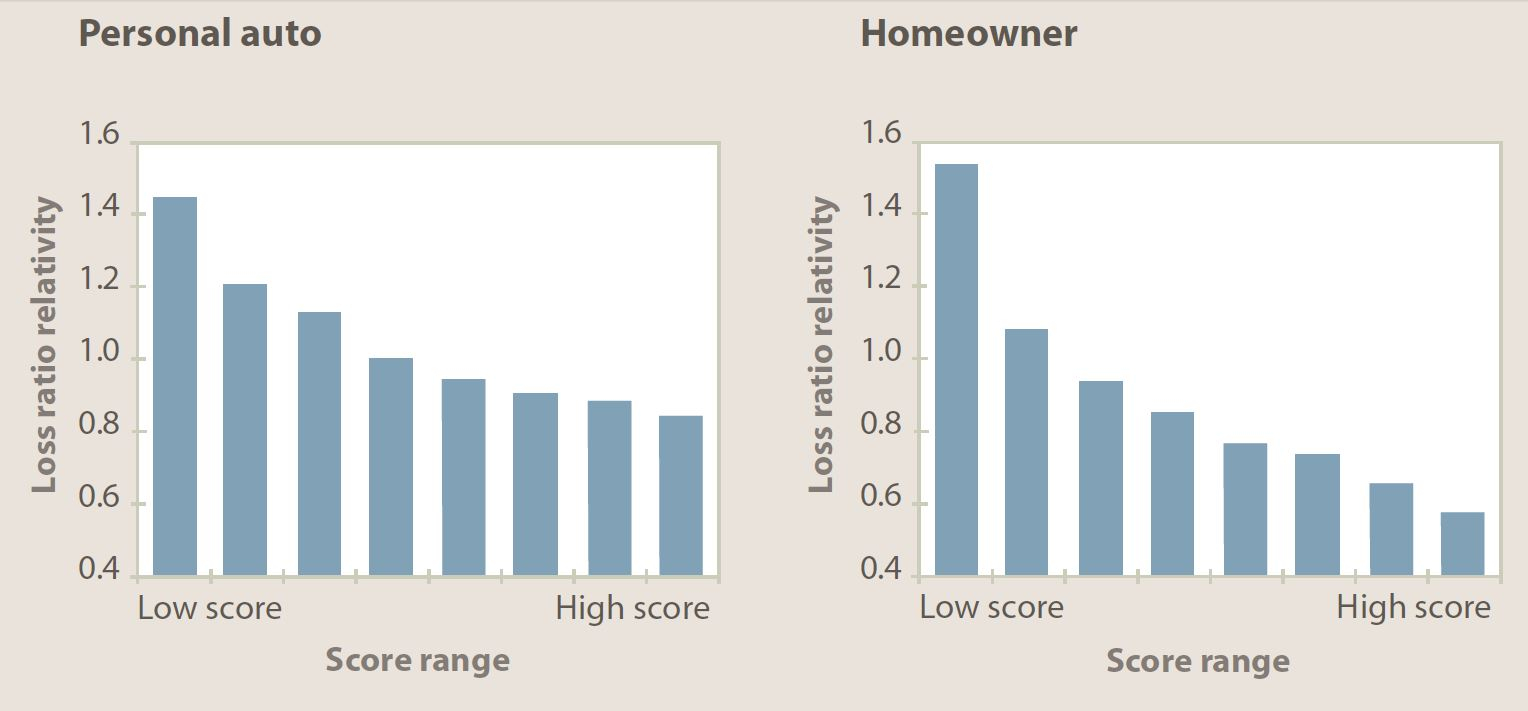

Fico Insurance Scores Fico within sizing 5192 X 2815

Fico Insurance Scores Fico within sizing 5192 X 2815Another way you may choose to receive really low-priced automobile insurance is in case you bundle it along with one other kind of insurance – especially home insurance or multi- auto insurance – all with similar company. Many companies give larger discount to people who will be happy to purchase multiple policies from their website. Some even offer deals about auto insurance / insurance coverage packages.

Fico Insurance Scores Fico in sizing 1528 X 711

Fico Insurance Scores Fico in sizing 1528 X 711To possibly save possibly more cash, consider enrollment inside a defensive driving course. In the event you successfully complete this, a great insurance provider will most likely incentive you using a discount on your own premium. If you’re having difficulty obtaining low estimates when you lack great credit rating, you may well make use of functioning which has a credit score improvement or debt enterprise. For the very least, understand credit improvement and just how you’ll be able to do it yourself. Consider every single measure necessary showing automobile insurance firms that you’re fitting in with clear your credit report.

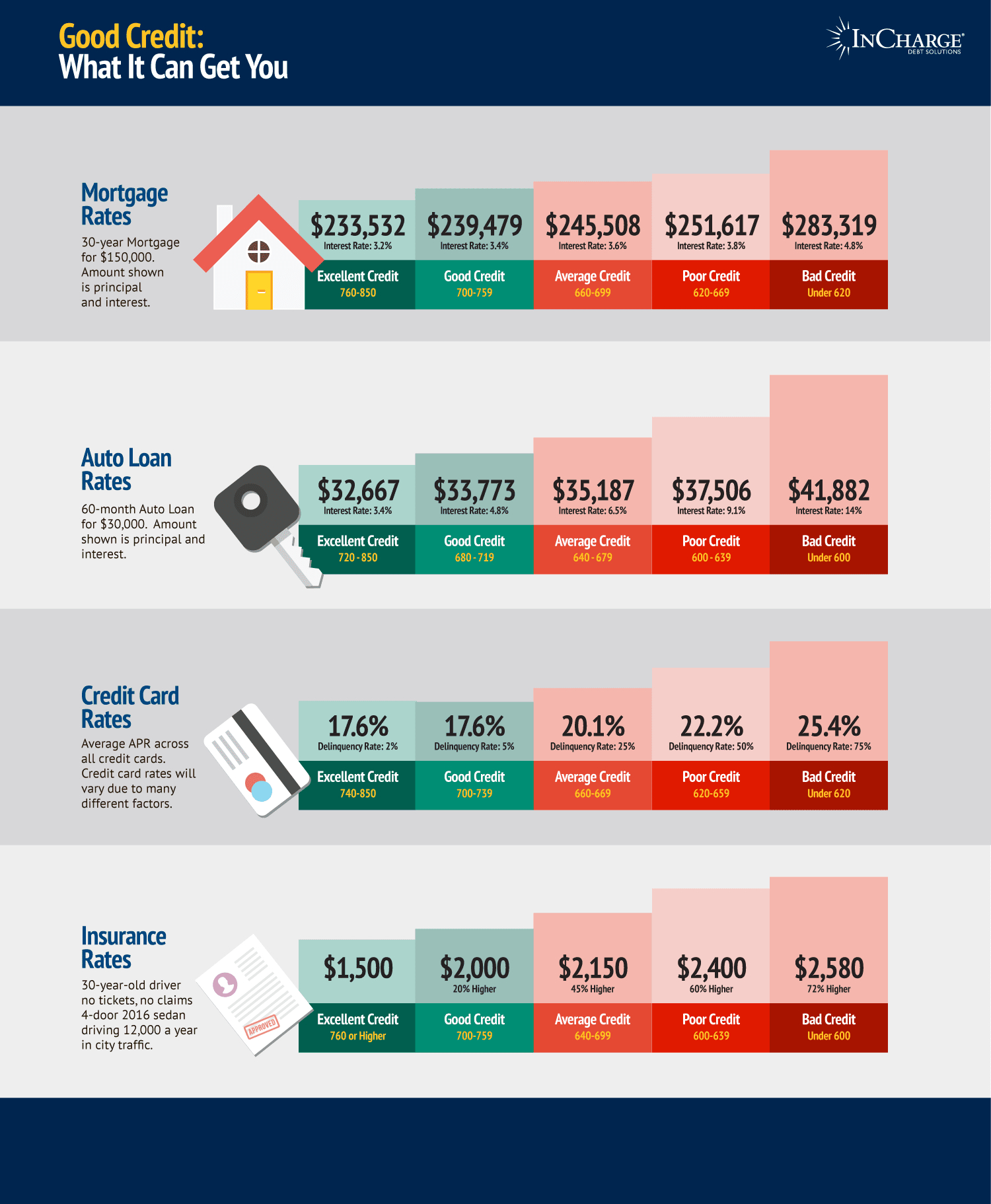

Benefits Of Having A Good Credit Score pertaining to measurements 1500 X 1823

Benefits Of Having A Good Credit Score pertaining to measurements 1500 X 1823If you’re a student, professional or even a part of some club, start looking to see what types of discounts may be available for you. When once again, you can’t say for sure what types of savings you may be qualified to apply for. Do you realize that you simply could potentially spend less when you are a responsible student with high gpa’s? Or for as a head within your field? Or perhaps whenever you’re an engineer as well as teacher / lawyer as well as doctor or customer of your auto club?