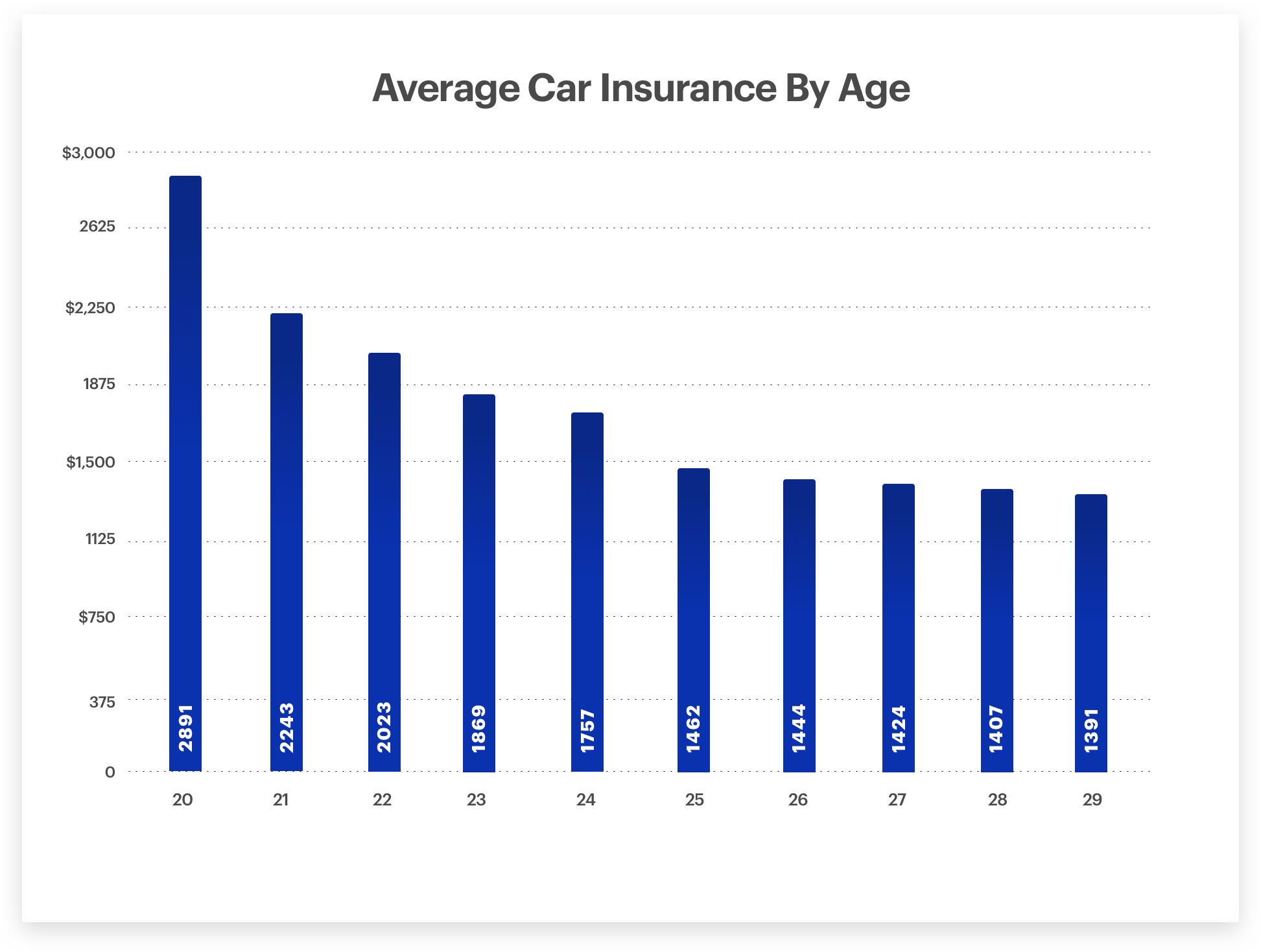

Do Auto Insurance Rates Go Up With Age intended for measurements 1945 X 1468

Do Auto Insurance Rates Go Up With Age intended for measurements 1945 X 1468Does Car Insurance Rates Go Down – A single with the first steps when you get low-cost online vehicle insurance is actually judging quotes and researching the businesses that offer the regulations. May increase the risk for mistake of looking over lesser-known, smaller insurers as they are able often provide better, even more personalized customer satisfaction compared to corporations. Just because 2/3s with the US companies are protected by 7 automobile insurance companies does not mean you might have to become one particular. It could be beneficial to become part with the 1/4 who have gets your insurance coming from a smaller company.

You Can Save A Lot Today On Auto Insurance With These Tips pertaining to proportions 1058 X 1497

You Can Save A Lot Today On Auto Insurance With These Tips pertaining to proportions 1058 X 1497Costs are gonna vary substantially, regardless, and a lot of with the elements that affect the speed are issues that you could not have much treating, like the position, status, age, past driving background, and so on. Even to your credit rating probably have an effect around the quotes you obtain. If you lack the top driving history or perhaps the best credit, make an effort to have back on track with those as soon as you are able to as a way to be eligible for a lower insurance rates.

Car Insurance Tips For The Occasional Driver throughout proportions 1058 X 1497

Car Insurance Tips For The Occasional Driver throughout proportions 1058 X 1497An additional factor may be the a higher level protection you actually need. The cheapest insurance policy is not always the top, and may wind up costing you more inside long haul. For instance, low-cost online vehicle insurance probably won’t present collision protection, that is something you may need in the event you don’t wish to have to cover high deductibles inside celebration that your car or truck is linked to a great incident. You probably won’t require smashup if your automobile looks her age instead of worth quite definitely. Make a decision whether it could be worth every penny to cover higher premiums over a get car finance comparisons.

Heres When Your Car Insurance Rates Start To Go Down intended for measurements 1455 X 768

Heres When Your Car Insurance Rates Start To Go Down intended for measurements 1455 X 768If perhaps you might have a newer auto, the model and earn are going to become huge factors inside prices you will get. It’s easier to get low-cost online vehicle insurance for those who have a car which is safe and cost-effective, like a Honda Odyssey minivan, Subaru Umland, or perhaps Jeep Wrangler. The reason is family-oriented vehicles are usually to become driven by mature, secure drivers (parents) that are not as likely to become reckless. High-end high end and sports autos truly must be essentially the most expensive to confirm.

Auto Insurance Made Simple The Best Tips And Tricks with regard to size 1058 X 1497

Auto Insurance Made Simple The Best Tips And Tricks with regard to size 1058 X 1497There are invariably discounts to look into, even in the event you don’t even think you’ll be eligible for a any. Most insurance firms give a number of discounts, out of “Switch and Save” to “Security Features”.