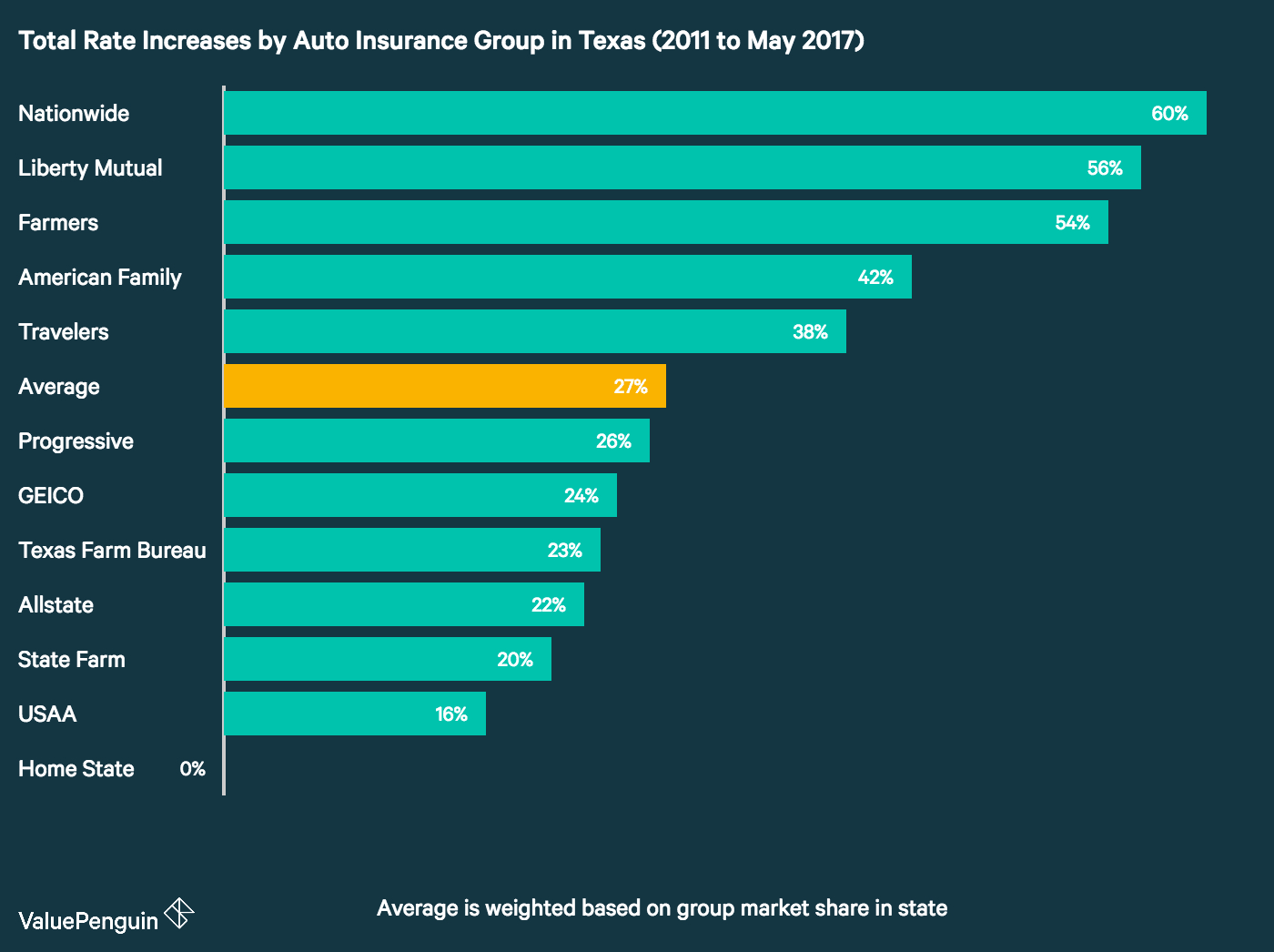

Auto Insurance Rate Increases In Texas Valuepenguin pertaining to dimensions 1400 X 1046

Auto Insurance Rate Increases In Texas Valuepenguin pertaining to dimensions 1400 X 1046Auto Insurance Rates In Texas – Being pulled over rather than having any insurance showing the officer is planning to result in a great deal of problems. At a minimum, you will be fined a number of 100 bucks for driving uninsured. Everybody is legally needed to possess some kind of vehicle insurance as a way to drive most vehicles, even though form of protection required differs in every single state. Know the state’s regulations and start looking for quotes. Compare cheap automobile insurance to make a decision what one you will be capable to afford. However , decide in addition very important to you financially — the premiums or perhaps the allowable.

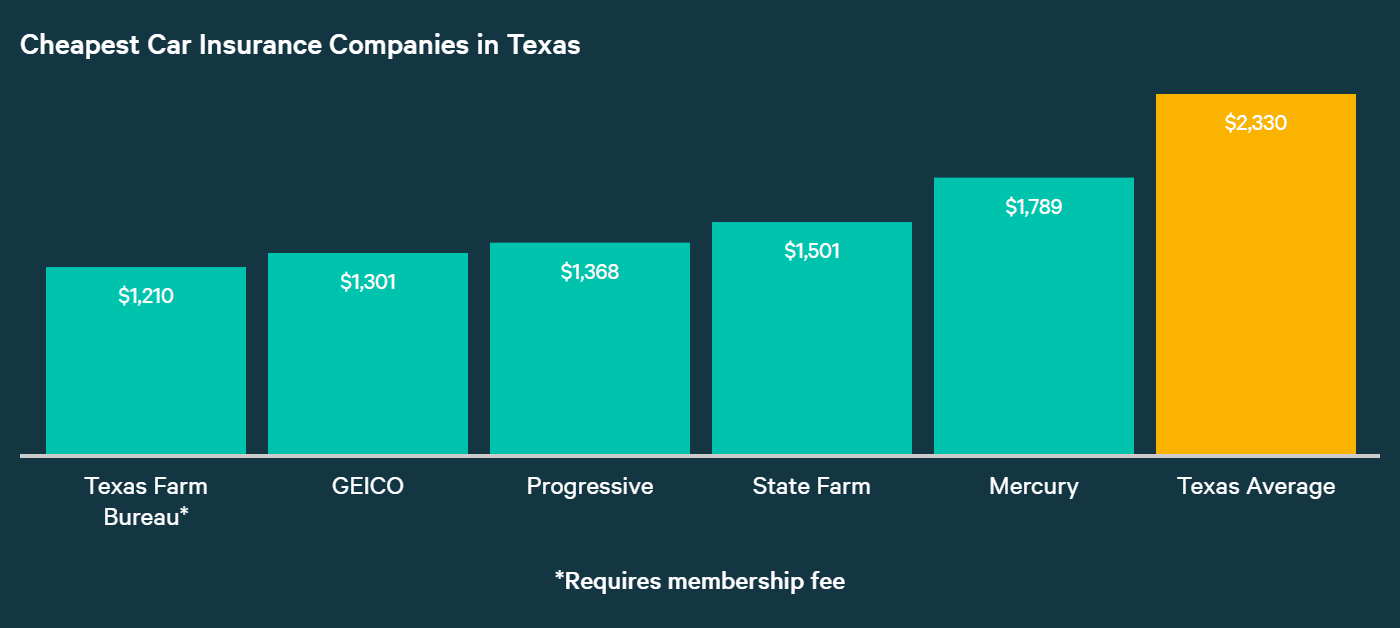

Best Auto Insurance Companies In Texas 2020 Compare Car for dimensions 1400 X 628

Best Auto Insurance Companies In Texas 2020 Compare Car for dimensions 1400 X 628It’s no secret that automobile insurance quotes be determined by a great deal of elements, many of which are personal, for example how old you are, driving history, credit standing, etc. It’s going being higher priced to operate a vehicle in some areas than on other occasions because of street conditions, average traffic, offense rate, and local laws. Within a city which has a high offense rate, it’s most likely planning to are more expensive to possess automobile insurance, unless you’ve a good home security system set up in your car or truck.

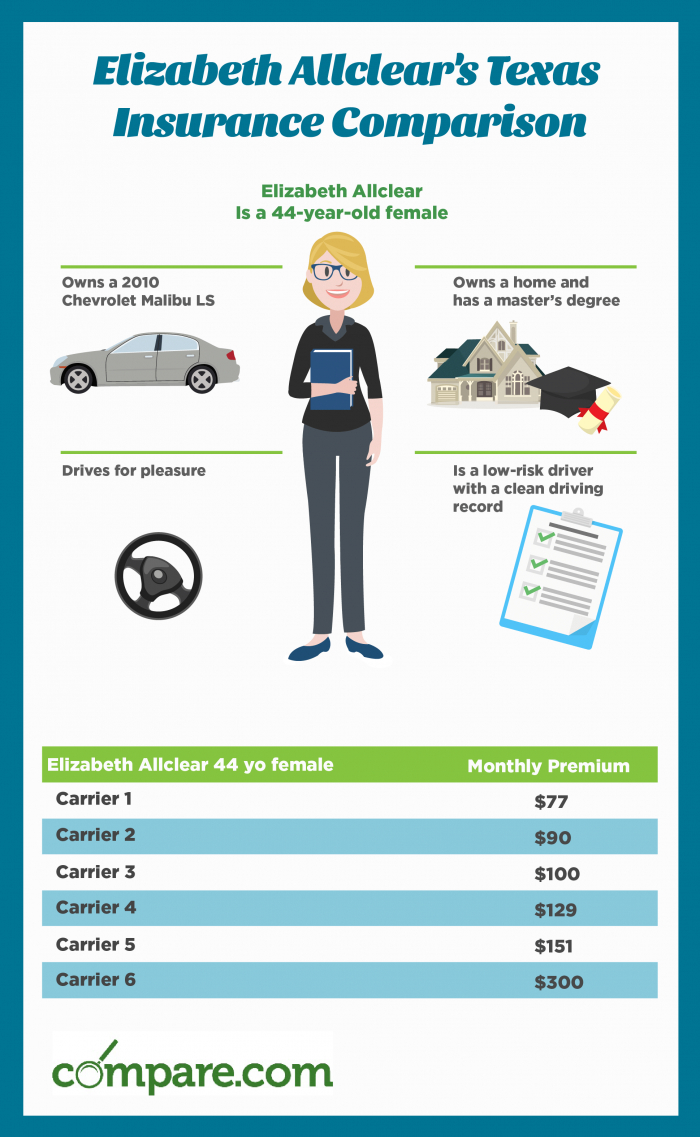

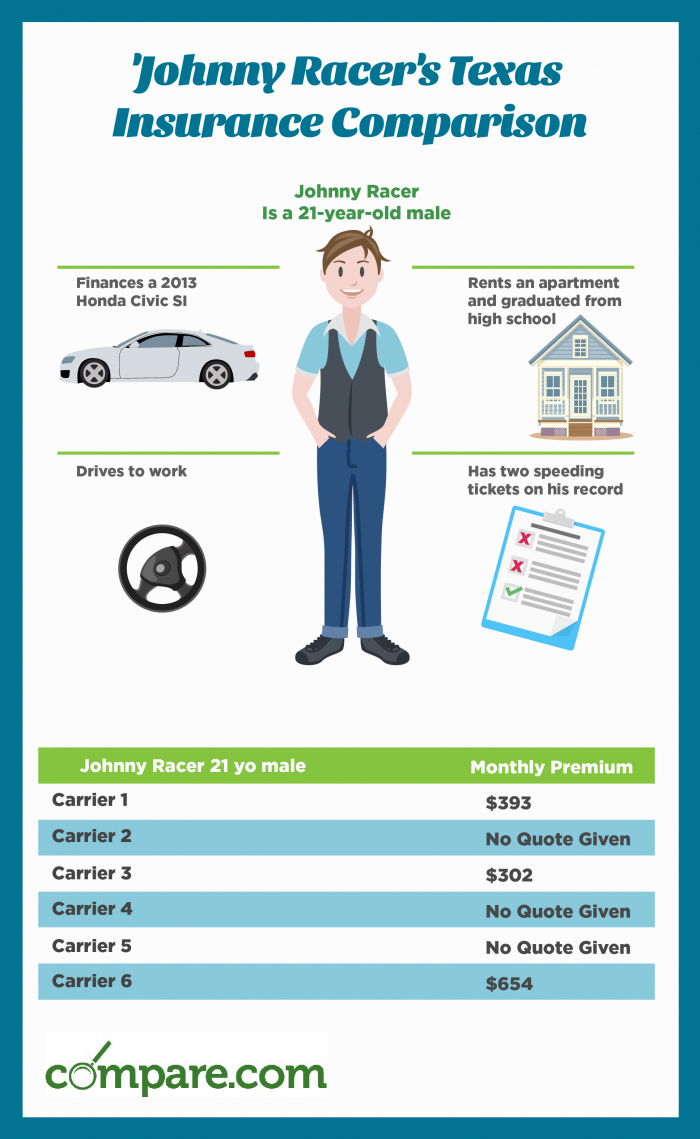

Compare Texas Car Insurance Rates Save Today Compare with sizing 700 X 1137

Compare Texas Car Insurance Rates Save Today Compare with sizing 700 X 1137As for age, it generally costs more income to get a high school graduation or perhaps student being insured. A whole lot of teen drivers include being included with their parent’s policy. On the other hand, some businesses DO offer discounts to college students who also keep a high GRADE POINT AVERAGE and take driver’s programs. Even in the event you ‘re above 25, you’ll be able to still register to take safe driving programs or perhaps programs and also you may be qualified to receive some type of discount.

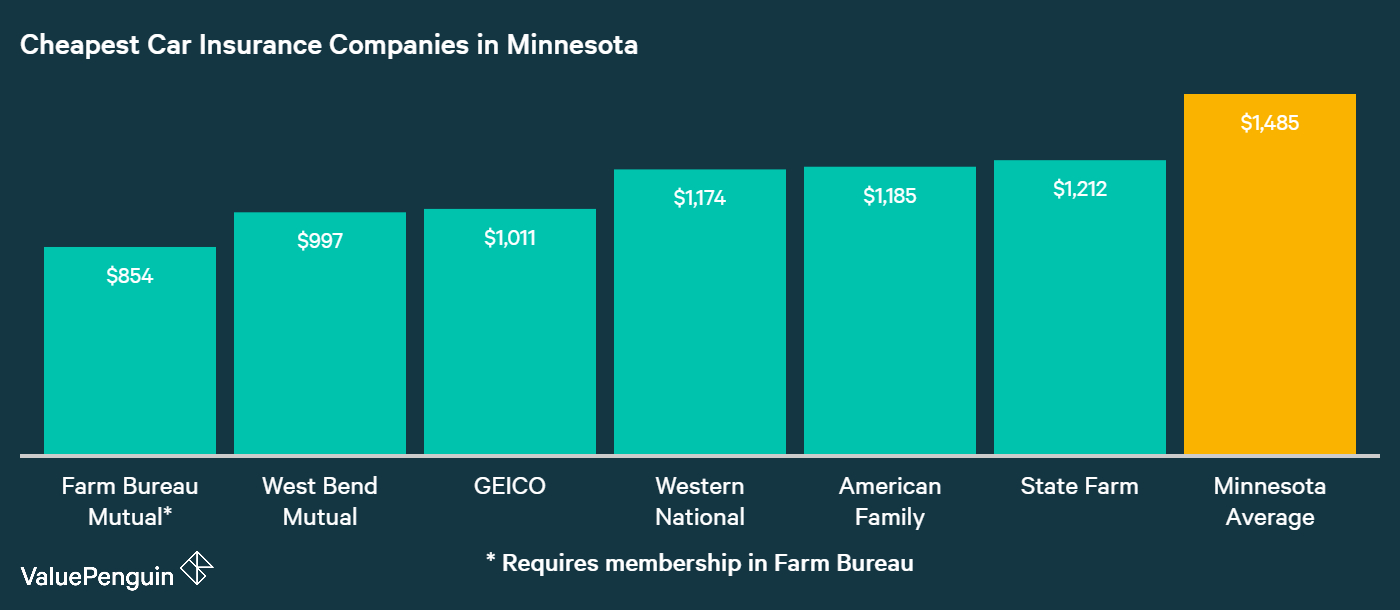

Get The Finest Automobile Insurance Coverage For Rental within dimensions 1400 X 610

Get The Finest Automobile Insurance Coverage For Rental within dimensions 1400 X 610It could factors for example these that want being looked at when comparing low-cost automobile insurance. Not happy using the costs you happen to be getting? Check with every individual company to determine what sorts of discount rates they provide and the way easy it’s going to be to suit your needs to obtain those discount rates.

Compare Texas Car Insurance Rates Save Today Compare pertaining to size 700 X 1139

Compare Texas Car Insurance Rates Save Today Compare pertaining to size 700 X 1139You should set the identical deductibles for every single rate which you compare to get a realistic concept of what will you be repaying, both around the payments and a lot poorer ahead of the coverage takes over. If you’ve a mature automobile that will not expense all the to exchange or restore, then you definitely could possibly need to associated risk an increased deductible as a way to conserve more cash around the payments. You can also need to decide in the event you desire more coverage than simply what are the legal minimum requirement is your state. Liability coverage is normally expected, but collision and private harm aren’t. Comprehensive protection will probably be worth considering at the same time, in the event that your automobile is damaged simply by a few other implies that wasn’t a collision. Yet again, with such things as safety measures and alarms, you’ll likely be capable to obtain a discount.