Fine Flower Dubai Heart Hka Hermann Kamte Associates throughout measurements 1273 X 900

Fine Flower Dubai Heart Hka Hermann Kamte Associates throughout measurements 1273 X 900Alamat Car Life Insurance Jakarta – The simplest way to acquire cost-effective automobile insurance is usually to first seek out rates and after that spend some time to compare these people. Find out about the firms that are providing the quotes and judge what one is providing solutions with a price you really can afford to spend. Since you’ll find most companies on the market all claiming to supply low priced motor insurance quotes, you will need to practice a bit about each one before you make your selection.

Non Life Insurance Stock Photos Non Life Insurance Stock within proportions 1300 X 956

Non Life Insurance Stock Photos Non Life Insurance Stock within proportions 1300 X 956Don’t only glance at the high quality insurers, both. There are smaller, local motor insurance businesses that offer affordable rates. And, being that they are smaller, they may be able to offer more unique plan to their clients. Liability-only motor insurance is usually going being the cheapest choice, as it’s the very least coverage needed in each state. On the other hand, it only covers such things as property damage and therapeutic bills for that people involved with an accident which is why you’re identified responsible. What about your individual therapeutic bills? How do you will get maintenance for your individual vehicle? That is comprehensive / collision insurance policy options that you will definitely be thinking about.

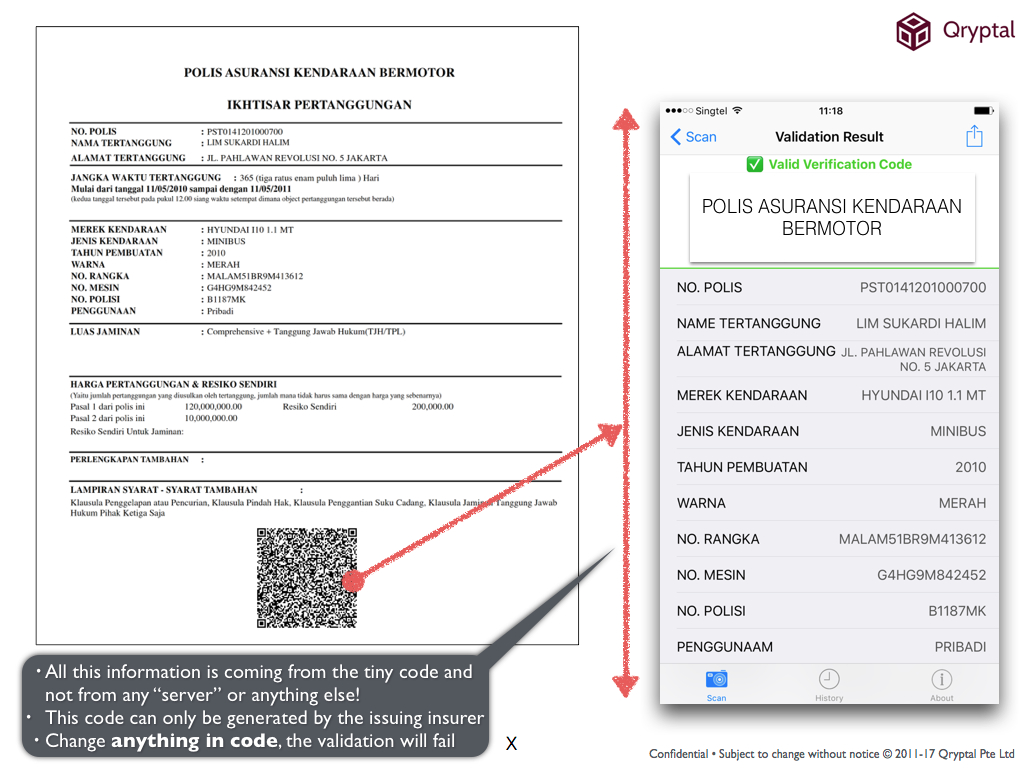

Secure Qr Codes For Insurance Policy Documents Secure Qr inside proportions 1024 X 768

Secure Qr Codes For Insurance Policy Documents Secure Qr inside proportions 1024 X 768Finding low priced motor insurance insurance quotes it not just about choosing the least expensive payment, and may just be thought to be for those who have a well used junk car that isn’t really worth the money you have to pay to insure it. You’ll nonetheless desire to maintain your medical costs at heart, though. An additional element to give thought to an amount get lucky and your family’s finances had you been badly injured in the car accident and can not work to get a long time frame? Some quotes should include solutions just for this too.

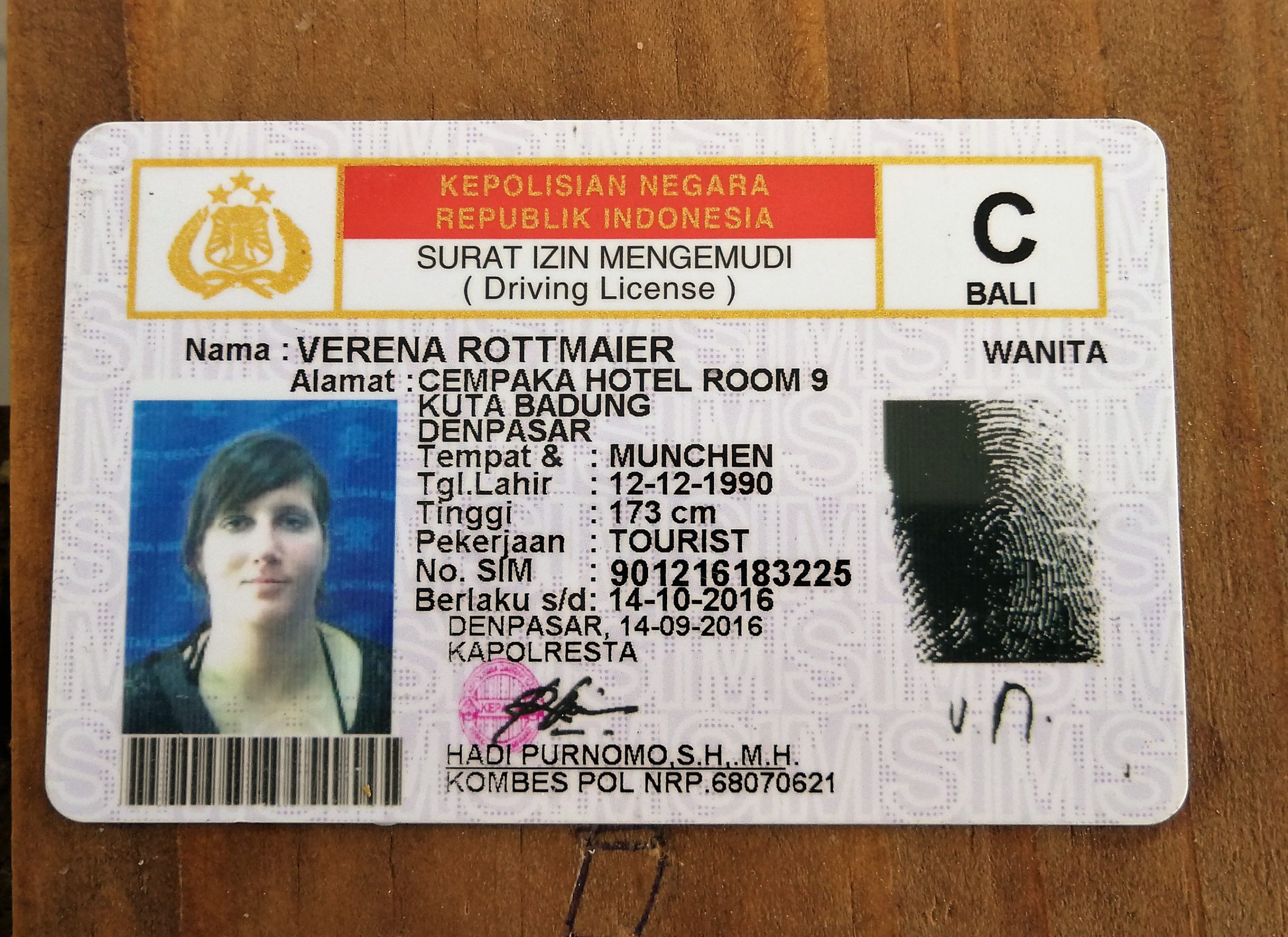

Giude To Get An Indonesian Drivers License Road To Everything with sizing 2699 X 1963

Giude To Get An Indonesian Drivers License Road To Everything with sizing 2699 X 1963As with any form of insurance, you will find the deductible VS prices debate. The deductible could be the insurance provider ‘s means of producing the policyholder share a few of the responsibility associated with an accident. The bottom the deductible, the larger the high quality, and the other way round. Decide an amount be described as a better solution for your requirements. If you’re not sure, inquire the insurance professional or fiscal consultant for advice.

Ba07 November 2018 Bali Advertiser Issuu pertaining to sizing 1051 X 1486

Ba07 November 2018 Bali Advertiser Issuu pertaining to sizing 1051 X 1486You could also perform a little mathematics on your individual. If you were to opt to get a higher deductible, simply how much will you be capable to save the a lesser premium? Would probably the money you’d probably save be equivalent fot it with the deductible inside event you’re within an occurrence and must pay a few of the repair costs through your bank? Whatever you determine, you’ll still may be capable to possibly preserve big money with discounts. Every single company provides a selection of discounts, and you will find there’s chance you will be capable to be entitled to a minimum of one. One place you can turn to find great deals and low priced motor insurance rates is esurance. You can begin simply by working which has a “Coverage Counselor” for top level coverage. Also, look into Esurance discounts – you’ll find various and you also may indeed be eligible for a one.