Keep Your Car In Top Shape With Aami with size 1200 X 686

Keep Your Car In Top Shape With Aami with size 1200 X 686Car Insurance Aami – Be sensible along with your motor insurance coverage. You will find most companies available that provide a wide selection of discounts. You could possibly be qualified to receive some that you do not have any idea exist. Keep this kind of in your mind when you’re doing mission to find quotes and assessing each company. Usually, the firms list the varieties of special discounts they have on their own websites. You should also try a better probability of getting genuinely low-priced automobile insurance when you have a clean record, are in least 25 years or so of aging, have a very good credit rating, and own a car or truck which has a lot of security features.

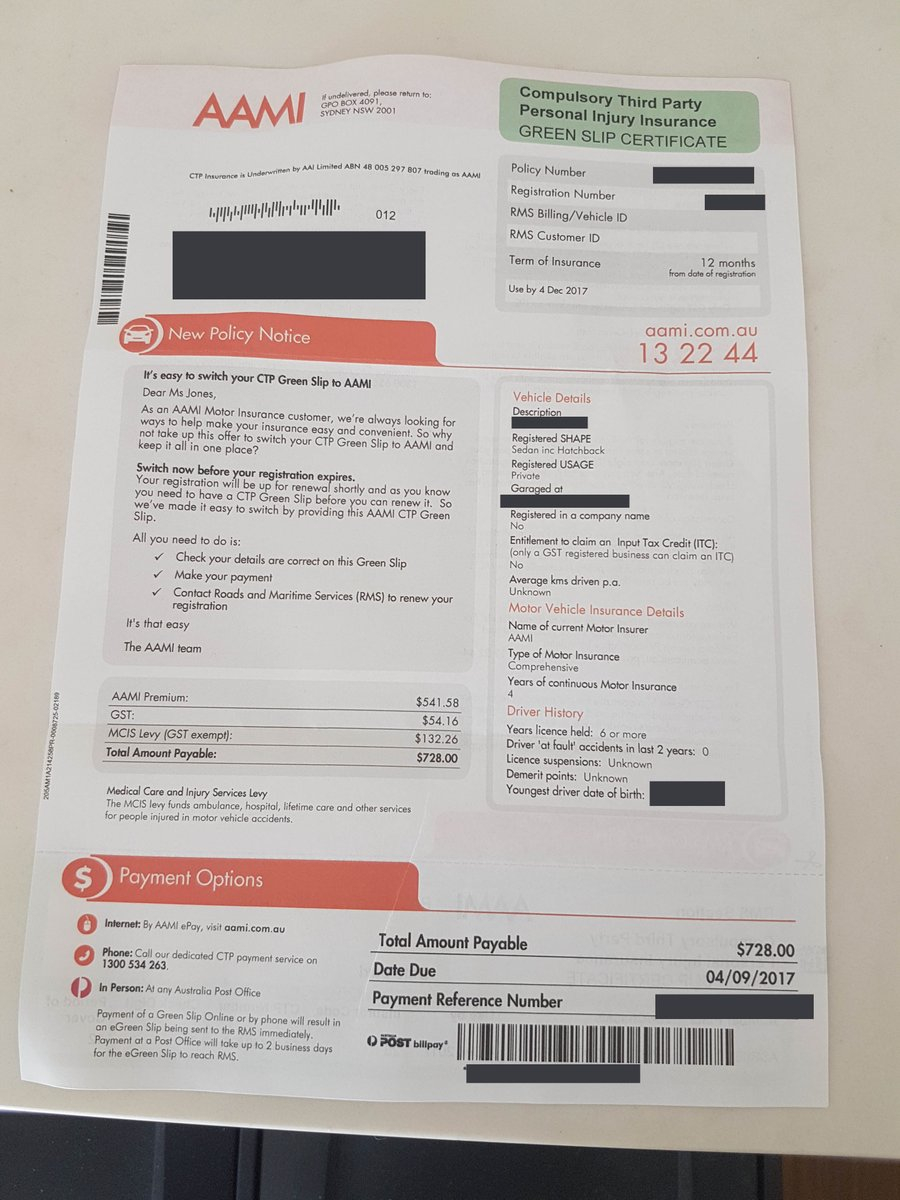

Natalie Tran On Twitter Heres An Ad Sent To Me Aami in sizing 900 X 1200

Natalie Tran On Twitter Heres An Ad Sent To Me Aami in sizing 900 X 1200It’s and a good option to become smart along with your insurance policy coverage. For instance, in the event you DO possess an adult motor vehicle that’s presently worth lower than say, $4, 000, you do not desire to work with having comprehensive and accident on your own insurance policy. It might ‘t be worth continually making obligations on the car that truly actually worth very much. However , this would be wise to be kept inside the back of your head when anything DOES get lucky and the automobile, you may be usually the one in charge of repairs, and for purchasing a brand new one.

Aami Car Renewal Account Mpa006039747 with regard to measurements 1190 X 1684

Aami Car Renewal Account Mpa006039747 with regard to measurements 1190 X 1684Another way you might obtain really low-priced automobile insurance is in the event you bundle it in addition to one other sort of insurance – especially home insurance or multi- motor insurance – all with similar company. Many companies give larger discount to prospects that are prepared to purchase multiple policies at their store. Some even offer deals in motor insurance / insurance coverage packages.

Insurer Aami In Strife After Customers Mistake Ugly Advert with size 1260 X 840

Insurer Aami In Strife After Customers Mistake Ugly Advert with size 1260 X 840To possibly save possibly additional money, consider enrollment in a very defensive driving course. When you successfully complete this, a great insurance provider will more than likely compensation you which has a discount on your own premium. If you’re having difficulty obtaining low rates when you don’t possess good credit rating, you could possibly adequately take advantage of functioning which has a credit score improvement or debt firm. By the very least, understand credit improvement and just how it is possible to do it yourself. Have every single measure necessary showing automobile insurance carriers that you’re fitting in with cleanup your credit file.

Stuck Up Ship Creek Aami Roadside Assist Can Help Aami with regard to proportions 1200 X 686

Stuck Up Ship Creek Aami Roadside Assist Can Help Aami with regard to proportions 1200 X 686If you’re a student, professional or perhaps an affiliate a particular club, start looking and find out what types of discounts could possibly be available for you. When once again, you can’t predict what types of special discounts you could possibly be qualified to receive. Were you aware that you just could potentially spend less when you are a responsible student with high gpa’s? Or for as an innovator with your field? Or perhaps whenever you’re an engineer as well as teacher / lawyer as well as doctor or affiliate associated with an auto club?