Extension And Scope Of Automobile Insurance Coverage In Case regarding measurements 1024 X 1024

Extension And Scope Of Automobile Insurance Coverage In Case regarding measurements 1024 X 1024Auto Insurance Lawyer California – Auto insurance coverage is something nobody wants to pay for however it is necessary and need to be practiced. It might appear like an excellent unnecessary expense in the beginning — until your vehicle is damaged somehow and after that it’s important you will get claiming paid for your requirements. By this time, it does not take deductible you do not desire to pay for. Regardless of what form of motor vehicle you might have, you are going to – at least – get low cost auto insurance that covers the fundamentals and suits the needs on your state.

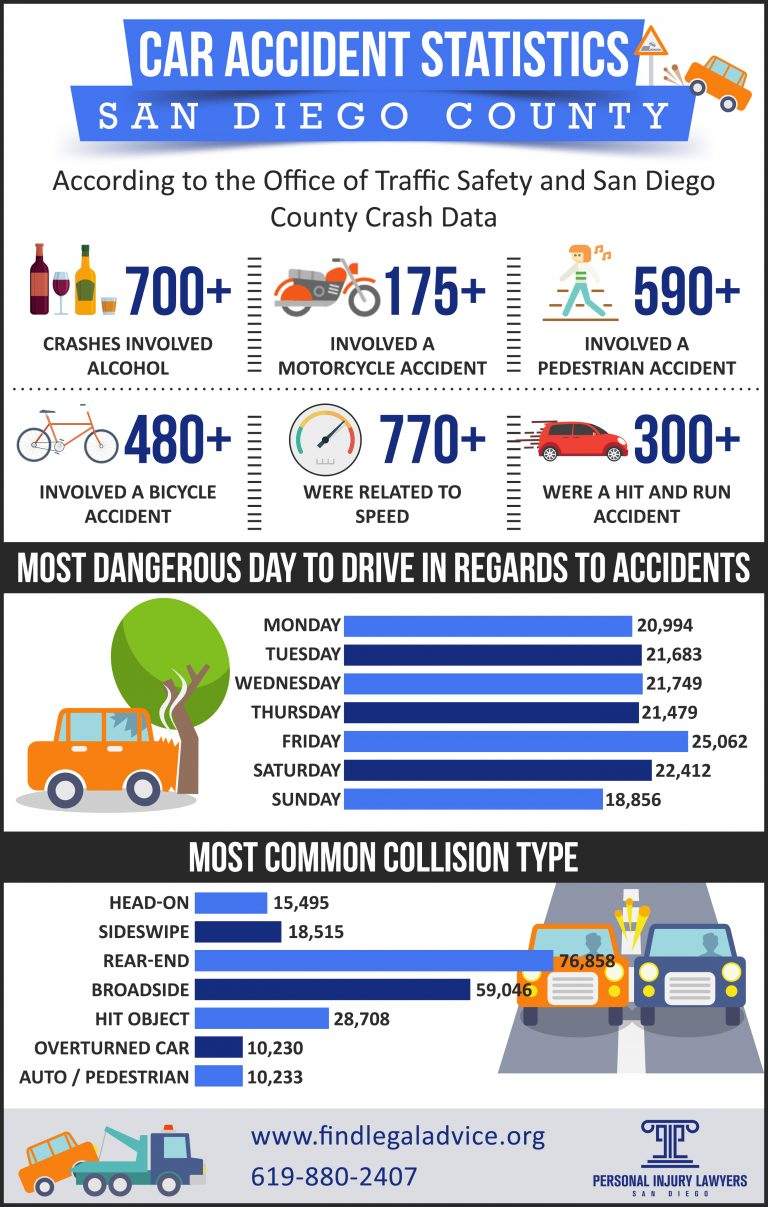

San Diego Car Accident Lawyer Ozols Law Firm throughout proportions 768 X 1207

San Diego Car Accident Lawyer Ozols Law Firm throughout proportions 768 X 1207Have good thing about online tools that permit you to compare many quote at any given time to enable you to start to see the similarities yellow sand differences between multiple insurance agencies. If you might have house insurance plus your provider also provides automobile insurance, see in the event you can get yourself a discount in the event you bundle that all together.

Insurance Claim Lawyers Morgan Morgan Law Firm throughout dimensions 1148 X 696

Insurance Claim Lawyers Morgan Morgan Law Firm throughout dimensions 1148 X 696In addition towards the style to make in the vehicle, the driving background, age, and credit history, below are a few additional factors that affect the rates you’ll receive when you wish to acquire cheap auto insurance: Diddly code – some areas are merely likely to have higher-than-normal injuries and car reduction on account of heavier road circumstances and traffic and/or large criminal rates. Number of mls – The amount of mileage you put onto your car or truck every month make a difference the insurance charges. Age and spouse status. Young, unmarried guys will often have to pay for one of the most. History claims background – People that have previous filing claims inside past could be more likely to pay for more after they switch businesses or perhaps renew an ongoing insurance policy.

Car Accident Lawyers Shouse California Law Group inside size 1280 X 720

Car Accident Lawyers Shouse California Law Group inside size 1280 X 720Each company features its own guideline about what constitutes as “high risk”. If you’re linked to a great accident or have additional negative items in your record, the variance in high quality differs from business to business. Provided that you’re diligent and check out special discounts and solutions to save, you have to be in a position to find an insurance policy and rate you’ll be able to experience.

Law Offices Of Larry H Parker Car Accident Lawyers In Los intended for size 800 X 1000

Law Offices Of Larry H Parker Car Accident Lawyers In Los intended for size 800 X 1000You may be thinking about skipping on detailed insurance policy coverage for those who have a mature motor vehicle considering that the money you have to pay to the insurance might set you back a lot more than that old “clunker” may be worth regardless. However , it’s almost certainly best if you possess some form of insurance policy coverage to pay for to the cost of the medical bills in the event you change into injured.