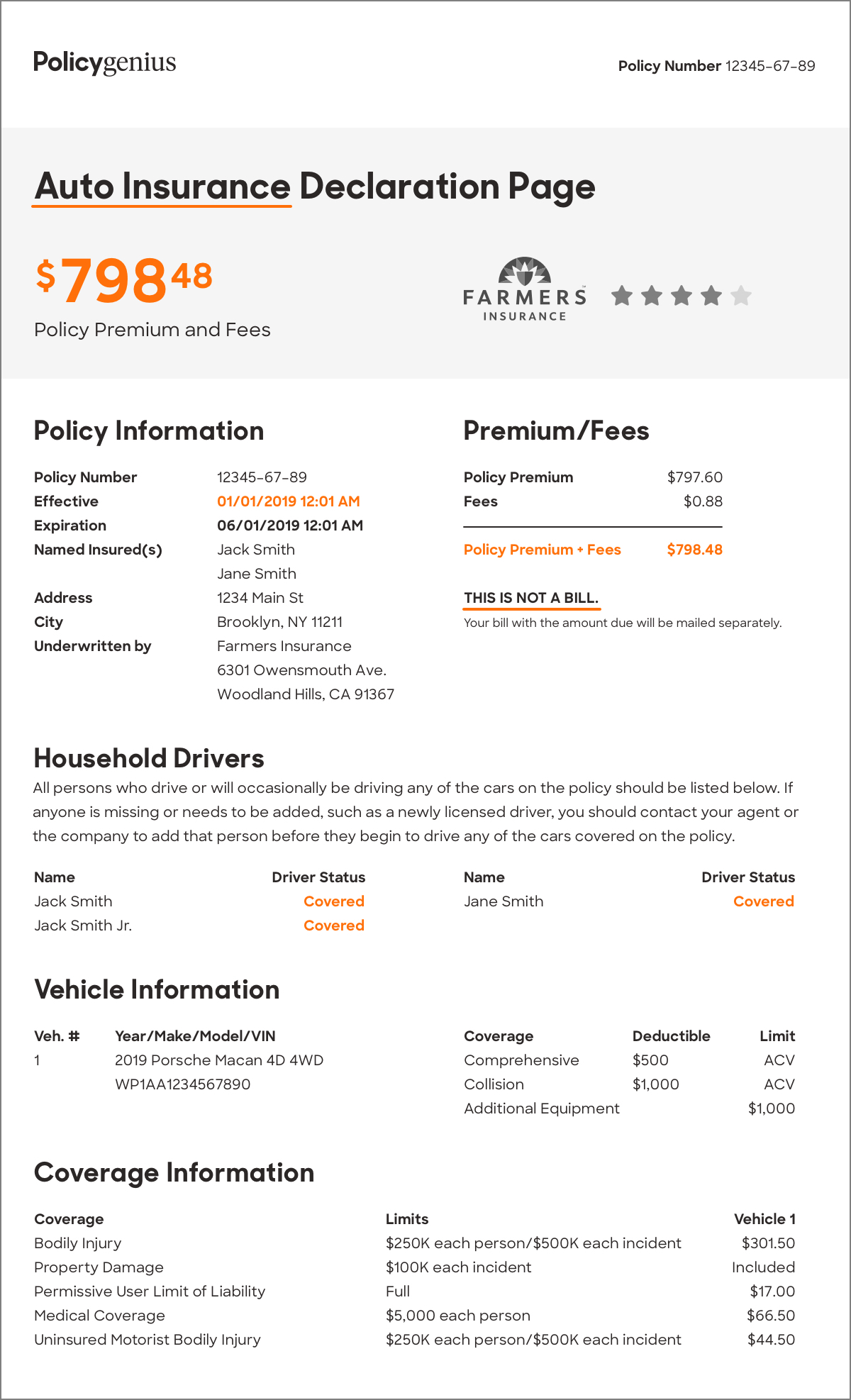

Understanding Your Car Insurance Declarations Page regarding size 1200 X 1974

Understanding Your Car Insurance Declarations Page regarding size 1200 X 1974Auto Insurance Policy Number Format – This is incredibly easy currently to obtain auto insurance quotes on-line. The part which is not easy is definitely comparing the quotes and determining what one supplies the type(s) of coverage you virtually all need at the fair price. To be able to begin, you will want to submit a couple of details thus hitting the “submission” button. The varieties of details you will be expected to supply change from one site on the next. Experts recommend that compares at the very least three offers before you make your own preference. Also, take a look at current policy. It may perfectly nonetheless be the ideal option to suit your needs.

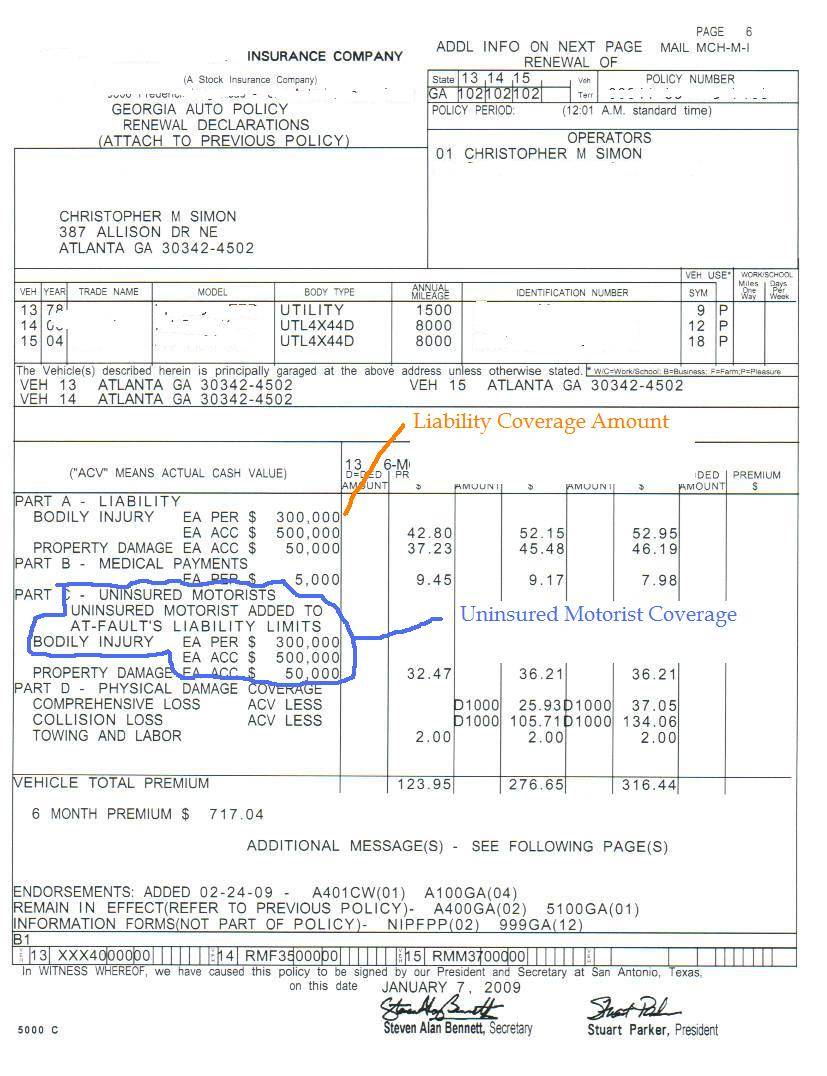

Top 50 Insurance Interview Questions Answers throughout proportions 827 X 1076

Top 50 Insurance Interview Questions Answers throughout proportions 827 X 1076Should you wish to add someone else for your policy, like a teenager or perhaps other half, then make sure through adding their details at the same time once requesting quotes. What form of coverage do you require? Most areas require drivers incorporate some type of automobile insurance. Find out what your california’s minimum requirements are. Actually should you think you know, check to make sure that nothing is different because the last time you bought a great automobile insurance plan.

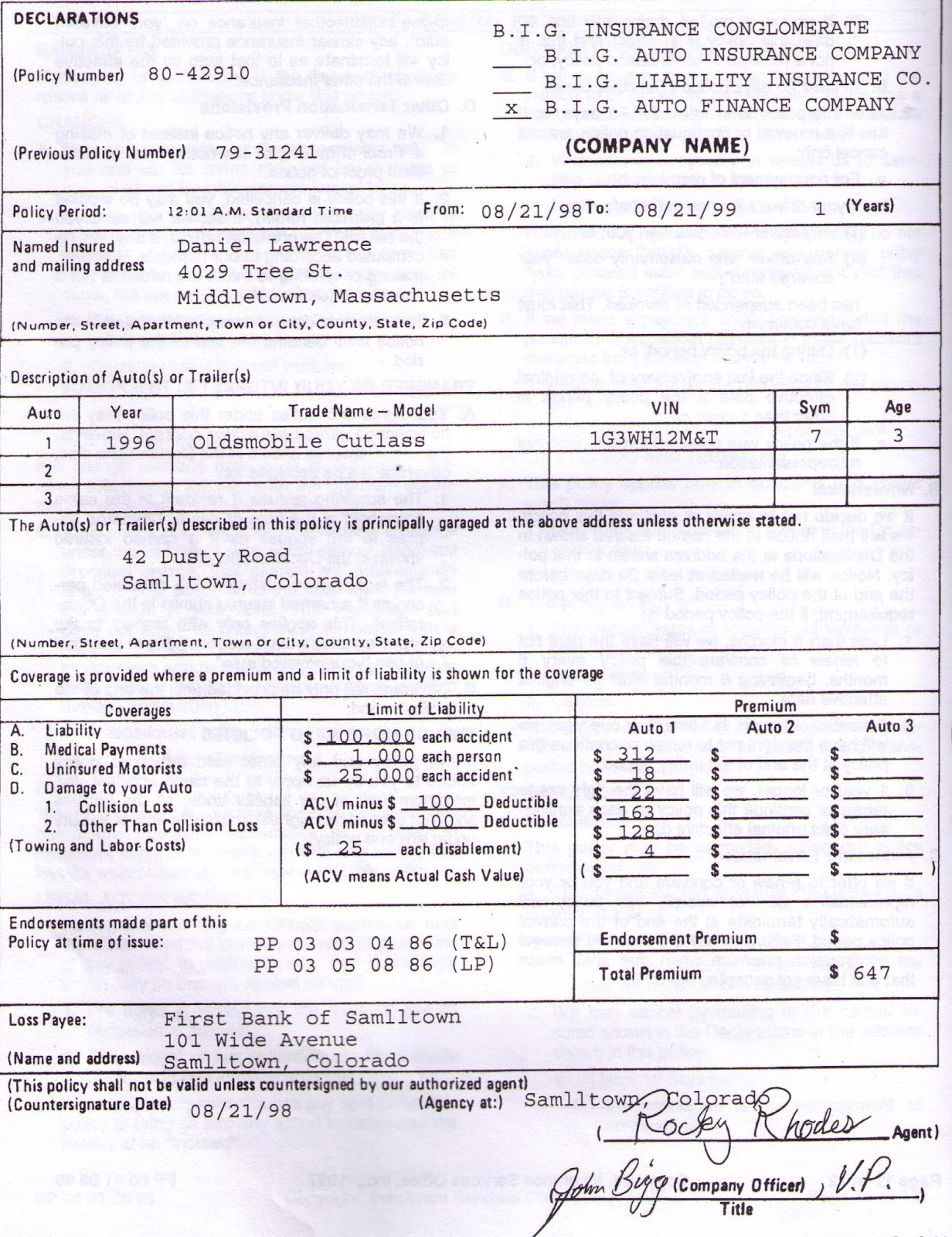

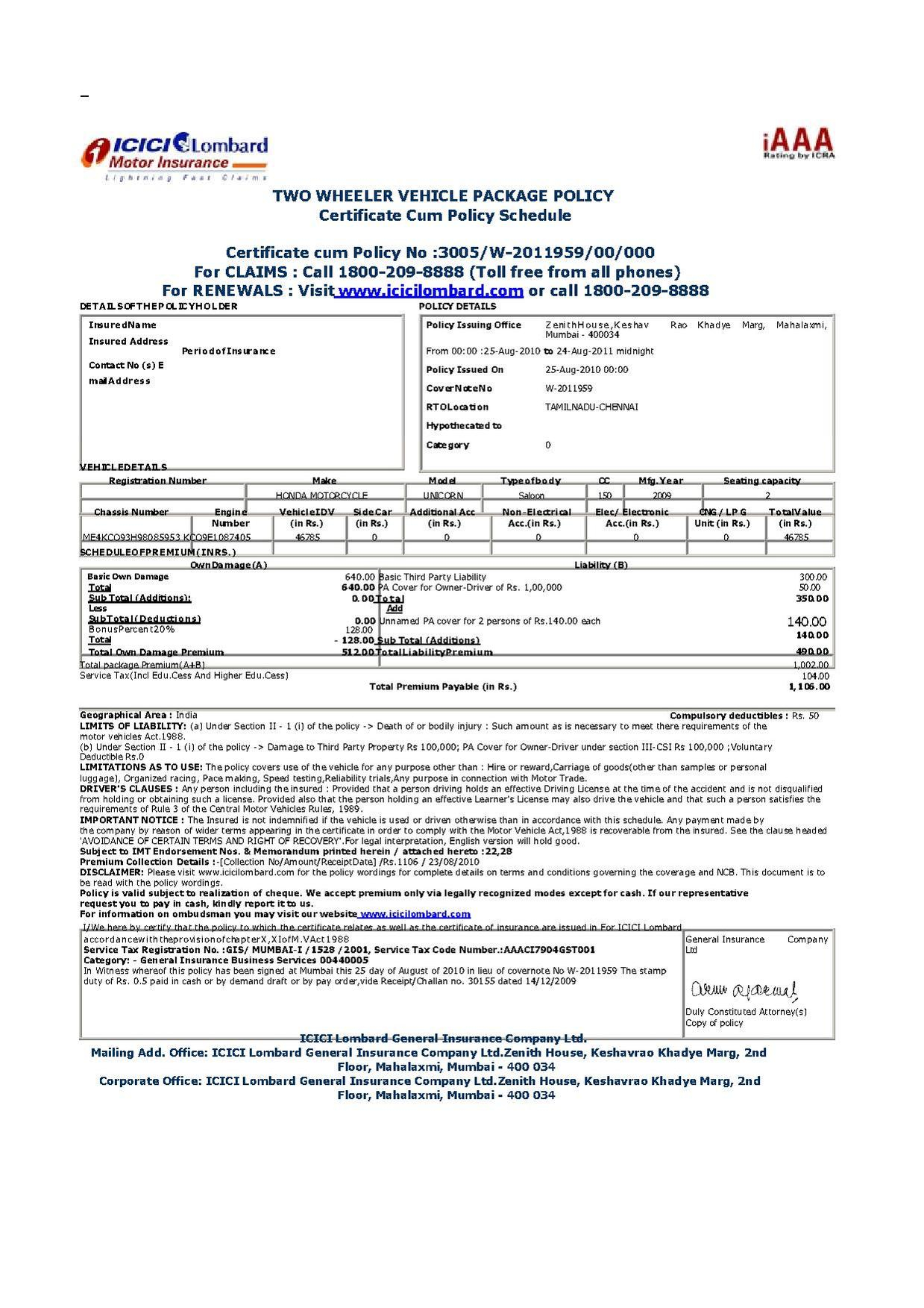

Insurance Planet Insurance Policy Number Definition And pertaining to proportions 1232 X 1600

Insurance Planet Insurance Policy Number Definition And pertaining to proportions 1232 X 1600Most areas require, anyway, that motorists have responsibility insurance. The moment purchasing this form of insurance, the policy limits tend to become indicated simply by three volumes. The first number pertains on the maximum bodily harm (in thousands ) for just one individual injured within a crash. The second number refers on the maximum liability for each harm triggered within the accident, and third number indicates the absolute maximum property or home damage liability. Preserve this at heart when you’re trying to obtain auto insurance estimates on-line.

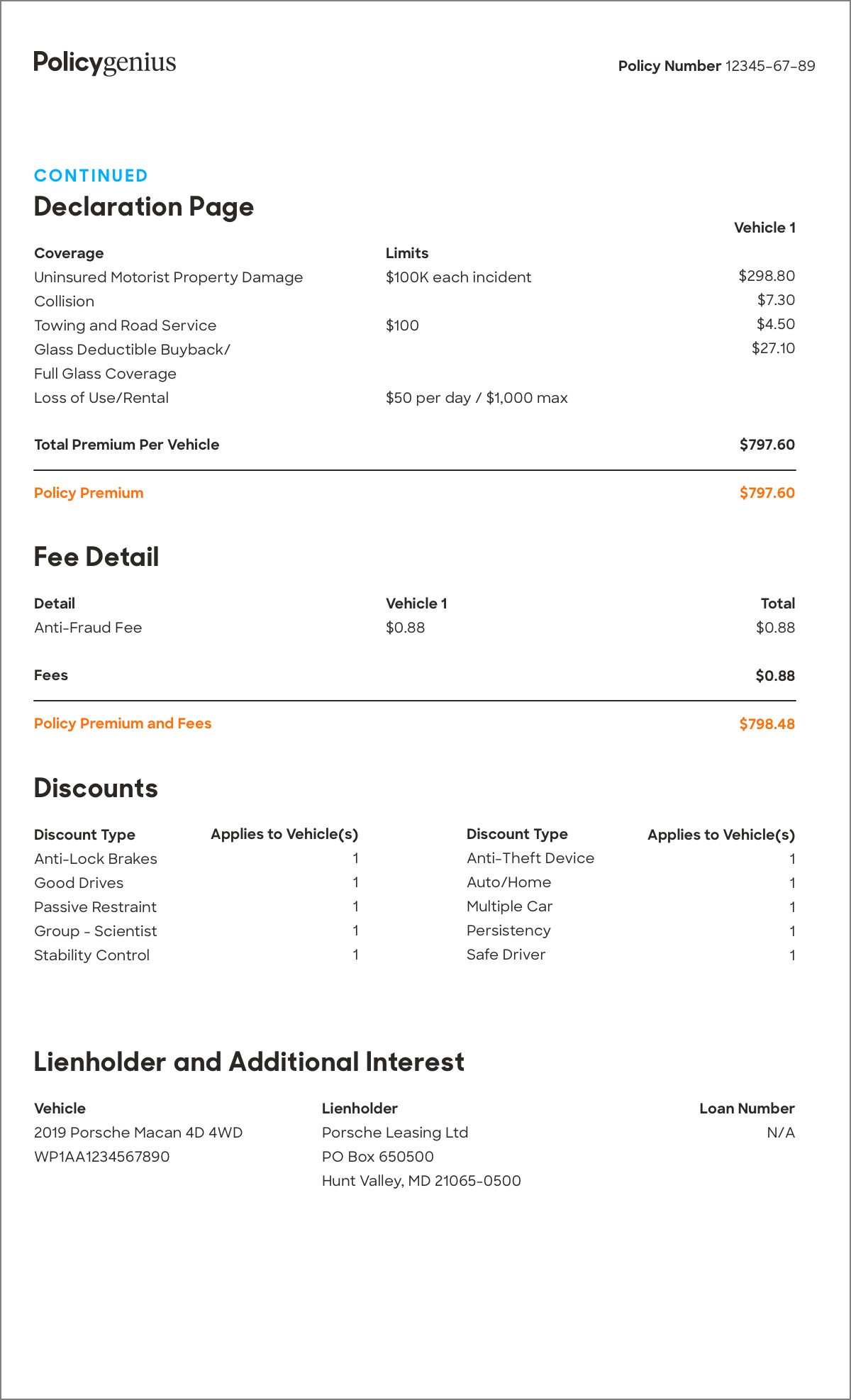

Understanding Your Car Insurance Declarations Page pertaining to dimensions 1200 X 1974

Understanding Your Car Insurance Declarations Page pertaining to dimensions 1200 X 1974Another thought is injury protection (PIP). This is important should you play a huge role within your family’s finances. If you find yourself badly injured and within the hospital and struggling to do the job, then have to pay for therapeutic bills added to that, your whole family have been around in trouble. PIP is unquestionably essential coverage to possess. Do you need comprehensive coverage? In the event you’ve an inexpensive, older motor vehicle then you definitely may well not. This form of coverage reimburses you within the event that your automobile is terribly damaged within a crash or thieved. If that isn’t worthy of much in any case, then it may be described as a waste of income to pay for on a plan with extensive coverage. You may be best using risk then simply just make payment on deductible whether or not this is damaged.

Insurance Pdf regarding size 1239 X 1753

Insurance Pdf regarding size 1239 X 1753