Auto Insurance Homeowners Insurance Harlem Irving Plaza with measurements 950 X 950

Auto Insurance Homeowners Insurance Harlem Irving Plaza with measurements 950 X 950Auto Insurance 60634 – Thanks a lot for the internet, automobile insurance now is easier to purchase than previously. It’s so easy to acquire multiple auto insurance quotes on-line immediately from distinct firms, all at one blog. The downside is that you must spend some time to compare them to be able to choose which alternative may be the best to suit your needs. To help increase the risk for process choose quicker, you need to have all your info prepared capable to go.

Auto Insurance Portage Park Steven Clark State Farm inside size 950 X 950

Auto Insurance Portage Park Steven Clark State Farm inside size 950 X 950When you obtain an vehicle insurance estimate online, whether via an agent or directly, you may need to offer some documentation like the license, make / style of vehicle, address, VIN, era, ssn, etc . Like that or otherwise not, you’ll find certain age brackets which are considered “higher risk” as opposed to runners. Your location could possibly may play a role inside kinds of quotes you obtain at the same time – particularly when you live within a location susceptible to extreme weather and road conditions, or just where there’s a high rate of crime.

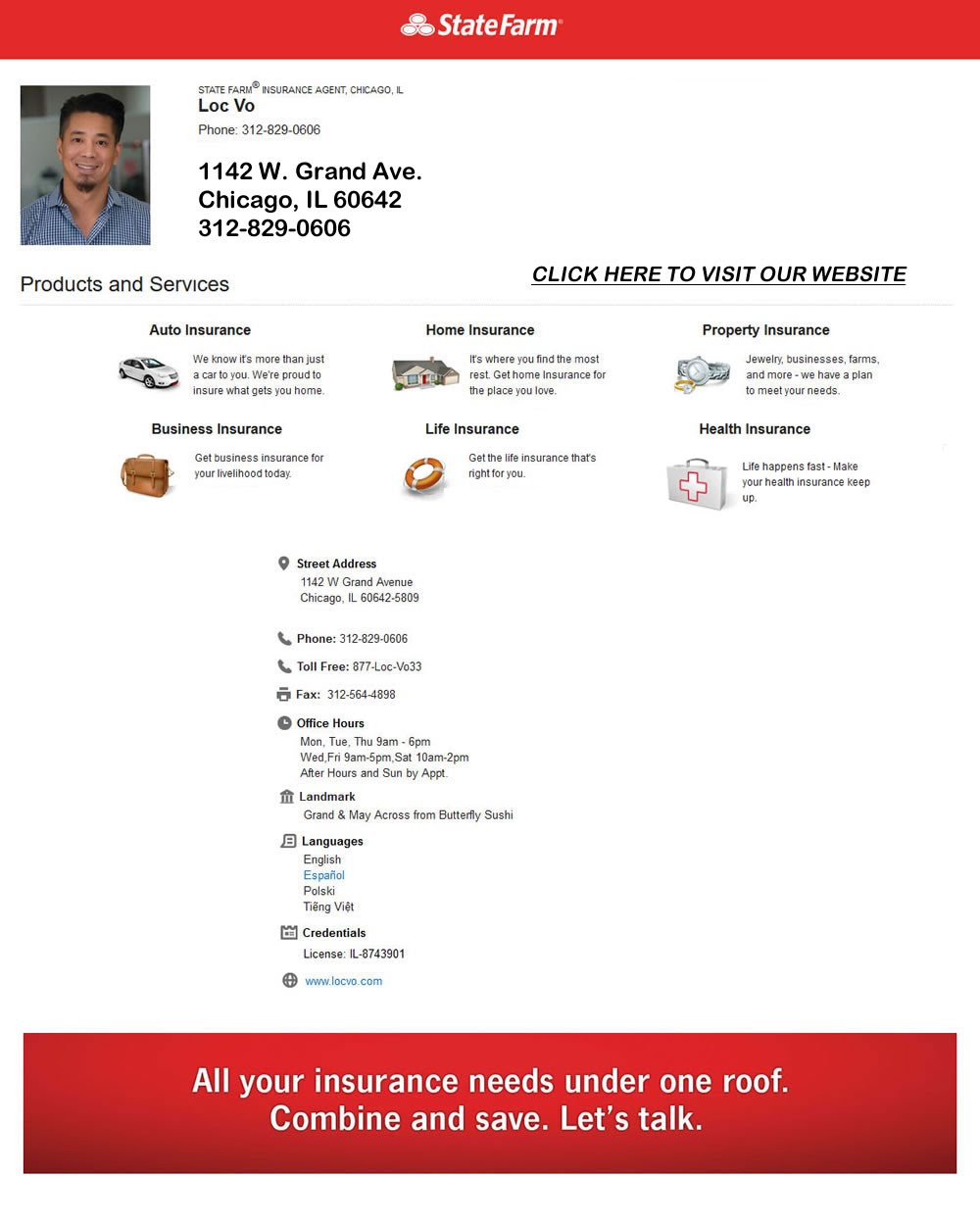

Auto Insurance Wicker Park Bucktown The Best Stores And intended for proportions 1000 X 1250

Auto Insurance Wicker Park Bucktown The Best Stores And intended for proportions 1000 X 1250If your motor vehicle offers certain security features, like anti-lock brakes, front and area airbags, GPS, with a security alarm, you’ll probably qualify to get a discount when searching for auto insurance quotes on-line. Many vehicle insurance providers provide discounts to safety-conscious motorists. Also, you are able to potentially save much more in case you take a defensive driver’s study course.

Auto Insurance Homeowners Insurance Lakeview The Best with regard to proportions 1000 X 1000

Auto Insurance Homeowners Insurance Lakeview The Best with regard to proportions 1000 X 1000One other possible factor impacting on the quotes you can get is your credit history. Those with a low credit score may have a far more hard time obtaining a great rate on the auto insurance. In the event that you’ve got a low credit score, the most effective issue you are able to do is attempt to look for as much discounts as you can. Some insurance providers give you a large various discounts so you’ll likely be entitled to no less than an individual ones.

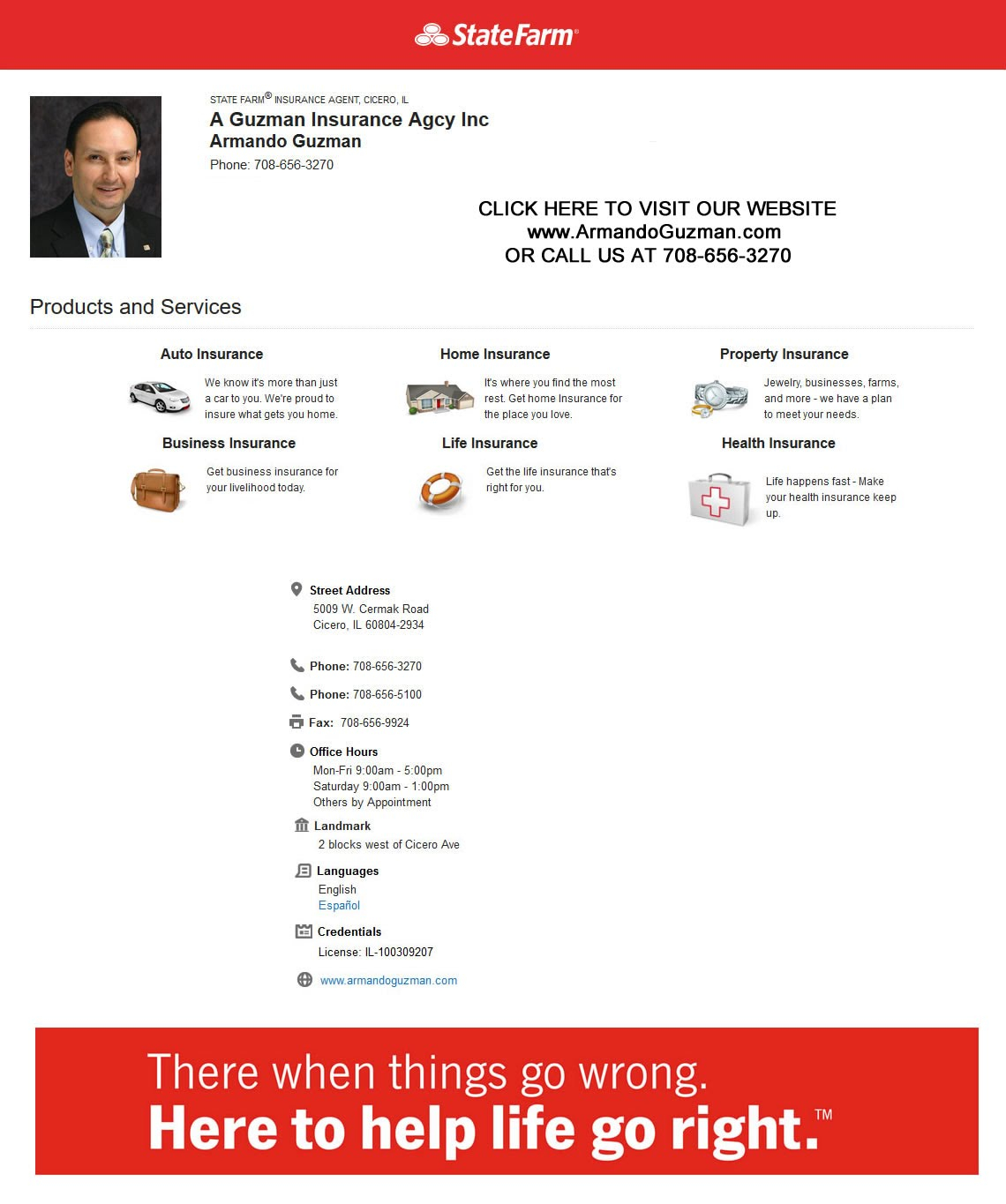

Armando Guzman Auto Insurance Cicero 60804 The Best throughout sizing 1140 X 1365

Armando Guzman Auto Insurance Cicero 60804 The Best throughout sizing 1140 X 1365As for age and gender, the male is usually forced to pay higher rates than females since women are thought to become more cautious once driving. Also, drivers more radiant than 25 are statistically more likely to become careless, in order that they are often charged higher premiums. In the event that you happen to be a university student who also makes a’s and b’s, even so, you’ll likely be eligible to get a discount. Right now there is often a more recent thing some insurance providers are selling called “usage-based insurance”. This implies they are giving motorists the possibility to get their driving supervised with a mobile app to acquire possible discounts reducing payments.