Getting A Dui And Insurance Companies regarding sizing 2000 X 1333

Getting A Dui And Insurance Companies regarding sizing 2000 X 1333Car Insurance With Dui – The simplest way to acquire inexpensive car insurance is always to first seek out estimates after which invest time to compare all of them. Uncover about the firms that are offering to you the quotes and choose what one is providing all you need in a price you can pay for to pay for. Since you will find a lot of companies around all claiming to provide affordable motor insurance quotes, you need to practice a bit about all of them before you make your choice.

Car Insurance For Dui Offenders 2017 Car Insurance Policy with proportions 1280 X 720

Car Insurance For Dui Offenders 2017 Car Insurance Policy with proportions 1280 X 720Don’t just simply glance at the high quality insurers, possibly. There are smaller, local motor insurance businesses that offer affordable estimates. And, because they are smaller, they may be able to offer more unique want to the clientele. Liability-only automobile insurance is definitely going being the cheapest choice, as it’s the very least coverage expected in each state. Even so, it only covers items like property damage and therapeutic bills for that others involved with an accident that you’re discovered responsible. What about your individual therapeutic bills? How do you will get improvements for your individual vehicle? This really is comprehensive / collision insurance policy options you will definitely want to think about.

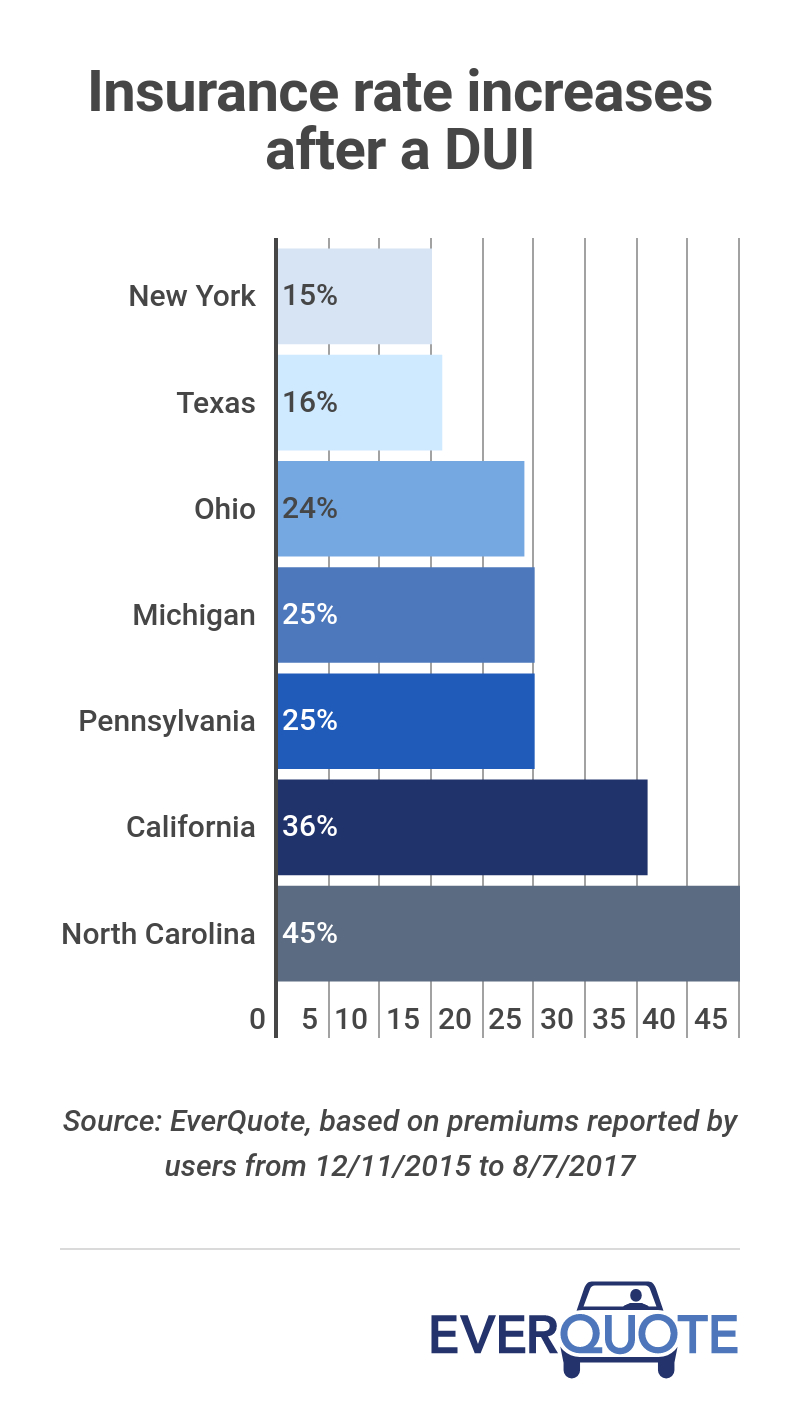

The Dui Insurance Guy Has The Best Insurance Rates In North Carolina throughout sizing 1280 X 720

The Dui Insurance Guy Has The Best Insurance Rates In North Carolina throughout sizing 1280 X 720Finding affordable motor insurance insurance quotes is not only about seeking the least expensive payment, and may just be regarded as for those who have a classic junk car that isn’t really worth the money you spend to insure it. You’ll nonetheless need to maintain your medical costs in your mind, though. A further issue to give thought to what might eventually your family’s finances if you’ve been badly injured within an automobile accident and can not work for the long time period? Some insurance rates will incorporate solutions with this too.

Auto Insurance After A Dui Were Here To Help Rates pertaining to sizing 1875 X 1042

Auto Insurance After A Dui Were Here To Help Rates pertaining to sizing 1875 X 1042As with any sort of insurance, you have the deductible VS monthly payments debate. The deductible could be the insurance carrier ‘s means of producing the policyholder share a number of the responsibility associated with an accident. The reduced the deductible, the larger the top quality, and the other way round. Decide what might certainly be a better solution to your requirements. If you’re not sure, request the insurance broker or economic consultant for advice.

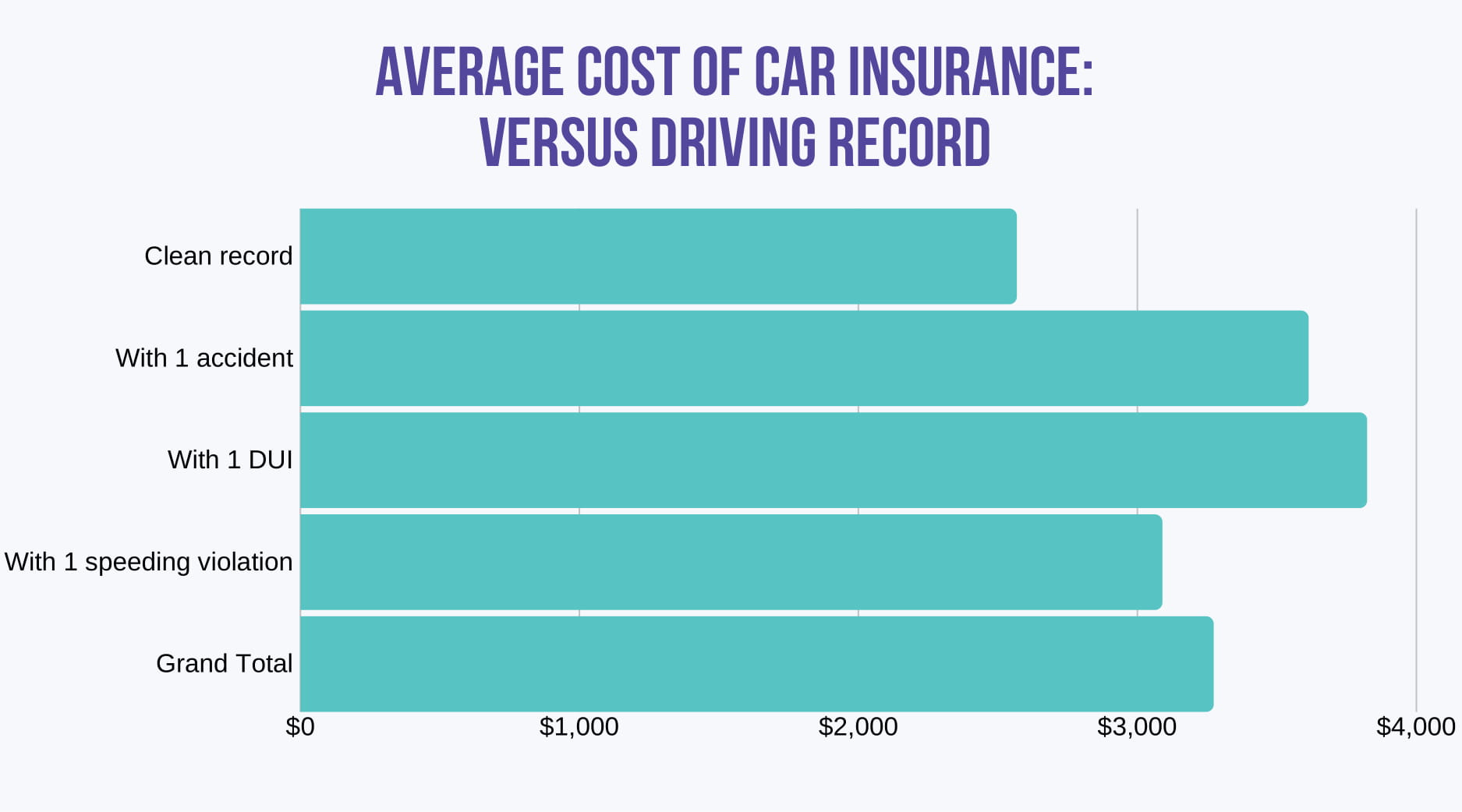

Car Insurance After A Dui within dimensions 800 X 1414

Car Insurance After A Dui within dimensions 800 X 1414You may also perform little mathematics on your individual. If you were to opt for the higher deductible, just how much will you be capable to save the less premium? Will the money you’ll save be equivalent to that particular with the deductible within the event you happen to be in the event and must pay a number of the repair costs from your hand? Whatever you determine, you will still may be capable to possibly conserve big money with discounts. Just about every company comes with a selection of discounts, and there exists a chance you will be capable to be eligible for a no less than one. One place you can turn to find discounted prices and affordable motor insurance rates is esurance. You can begin simply by working using a “Coverage Counselor” to get the best coverage. Also, look into Esurance discounts – you will find a large number of and also you may indeed be eligible for one.