Car Insurance Companies Auto Insurance Quotes Best Car throughout dimensions 1446 X 668

Car Insurance Companies Auto Insurance Quotes Best Car throughout dimensions 1446 X 668Auto Insurance Usa 2020 – Every driver and passengers inside US must involve some sort of liability coverage as a way to legally travel. It’s not really something you desire to at any time risk undertaking without. You’ll ought to locate one method or another to cover it, if you want this you aren’t. Vehicle insurance plans really do not ought to price big money, even though. You do involve some alternatives in terms of cheap responsibility automobile insurance. However , you shouldn’t select a plan based about the price tag alone, as you’ll find a large number of additional factors which are crucial that you think of too.

Welcome To Methaq Takaful Insurance Company within proportions 2480 X 3507

Welcome To Methaq Takaful Insurance Company within proportions 2480 X 3507Always check while using self-employed rating agencies like Regular & Poor and HAVE ALWAYS BEEN Best to study the fiscal balance of each one insurance provider you happen to be taking into consideration. Take time to read evaluations business buyers on each business. Even though you don’t know whenever they may be all legitimate evaluations, will still be best if you avoid any organization that’s been obtaining a large sum of problems – just being about the safe side.

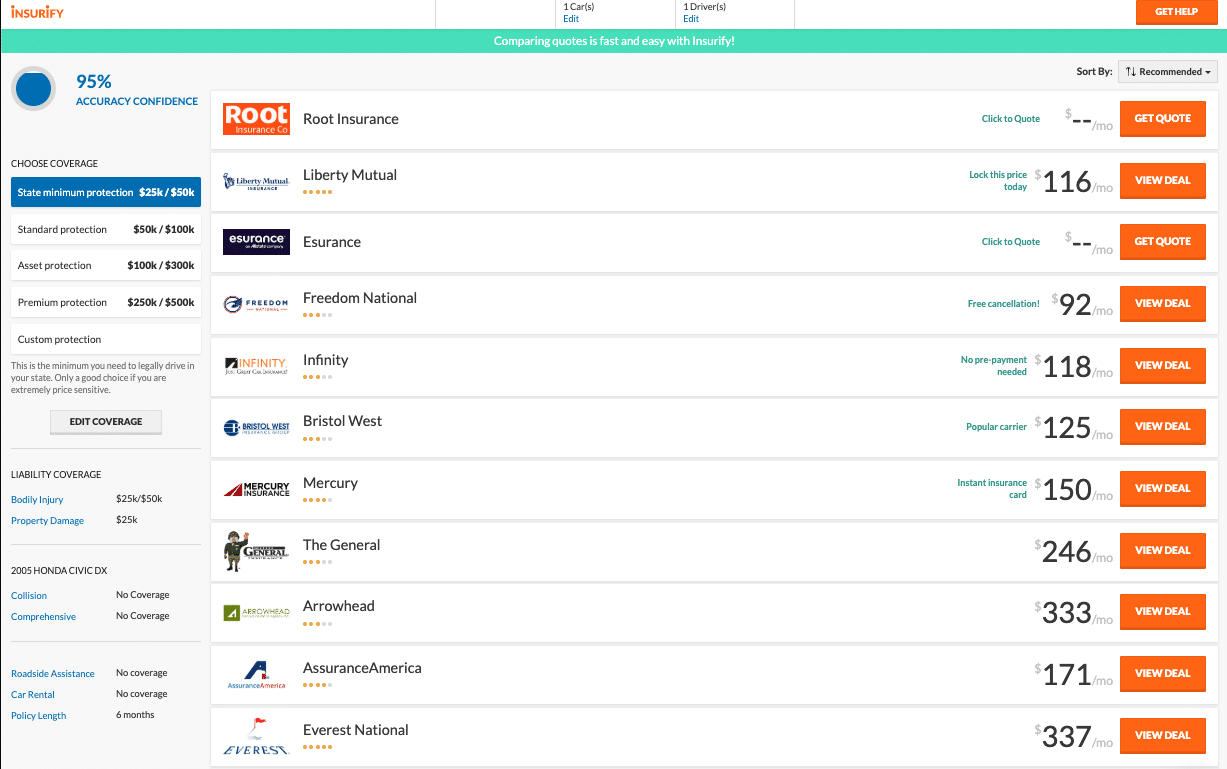

Auto Insurance Quotes Comparison Updated 2020 Insurify regarding size 1227 X 769

Auto Insurance Quotes Comparison Updated 2020 Insurify regarding size 1227 X 769Find out what are the minimum requirements are designed for automobile insurance inside your state. Also in case you only require affordable responsibility automobile insurance, you should think about additional forms of coverage too, which include injury protection. PIP policy covers both your own personal plus your passengers’ medical bills if you happen to be ever associated with a great car accident. PIP insurance plans are sometimes called “no-fault” insurance. However , although it covers medical expenses and in many cases, it may also spend on wage reduction. However , no-fault / PIP insurance pays to the genuine damage from the car. With this, you will need to get your own personal wreck coverage or by the insurance coverage from the other party should they were those who caused the accident.

Insurance Ai And Innovative Tech Usa 2020 Nuadox for measurements 1170 X 780

Insurance Ai And Innovative Tech Usa 2020 Nuadox for measurements 1170 X 780Consider value of your motor vehicle when seeking cheap responsibility automobile insurance to ascertain whether it could be worth the cost to get collision policy. If it’s a mature model, the price tag on paying to get this protected might run you more cash compared to what the specific price could be to do the repair inside celebration that it can be ruined. Think about the deductible too.

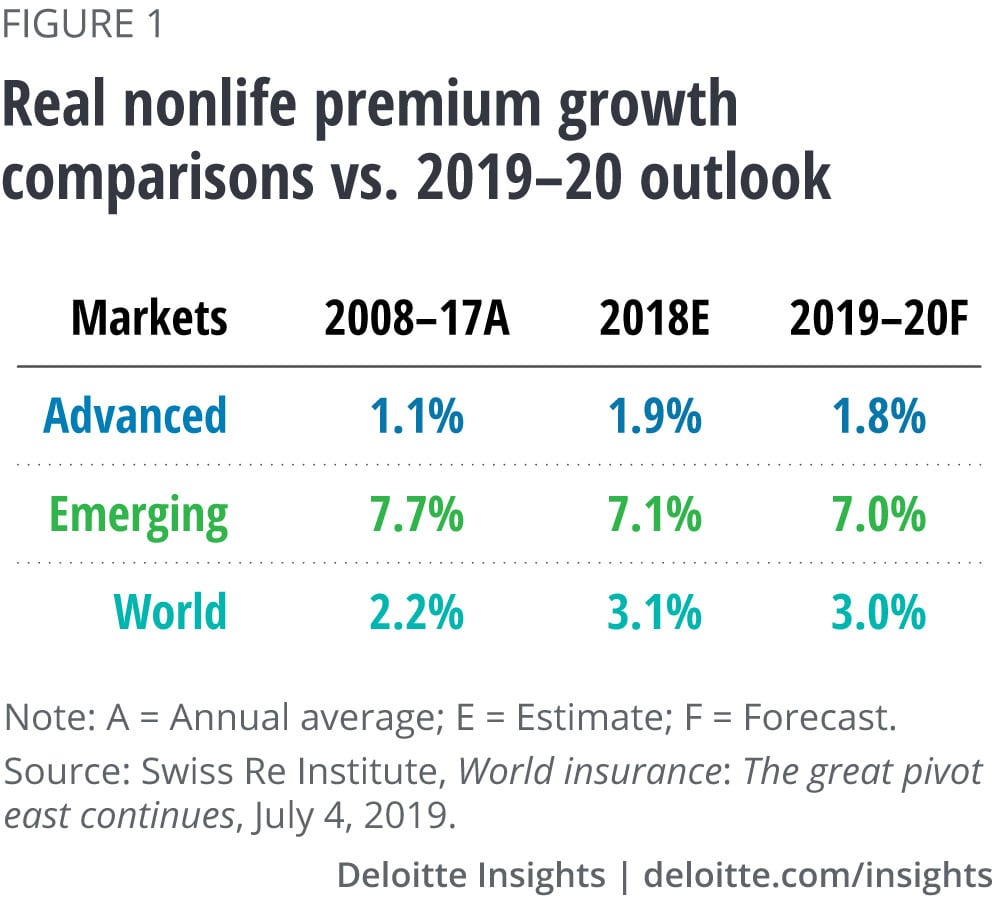

2020 Insurance Industry Outlook Deloitte Insights regarding dimensions 1000 X 917

2020 Insurance Industry Outlook Deloitte Insights regarding dimensions 1000 X 917A large number of people desire to know how you can reduce the premium. The concept, obviously, would be to purchase sufficient coverage ideal for your requirements with no overspending. Under no circumstances believe you’ve to sacrifice coverage as a way to cut costs. Rather, check around a few. Consider bundling your automobile insurance along with other forms of insurance you’ve, for example property insurance. Some firms give reductions for multiple guidelines.