Coles Vs Woolworths Car Insurance Finderau in size 1536 X 864

Coles Vs Woolworths Car Insurance Finderau in size 1536 X 864Woolworths Motorcycle Insurance – This is quite easy currently to have motor insurance quotes on-line. The part that’s not easy is in fact comparing the quotes and determining what type provides type(s) of coverage you virtually all need in a sensible price. To be able to begin, you will need to submit a number of details striking the “submission” button. The forms of details you will be expected to deliver consist of one site on the next. Experts recommend that compares no less than three offers prior to your selection. Also, take a look at current policy. It may perfectly nonetheless be the greatest option in your case.

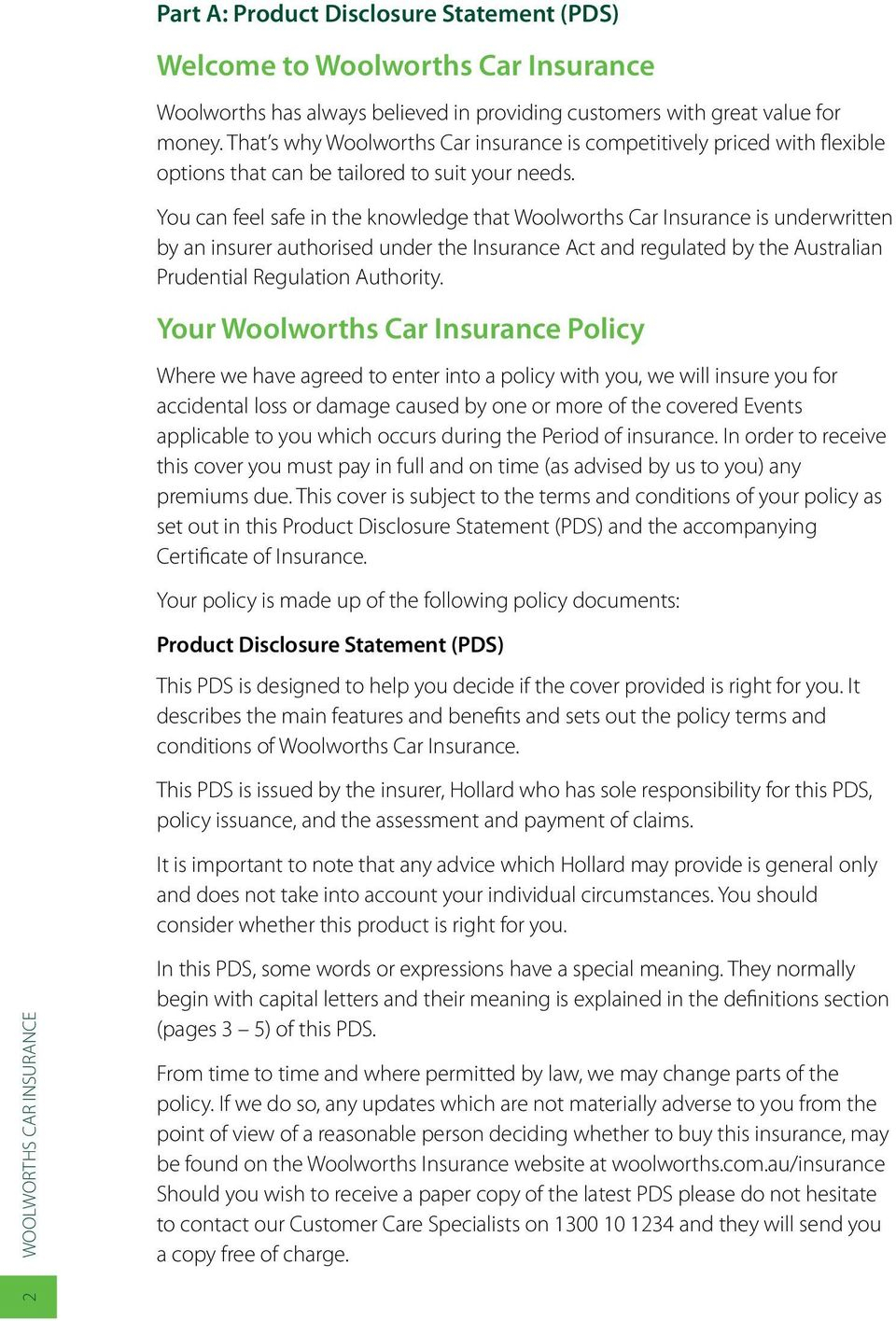

Woolworths Car Insurance Combined Product Disclosure with sizing 960 X 1422

Woolworths Car Insurance Combined Product Disclosure with sizing 960 X 1422In the event you need to add some other person in your policy, including a teenager or perhaps significant other, then make sure through adding their details at the same time once requesting quotes. What form of coverage do you really need? Most expresses require drivers incorporate some form of vehicle insurance. Find out what your california’s minimum requirements are. Also in case you think you know, verify in order that nothing is different since last time you got a great vehicle insurance coverage.

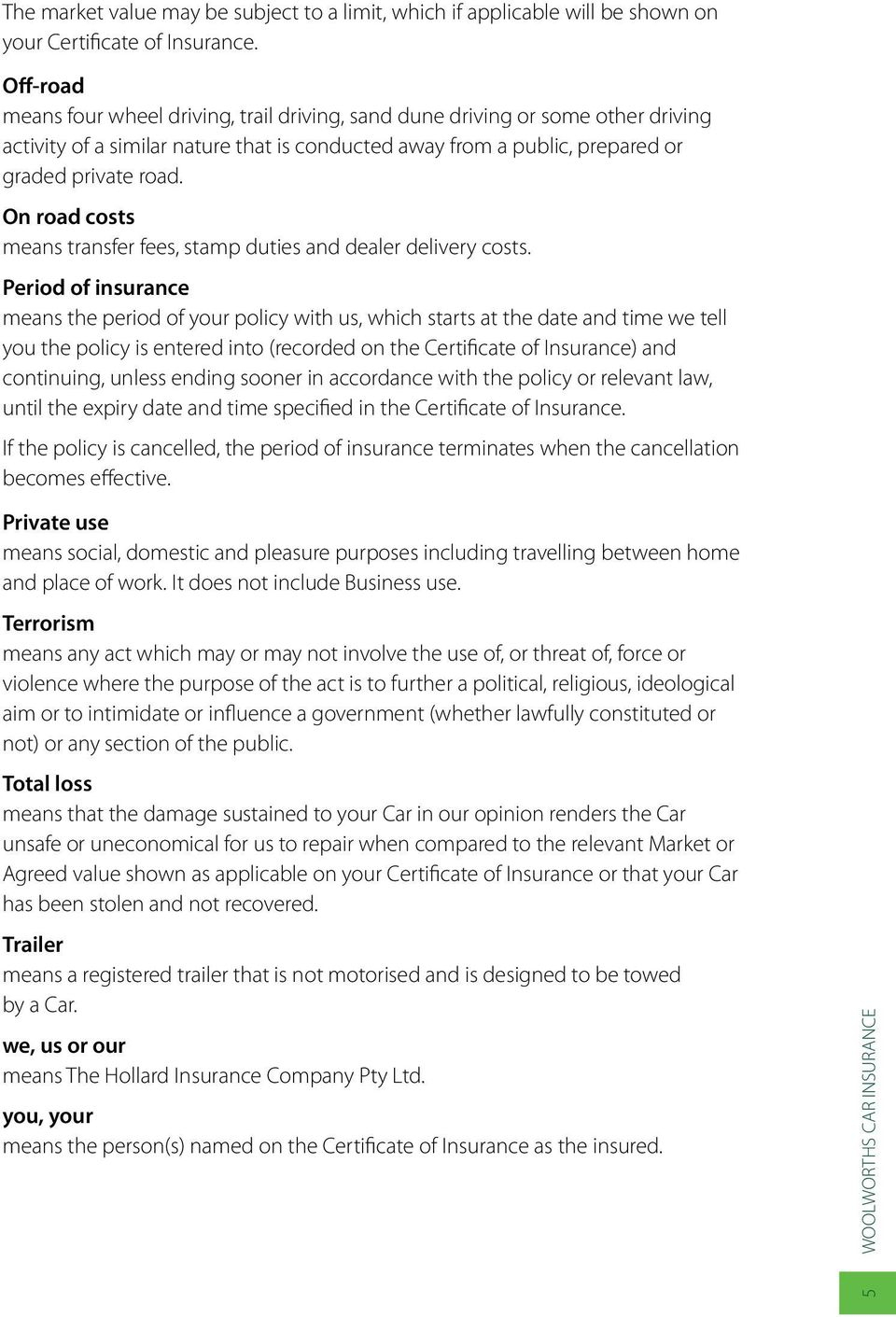

Woolworths Car Insurance Combined Product Disclosure inside dimensions 960 X 1415

Woolworths Car Insurance Combined Product Disclosure inside dimensions 960 X 1415Most expresses require, at least, that motorists have the liability insurance. The moment purchasing this form of insurance, the policy limits tend to get indicated by simply three quantities. The first number makes reference on the maximum bodily personal injury (in 1000s of dollars ) for just one individual injured in an incident. The second number refers on the maximum liability for each personal injury induced inside the accident, and third number indicates the absolute maximum home damage liability. Retain this at heart when you’re trying to have motor insurance insurance quotes on-line.

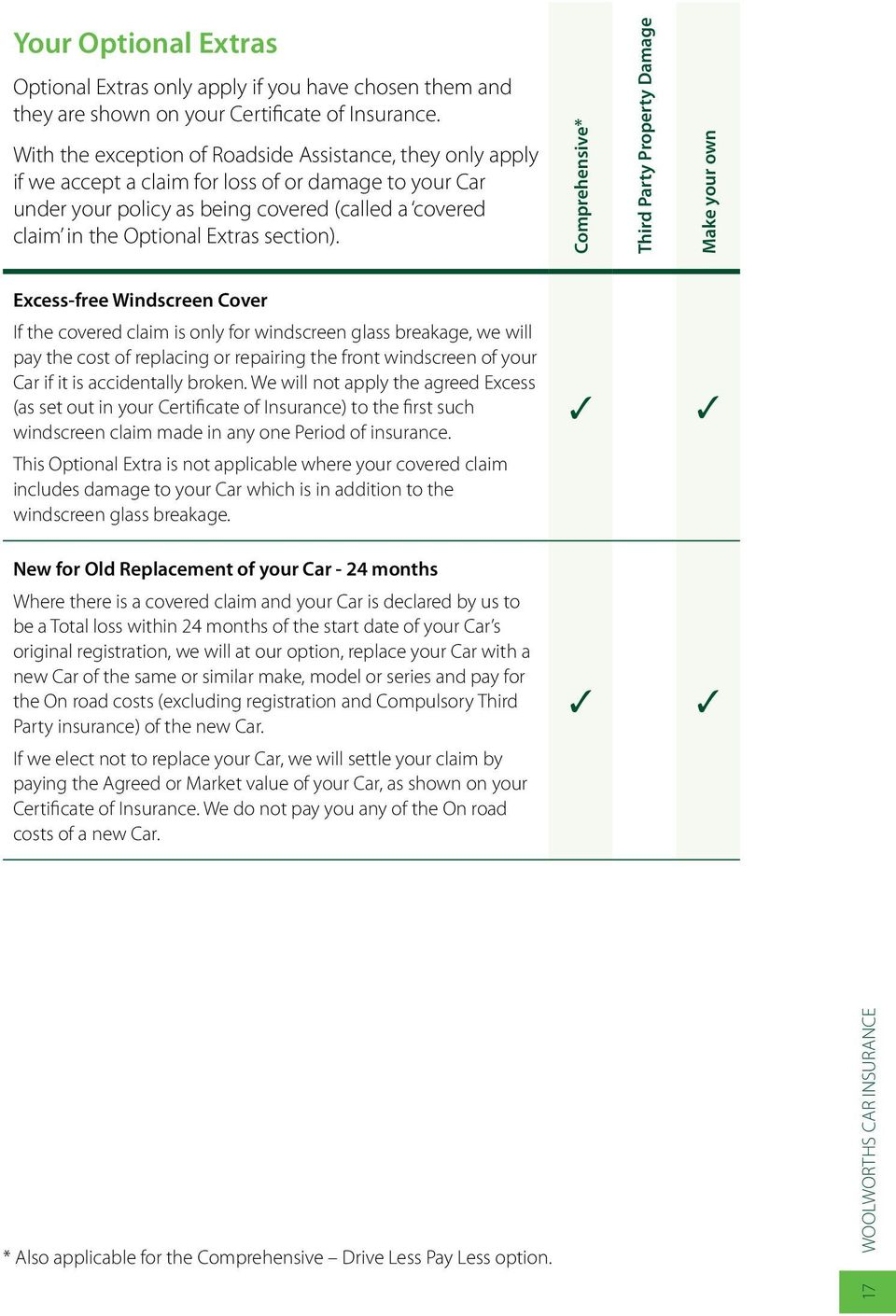

Woolworths Car Insurance Combined Product Disclosure within proportions 960 X 1411

Woolworths Car Insurance Combined Product Disclosure within proportions 960 X 1411Another aspect to consider is injury protection (PIP). This is important in case you play a huge role with your family’s finances. If you wind up badly injured and inside the hospital and not able to job, then have to spend skilled bills in addition, in that case your complete family come in trouble. PIP is unquestionably essential coverage to get. Do you need comprehensive coverage? In cases where you’ve a low priced, older car then you definitely probably won’t. This sort of coverage reimburses you inside the event that your automobile is poorly damaged in an incident or taken. If that isn’t worthy of much regardless, then it will be considered a waste of cash to spend on an insurance policy with extensive coverage. You may be best utilizing the risk then just simply paying of the deductible whether or not this is damaged.

Woolworths Car Insurance Combined Product Disclosure pertaining to measurements 960 X 1410

Woolworths Car Insurance Combined Product Disclosure pertaining to measurements 960 X 1410