All You Need To Know About No Claim Bonus On Car Insurance throughout dimensions 1200 X 900

All You Need To Know About No Claim Bonus On Car Insurance throughout dimensions 1200 X 900Car Insurance 2 Cars – Be clever along with your motor insurance coverage. You will discover a lot of companies around that share a wide number of discounts. You may be qualified to receive some you don’t know exist. Keep this kind of at heart when you happen to be executing looks for quotes and checking each company. Usually, the firms list the varieties of discount rates they feature on his or her websites. You might also need a better potential for getting actually low cost car insurance for those who have a clean record, have reached least 25 years or so of aging, have a very good credit rating, and own an automobile having a lot of security features.

Car Insurance Report Following An Accident Concept With Toy with sizing 1600 X 1185

Car Insurance Report Following An Accident Concept With Toy with sizing 1600 X 1185It’s and a wise decision to become smart along with your insurance. For instance, should you DO have got an adult car or truck that is certainly presently worth under say, $4, 000, you do not desire to use having comprehensive and accident in your insurance plan. It might not worth continually making repayments with a car that actually actually worth a whole lot of. However , this must always be kept inside the back of your head when a thing DOES occur to the car, you will be normally the one in charge of repairs, and purchasing another one.

Comprehensive Car Insurance Stock Photos Comprehensive Car regarding size 1300 X 956

Comprehensive Car Insurance Stock Photos Comprehensive Car regarding size 1300 X 956Another way you can actually obtain really low cost vehicle insurance is should you bundle it in addition to an additional kind of insurance – specifically home insurance or multi- motor insurance – all sticking with the same company. Many companies give greater discount to prospects who’re prepared to purchase multiple policies from their store. Some even offer deals about motor insurance / term life insurance packages.

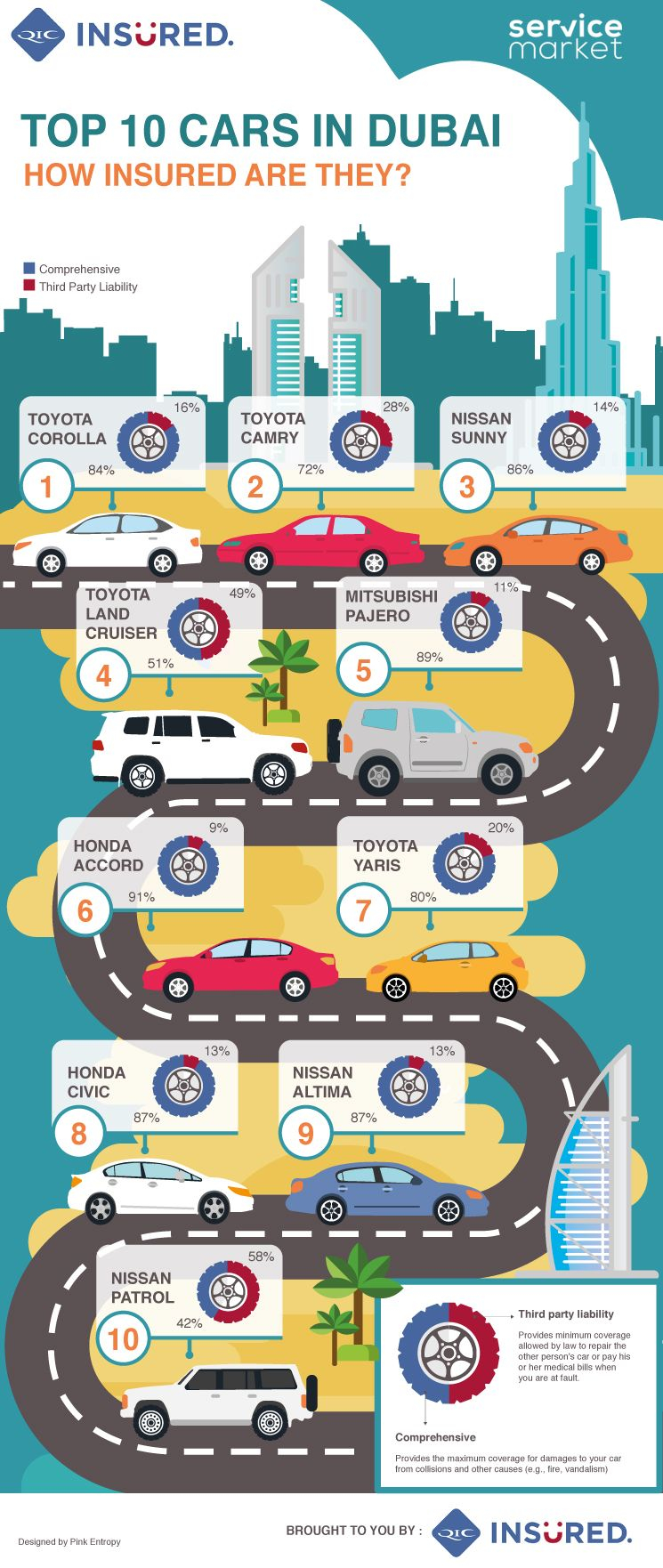

Infographic 2 In 10 Dubai Cars Are Under Insured The Home pertaining to sizing 745 X 1762

Infographic 2 In 10 Dubai Cars Are Under Insured The Home pertaining to sizing 745 X 1762To possibly save also additional money, consider enrollment in a very defensive driving course. When you successfully complete this, a great insurance carrier will more than likely pay back you having a discount in your premium. If you happen to be having difficulty obtaining low insurance quotes since you do not have excellent credit rating, you may adequately make use of functioning which has a credit score improvement or debt provider. By the very least, discover credit improvement and exactly how you are able to do it yourself. Have just about every measure necessary showing vehicle insurance carriers that you happen to be trying to clear your credit history.

Car Insurance Company Vector Horizontal Web Stock Vector throughout dimensions 1500 X 543

Car Insurance Company Vector Horizontal Web Stock Vector throughout dimensions 1500 X 543If you happen to be a student, professional or perhaps a person in a specific club, glance and discover what types of discounts may be available for you. When once again, you don’t know what types of discount rates you may be qualified to receive. Are you aware that you simply could potentially spend less when you are a responsible student with a’s and b’s? Or for as a head with your field? Or perhaps in the event that you happen to be an engineer as well as teacher / lawyer as well as doctor or customer associated with an auto club?