A Max Hr Vision 2020 Pages 1 18 Text Version Anyflip within dimensions 1391 X 1800

A Max Hr Vision 2020 Pages 1 18 Text Version Anyflip within dimensions 1391 X 1800Amax Auto Insurance Hours – The best method to obtain cost-effective vehicle insurance would be to first look for rates and after that invest time to compare all of them. Find out about the businesses that are providing the quotes and judge which is providing solutions with a price you can pay for to spend. Since you’ll find many organisations available all claiming to make available inexpensive motor insurance quotes, you will need to become familiar with a bit about all of them before you make your selection.

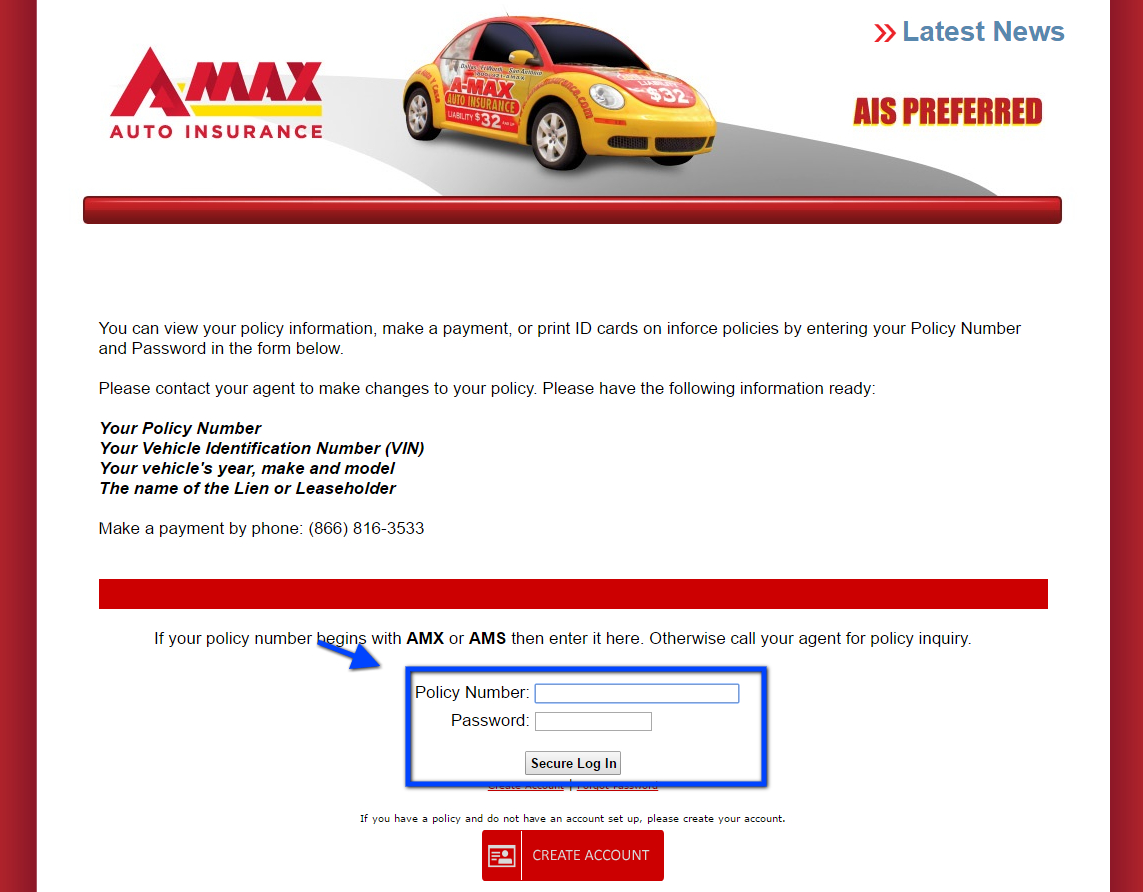

Amax Auto Insurance Login Make A Payment for dimensions 1143 X 892

Amax Auto Insurance Login Make A Payment for dimensions 1143 X 892Don’t merely glance at the big insurers, possibly. There are smaller, local motor insurance businesses that offer affordable rates. And, because they are smaller, they’re able to supply more tailored intend to their potential customers. Liability-only auto insurance is definitely going to get the cheapest alternative, since it is a nominal amount coverage expected in each state. Nevertheless, it only covers things such as property damage and therapeutic bills for that others linked to an accident in which you’re located responsible. What about your personal therapeutic bills? How do you receive vehicle repairs for your personal vehicle? This is certainly comprehensive / collision insurance plan options that you will definitely be considering.

A Max Auto Insurance inside dimensions 2643 X 1271

A Max Auto Insurance inside dimensions 2643 X 1271Finding inexpensive motor insurance quotations is not only about locating the most competitive payment amount, and may basically be thought to be when you have a vintage junk car that is not definitely worth the money you spend to insure it. You’ll nonetheless wish to maintain your medical costs in your mind, though. One more element to give thought to is what can occur to your family’s finances had you been badly injured within a mishap and struggling to work for the long time frame? Some quotes includes solutions just for this also.

A Max Auto Insurance 30 Second Tv Spot Hou English inside dimensions 1280 X 720

A Max Auto Insurance 30 Second Tv Spot Hou English inside dimensions 1280 X 720As with any form of insurance, you have the deductible VS prices debate. The deductible will be the insurance provider ‘s method of producing the policyholder share a few of the responsibility of the accident. The reduced the deductible, the greater the high grade, and the other way around. Decide what can be considered a better solution to meet your needs. If you’re not sure, request the insurance broker or fiscal specialist for advice.

A Max Auto Insurance Insurance Agency 10100 Beechnut St within measurements 1024 X 768

A Max Auto Insurance Insurance Agency 10100 Beechnut St within measurements 1024 X 768You may also perform little bit of mathematics on your personal. If you were to opt for the higher deductible, the amount are you capable of save money on a lesser premium? Might how much money you’ll save equate to that particular with the deductible inside event you happen to be in the occurrence and must pay a few of the repair costs from the bank? Whatever you make a decision, you continue to may be capable of possibly conserve a lot of cash with discounts. Just about every company supplies a various discounts, and you will find there’s chance you will be capable of be eligible for an at the very least one. One place you can look to find discounted prices and inexpensive motor insurance estimates is esurance. You can begin simply by working which has a “Coverage Counselor” for top level coverage. Also, look into Esurance discounts – you’ll find a large number of and also you could possibly be eligible for a one.