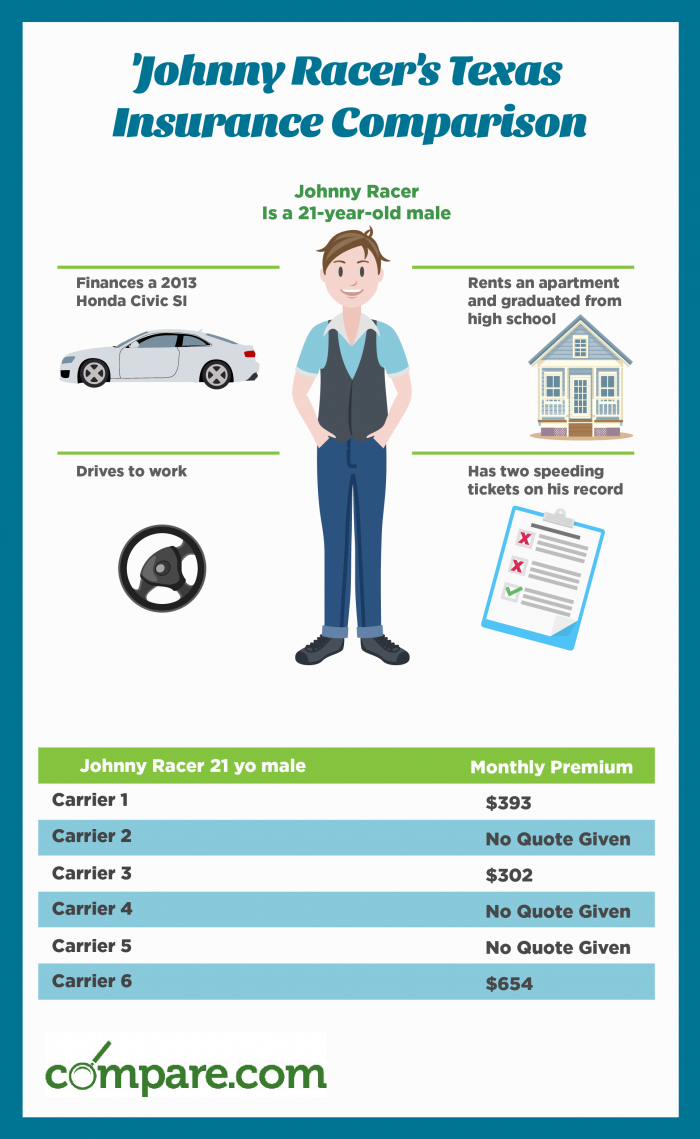

Compare Texas Car Insurance Rates Save Today Compare in measurements 700 X 1139

Compare Texas Car Insurance Rates Save Today Compare in measurements 700 X 1139Car Insurance Rates Texas – Be intelligent using your motor insurance coverage. You will find most companies around that share a wide various discounts. You could possibly be qualified to receive some you do not be aware of exist. Keep this kind of in your mind when you might be performing looks for quotes and looking at each company. Usually, the businesses list the forms of discount rates they have on the websites. You should also try a better possibility of getting genuinely inexpensive car insurance for those who have a clean record, are near least twenty five years of aging, have a great credit rating, and own a car or truck having a lot of precautionary features.

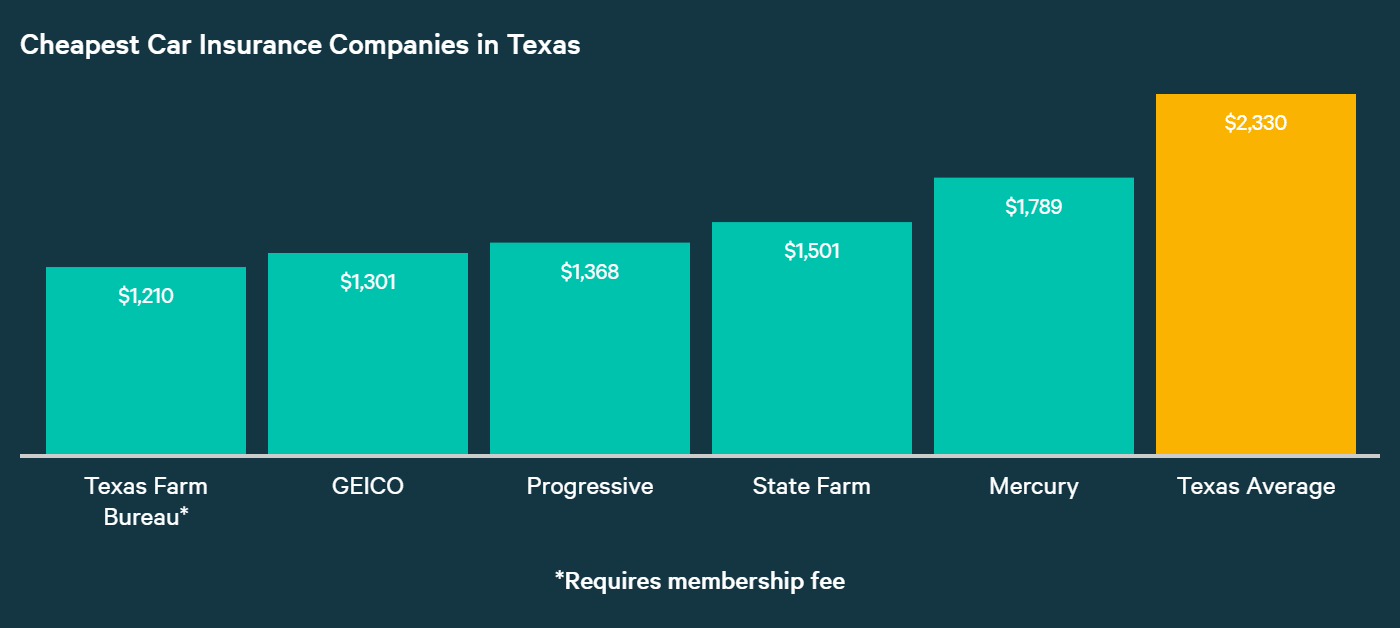

Best Auto Insurance Companies In Texas 2020 Compare Car with sizing 1400 X 628

Best Auto Insurance Companies In Texas 2020 Compare Car with sizing 1400 X 628It’s another good option to become smart using your insurance. For instance, should you DO include a mature car that is certainly presently worth lower than say, $4, 000, you may not desire to use having comprehensive and wreck on your own plan. It might not worth continually making repayments over a car that basically isn’t really worth a whole lot of. However , that should be kept within the back of the mind when anything DOES occur to the car, you will be normally the one in charge of repairs, and for getting another one.

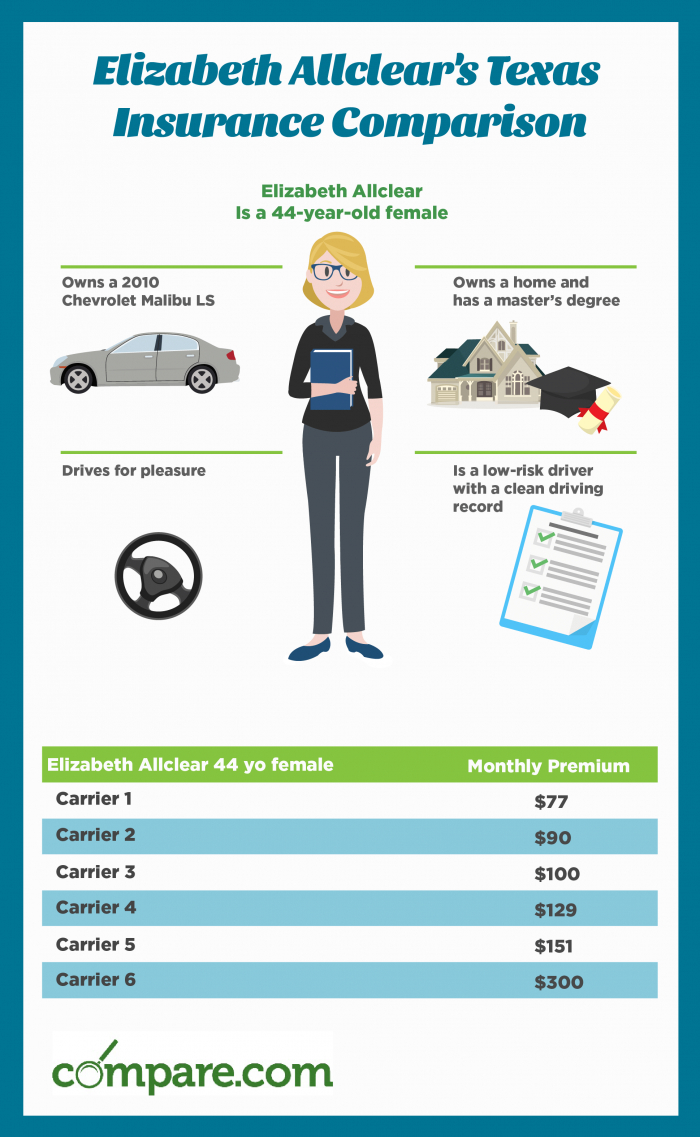

Compare Texas Car Insurance Rates Save Today Compare regarding sizing 700 X 1137

Compare Texas Car Insurance Rates Save Today Compare regarding sizing 700 X 1137Another way you may choose to obtain really inexpensive car insurance is should you bundle it in addition to one more form of insurance – especially home insurance or multi- motor insurance – all sticking with the same company. Many companies give larger discount to people that are ready to purchase multiple policies from their website. Some even offer deals upon motor insurance / life insurance coverage packages.

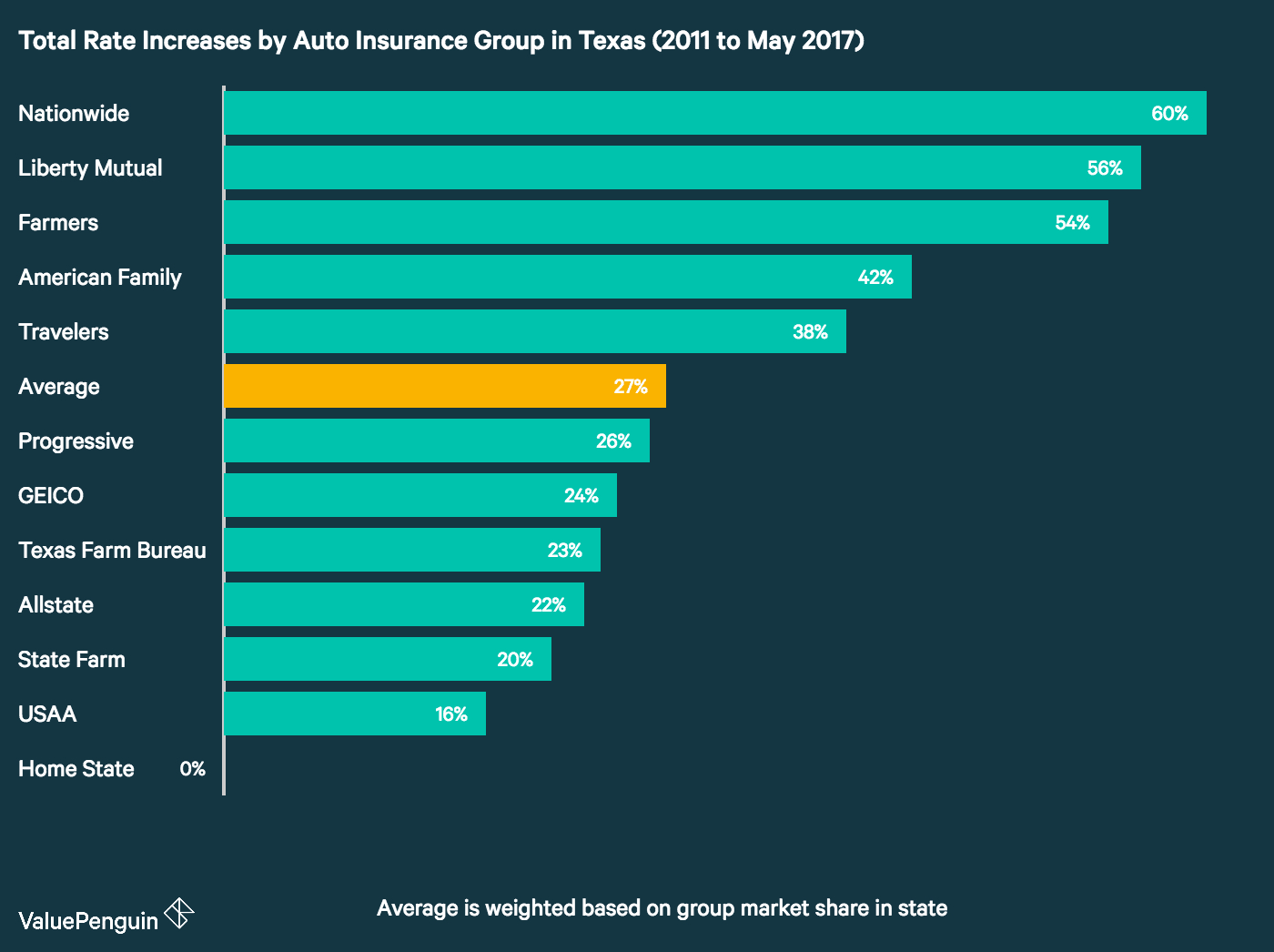

Auto Insurance Rate Increases In Texas Valuepenguin intended for sizing 1400 X 1046

Auto Insurance Rate Increases In Texas Valuepenguin intended for sizing 1400 X 1046To possibly save actually more cash, consider enrollment inside a defensive driving course. When you successfully complete this, a great insurance carrier will more than likely prize you having a discount on your own premium. If you might be having difficulty obtaining low prices when you don’t possess excellent credit rating, you could possibly well reap the benefits of functioning having a credit restoration or debt provider. For the very least, find out about credit restoration and exactly how you’ll be able to do it yourself. Have just about every measure necessary to exhibit car insurance firms that you might be fitting in with clear your credit file.

Get The Finest Automobile Insurance Coverage For Rental for proportions 1400 X 610

Get The Finest Automobile Insurance Coverage For Rental for proportions 1400 X 610If you might be a student, professional or perhaps a person in some club, appearance and find out what sorts of discounts could possibly be available to you personally. When once again, you can’t predict what sorts of discount rates you could possibly be qualified to receive. Are you aware that you simply could potentially cut costs since they can be a responsible student with a’s and b’s? Or for as being an innovator inside your field? Or perhaps in the event that you might be an engineer as well as teacher / lawyer as well as doctor or membership of the auto club?